Expansion of Distribution Channels

The fortified energy-bar market is witnessing an expansion of distribution channels, which plays a crucial role in enhancing product accessibility. Retailers are increasingly recognizing the potential of energy bars as a staple snack, leading to their placement in various outlets, including convenience stores, gyms, and health food shops. E-commerce platforms also contribute significantly to this trend, allowing consumers to purchase their favorite products online with ease. This diversification in distribution channels is expected to boost sales, as the fortified energy-bar market adapts to consumer shopping preferences. Enhanced availability may lead to a projected increase in market share by 15% over the next few years.

Innovations in Product Formulation

Innovations in product formulation are a driving force within the fortified energy-bar market, as manufacturers strive to meet evolving consumer preferences. The introduction of plant-based ingredients, superfoods, and functional additives reflects a growing trend towards health-oriented products. These innovations not only cater to dietary restrictions but also appeal to a broader audience seeking enhanced nutritional profiles. The fortified energy-bar market is likely to see a rise in products that offer unique health benefits, such as improved digestion or energy boosts, thereby attracting a diverse consumer base. This trend may lead to a competitive edge for brands that prioritize innovation.

Increased Focus on Active Lifestyles

The fortified energy-bar market is significantly influenced by the increasing focus on active lifestyles among consumers. As more individuals engage in fitness activities and outdoor adventures, the demand for energy-dense snacks that provide sustained energy becomes paramount. This trend is particularly prevalent among millennials and Gen Z, who prioritize health and fitness in their daily routines. The fortified energy-bar market is thus adapting by offering products that cater specifically to this demographic, emphasizing performance-enhancing ingredients. This shift is expected to drive market growth, with projections indicating a potential increase in sales by 20% in the coming years.

Growing Awareness of Nutritional Benefits

There is a marked increase in consumer awareness regarding the nutritional benefits of fortified energy bars, which significantly influences the fortified energy-bar market. As health education becomes more prevalent, consumers are more informed about the importance of vitamins, minerals, and protein in their diets. This awareness drives the demand for products that not only satisfy hunger but also contribute to overall health. The fortified energy-bar market is responding by innovating formulations that highlight these benefits, with many products now boasting high protein content and essential nutrients. This shift is likely to attract health-conscious consumers, further propelling market growth.

Rising Demand for Nutritional Convenience

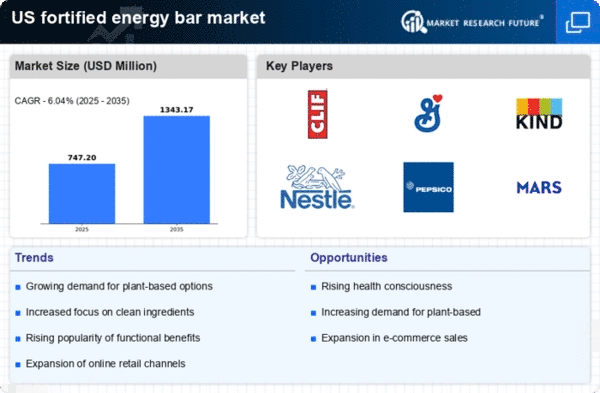

The fortified energy-bar market experiences a notable surge in demand driven by consumers' increasing preference for convenient nutritional options. As busy lifestyles become the norm, individuals seek quick and healthy snacks that can be consumed on-the-go. This trend is particularly evident among working professionals and fitness enthusiasts who prioritize nutrition without sacrificing time. According to recent data, the market is projected to grow at a CAGR of 6.5% over the next five years, indicating a robust appetite for fortified energy bars. The fortified energy-bar market is thus positioned to capitalize on this demand, offering products that cater to the need for convenience while ensuring nutritional value.