Rising Awareness and Advocacy

The growing awareness and advocacy surrounding glioblastoma are crucial drivers for the glioblastoma market. Non-profit organizations and patient advocacy groups are increasingly active in raising awareness about the disease, leading to enhanced public understanding and support for research initiatives. Campaigns aimed at educating the public about symptoms and treatment options have the potential to increase early diagnosis rates, which may improve patient outcomes. Furthermore, heightened awareness can lead to increased funding for research and development, as more stakeholders recognize the need for effective therapies. This shift in public perception is likely to create a more favorable environment for the glioblastoma market, encouraging investment and innovation.

Government Initiatives and Funding

Government initiatives aimed at combating glioblastoma are playing a pivotal role in shaping the glioblastoma market. Increased funding for research programs and clinical trials has been observed, with federal agencies allocating millions of dollars to support innovative studies. For example, the National Institutes of Health (NIH) has prioritized brain cancer research, which is expected to enhance the understanding of glioblastoma and lead to the development of new therapies. This financial backing not only encourages academic institutions and biotech companies to pursue groundbreaking research but also fosters collaboration across various sectors. As a result, the glioblastoma market is likely to benefit from a surge in novel treatment options and improved patient outcomes.

Advancements in Treatment Modalities

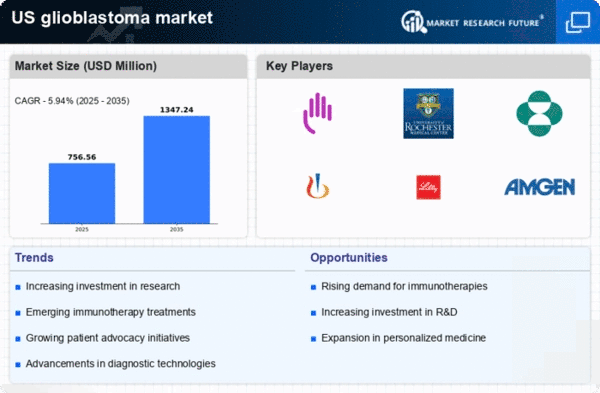

Innovations in treatment modalities are significantly influencing the glioblastoma market. The introduction of novel therapies, including targeted therapies and immunotherapies, has transformed the treatment landscape. For instance, the FDA has approved several new agents that have shown promise in extending survival rates. The market for glioblastoma treatments is projected to reach approximately $3 billion by 2026, reflecting the growing investment in research and development. These advancements not only enhance patient outcomes but also attract substantial funding from both public and private sectors, further propelling the market forward. As new treatment options emerge, the competitive dynamics within the glioblastoma market are likely to evolve, fostering innovation and improving patient care.

Increasing Incidence of Glioblastoma

The rising incidence of glioblastoma in the US is a critical driver for the glioblastoma market. Recent statistics indicate that approximately 3.2 cases per 100,000 individuals are diagnosed annually, with a notable increase in the aging population. This demographic shift is likely to contribute to a higher prevalence of glioblastoma, thereby intensifying the demand for effective treatment options. As the number of patients grows, pharmaceutical companies are compelled to invest in research and development, leading to a more competitive landscape. The increasing incidence not only drives the need for innovative therapies but also stimulates market growth, as healthcare providers seek to address the challenges posed by this aggressive form of brain cancer.

Emerging Biomarkers and Diagnostic Tools

The identification of emerging biomarkers and the development of advanced diagnostic tools are transforming the glioblastoma market. These innovations facilitate earlier and more accurate diagnosis, which is essential for effective treatment planning. The integration of molecular profiling and imaging technologies is enabling healthcare providers to tailor therapies to individual patients, thereby improving outcomes. As the demand for precision medicine grows, the market for diagnostic tools is expected to expand significantly, potentially reaching $1 billion by 2027. This trend not only enhances the understanding of glioblastoma but also drives the development of targeted therapies, creating a synergistic effect that propels the glioblastoma market forward.

.png)