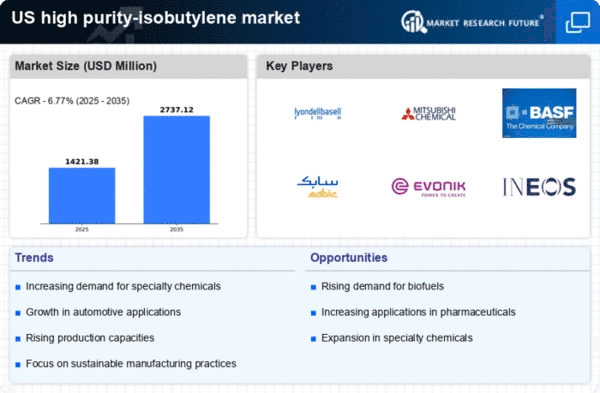

The high purity-isobutylene market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on sustainability. Key players such as LyondellBasell Industries (US), Mitsubishi Chemical Corporation (JP), and BASF SE (DE) are actively pursuing strategies that enhance their market positioning. LyondellBasell Industries (US) has been focusing on expanding its production capabilities, which appears to be a response to the growing demand for high purity-isobutylene in various applications, including specialty chemicals and fuels. Meanwhile, Mitsubishi Chemical Corporation (JP) emphasizes innovation in its product offerings, aiming to leverage advanced technologies to improve efficiency and reduce environmental impact. BASF SE (DE) is also investing in sustainable practices, indicating a collective industry shift towards greener operations.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure is moderately fragmented, with several key players exerting influence over pricing and supply dynamics. This fragmentation allows for competitive maneuvering, as companies seek to differentiate themselves through unique value propositions and operational excellence.

In October TPC Group Inc. (US) announced a strategic partnership with a leading technology firm to develop advanced purification processes for high purity-isobutylene. This collaboration is expected to enhance TPC Group's production efficiency and product quality, positioning the company favorably in a market that increasingly values technological advancements. The strategic importance of this partnership lies in its potential to reduce production costs while meeting stringent quality standards.

In September SABIC (SA) unveiled a new facility dedicated to the production of high purity-isobutylene, which is anticipated to significantly increase its market share. This facility is designed with state-of-the-art technology aimed at minimizing environmental impact, aligning with global sustainability trends. The establishment of this facility underscores SABIC's commitment to expanding its footprint in the high purity-isobutylene market while addressing the growing demand for eco-friendly products.

In August Evonik Industries AG (DE) launched a new line of high purity-isobutylene derivatives, targeting applications in the automotive and electronics sectors. This strategic move reflects Evonik's focus on innovation and its intent to capture emerging market opportunities. The introduction of these derivatives is likely to enhance the company's competitive edge by catering to specific industry needs, thereby fostering customer loyalty and driving revenue growth.

As of November the competitive trends in the high purity-isobutylene market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing innovation and operational efficiency. The competitive landscape is shifting from traditional price-based competition to a focus on technological advancements and supply chain reliability. This evolution suggests that companies that prioritize innovation and sustainability will likely emerge as leaders in the market, shaping the future dynamics of competition.