Rising Public Health Awareness

Rising public health awareness is a key driver of the human vaccines market. Educational campaigns and community outreach programs have significantly increased knowledge about the benefits of vaccination. The CDC and various health organizations have been actively promoting vaccination as a critical tool for disease prevention. Surveys indicate that public confidence in vaccines has improved, with over 80% of adults recognizing the importance of immunization. This heightened awareness is likely to translate into higher vaccination rates, thereby expanding the human vaccines market. As of 2025, the market is projected to grow by 5% annually, driven by this increasing public engagement and understanding of vaccine efficacy.

Advancements in Vaccine Technology

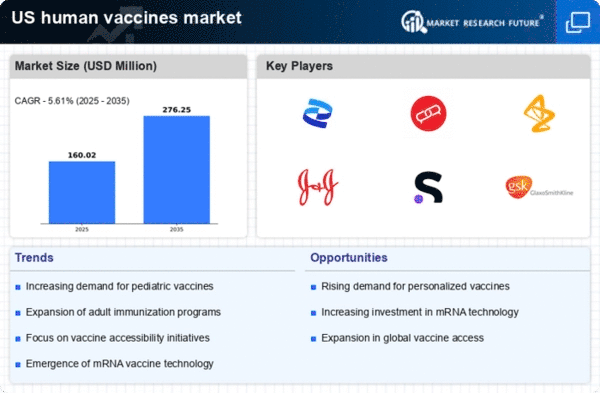

Advancements in vaccine technology are significantly influencing the human vaccines market. Innovations such as mRNA technology and viral vector platforms have revolutionized vaccine development, allowing for faster and more effective responses to emerging infectious diseases. The introduction of mRNA vaccines has demonstrated a remarkable efficacy rate of over 90% in clinical trials, which has encouraged further investment in research and development. As of 2025, market is projected to reach $40 billion, with a notable increase in the number of vaccines entering the pipeline.. These technological advancements not only enhance vaccine efficacy but also improve safety profiles, thereby fostering public trust and acceptance of vaccinations.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the human vaccines market. The US government has allocated substantial funding for vaccine research and development, particularly in response to emerging health threats. For instance, the National Institutes of Health (NIH) and the CDC have launched programs aimed at accelerating vaccine innovation. In 2024, federal funding for vaccine programs reached $5 billion, reflecting a commitment to enhancing public health infrastructure. These initiatives not only support the development of new vaccines but also facilitate access to existing vaccines, thereby increasing overall vaccination rates. As a result, the human vaccines market is likely to expand, driven by these supportive policies and funding mechanisms.

Rising Incidence of Infectious Diseases

human vaccines market is experiencing growth due to rising incidence of infectious diseases in the US.. Reports indicate that vaccine-preventable diseases, such as measles and pertussis, have seen a resurgence, prompting public health initiatives to increase vaccination rates. The Centers for Disease Control and Prevention (CDC) emphasizes the importance of vaccination in controlling outbreaks, which has led to increased funding for vaccine development and distribution. In 2023, the market was valued at approximately $30 billion, with projections suggesting a compound annual growth rate (CAGR) of 6% through 2030. This trend indicates a robust demand for vaccines, as healthcare providers and policymakers prioritize immunization to safeguard public health.

Increased Focus on Preventive Healthcare

human vaccines market is benefiting from increased focus on preventive healthcare in the US.. As healthcare systems shift towards value-based care, there is a growing recognition of the importance of vaccination in preventing diseases and reducing healthcare costs. Preventive measures, including vaccinations, are seen as essential components of public health strategies. In 2025, it is estimated that preventive healthcare spending will account for approximately 15% of total healthcare expenditures, highlighting the financial incentives for vaccination programs. This shift in focus is likely to drive demand for vaccines, as both healthcare providers and patients prioritize preventive measures to enhance overall health outcomes.