US Industrial Vision Market Overview:

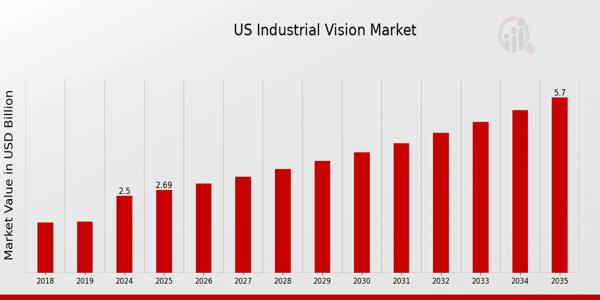

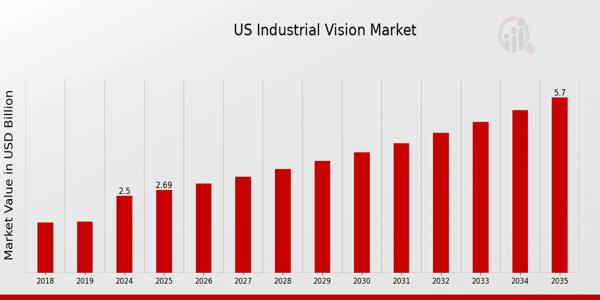

As per MRFR analysis, the US Industrial Vision Market Size was estimated at 2.28 (USD Billion) in 2023. The US Industrial Vision Market Industry is expected to grow from 2.5(USD Billion) in 2024 to 5.7 (USD Billion) by 2035. The US Industrial Vision Market CAGR (growth rate) is expected to be around 7.78% during the forecast period (2025 - 2035).

Key US Industrial Vision Market Trends Highlighted

The US Industrial Vision Market is experiencing significant shifts influenced by advancements in technology and increasing demand for automation across various sectors. One key market driver is the surge in demand for high-quality imaging and precision inspection. Industries like manufacturing, automotive, and healthcare are investing in vision systems to enhance quality control and reduce operational costs. The integration of artificial intelligence and machine learning with vision systems is facilitating smarter automation processes, allowing companies to streamline operations and improve productivity.

Opportunities to be explored include the growth of small and medium enterprises adopting vision systems, as the technology becomes more accessible and affordable.The increasing prevalence of smart factories and Industry 4.0 initiatives is driving the demand for integrated vision solutions that can work seamlessly with other automated systems. Additionally, the rise in e-commerce has led to a greater need for automated inspection systems in warehousing and logistics, helping to facilitate faster processing and distribution. Recent trends indicate a move towards more sophisticated and versatile vision systems that offer capabilities such as 3D imaging and real-time analysis.

This evolution is largely attributed to the necessity for efficient defect detection and process optimization in production lines.Moreover, the emphasis on promoting safety and compliance in industries like food processing and pharmaceuticals is fostering the adoption of advanced vision technologies that ensure high standards are maintained. These trends reflect a broader shift in the US towards greater utilization of industrial vision systems as essential tools for enhancing efficiency and quality across various sectors.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

US Industrial Vision Market Drivers

Growing Demand for Automation in Manufacturing Processes

The increasing demand for automation in the manufacturing sector is driving the growth of the US Industrial Vision Market Industry. With approximately 80% of manufacturers in the United States employing some degree of automation according to the National Association of Manufacturers, industrial vision systems are being increasingly utilized for quality control, inspection, and process optimization. The push for greater efficiency and reduced operational costs has led to a significant investment in advanced vision systems.A study by the U.S.

Department of Commerce indicates that the automation market could grow by 20% over the next few years, indicating a strong future for the US Industrial Vision Market. Major players such as Cognex Corporation and Keyence Corporation are leading this charge by innovating and providing sophisticated vision solutions that cater to these rising automation demands.

Increase in Quality Control Standards

As industries continue to uphold strict quality control standards, the necessity for advanced vision systems has escalated in the US Industrial Vision Market Industry. Regulatory bodies, including the Food and Drug Administration (FDA) and the International Standards Organization (ISO), enforce stringent regulations that require manufacturers to deliver high-quality products.

A report from the American Society for Quality shows that companies that adopt automated inspection systems, which are predominantly industrial vision systems, experience a 30% reduction in defect rates.Organizations like Rockwell Automation are spearheading technology development in vision systems, ensuring compliance with these strict quality expectations and enhancing product integrity through reliable automated inspection methods.

Growth in Machine Learning and Artificial Intelligence Implementation

The integration of Machine Learning (ML) and Artificial Intelligence (AI) in industrial vision systems is a prominent driver in the US Industrial Vision Market Industry. According to a report from the Massachusetts Institute of Technology, companies that leverage AI technologies have improved production efficiency by approximately 50%, showcasing the potential transformative effects of these technologies on manufacturing processes.

As more firms adopt these innovations, the demand for advanced vision systems that can process and analyze complex data in real-time is anticipated to surge.Companies like IBM and NVIDIA are actively involved in developing AI-powered vision solutions, thus significantly impacting the growth trajectory of the US Industrial Vision Market.

US Industrial Vision Market Segment Insights:

Industrial Vision Market Product Insights

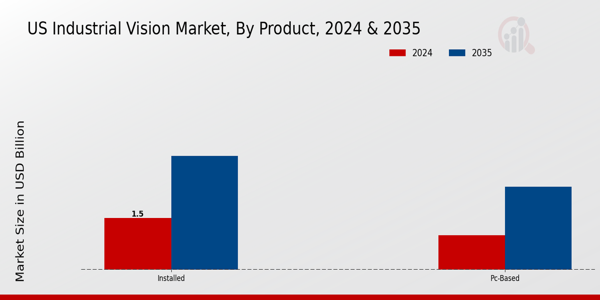

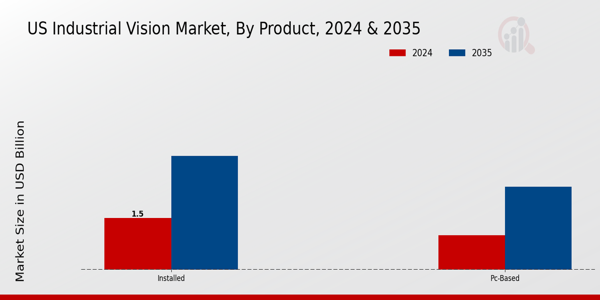

The US Industrial Vision Market is experiencing substantial growth, driven by advancements in automation, machine learning, and industrial robotics. The Product segment plays a crucial role in shaping the overall market dynamics, characterized by solutions that enhance efficiency and precision in manufacturing processes. Within this segment, various categories, such as Installed and PC-based systems, exhibit distinct characteristics and applications. Installed systems are pivotal for providing real-time image processing capabilities and are often utilized in quality control and inspection processes, thereby ensuring adherence to stringent product standards.

As industries increasingly adopt automation technologies, the demand for reliable and versatile Installed solutions continues to grow. On the other hand, PC-based vision systems are essential for their flexibility and higher processing power, making them suitable for complex imaging tasks across diverse industrial environments. These systems can be easily integrated with existing networks, allowing for smoother data analysis and storage, thus fostering improved decision-making in production. The PC-based category not only caters to high-performance requirements but also facilitates advancements in artificial intelligence, further enhancing image recognition and decision-making capabilities.

The US market landscape for these systems highlights an increasing trend towards integration of vision technologies with Internet of Things (IoT) devices, driving the need for sophisticated data analytics and real-time monitoring. With the rapid evolution of Industry 4.0 concepts, both Installed and PC-based systems are aligning with industrial needs for higher levels of automation and efficiency. Furthermore, investments from various sectors in Research and Development are propelling innovations in this segment. As a result, the US Industrial Vision Market segmentation reflects a growing diversity of products designed to address specific industrial challenges.

The emphasis on quality control, operational efficiency, and enhanced predictive maintenance underscores the significance of the Product segment in the broader industrial vision ecosystem. Additionally, the increasing focus on smart manufacturing and digital transformation across various manufacturing industries is poised to create new opportunities for growth in both Installed and PC-based systems. As these segments continue to evolve, they will undoubtedly play an integral part in the future landscape of industrial automation in the US, facilitating enhanced productivity and precision in manufacturing operations.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Industrial Vision Market Technology Insights

The Technology segment of the US Industrial Vision Market plays a crucial role in advancing automation and quality control across various industries. With the overall market expected to be valued at approximately 2.5 billion USD by 2024, the demand for sophisticated vision technologies such as Imaging, Laser, and Expanded systems continues to grow. Imaging technologies are essential for precise measurements and inspections, serving sectors like manufacturing and healthcare, where accuracy and efficiency are paramount. Laser technology, recognized for its speed and precision, is widely used in applications such as material cutting and surface analysis, thus driving productivity.

The Expanded segment encompasses a variety of emerging solutions that enhance the capabilities of traditional vision systems, allowing for integration with artificial intelligence and machine learning for improved decision-making. Trends in this sector are largely driven by the need for operational excellence, quality assurance, and enhanced safety in industrial processes.

Challenges such as integration with legacy systems and high initial costs are present, but opportunities abound for innovative players who can deliver cost-effective and cutting-edge solutions.As the market continues to evolve, understanding the dynamics within the Technology segment remains critical for stakeholders aiming to capitalize on the growth of the US Industrial Vision Market.

Industrial Vision Market Component Insights

The Component segment of the US Industrial Vision Market encompasses essential areas that are vital for industrial applications. This segment includes aspects such as Programming and Equipment, which play a significant role in enhancing the efficiency and effectiveness of automated systems. Programming facilitates the development of algorithms that drive vision systems, ensuring precise identification and analysis of components on production lines.

Meanwhile, Equipment includes cameras, sensors, and lighting systems that collectively contribute to image acquisition and processing, which are crucial for maintaining high-quality standards.As industries in the US increasingly adopt automation technologies, the demand for advanced Components in the Industrial Vision Market is growing, driven by the necessity for operational efficiency and accuracy. This segment not only supports manufacturing processes but also enables industries to implement predictive maintenance, quality control, and inventory management more effectively.

With ongoing advancements in technology and an increased focus on automation, the Components segment remains a crucial driver for innovation and improvement within the US Industrial Vision Market, illustrating its vital importance in addressing modern industrial challenges.

Industrial Vision Market Vertical Insights

The US Industrial Vision Market has shown significant development within the Vertical segment, indicating a focus on diverse applications across multiple industries. This segment encompasses various areas such as Shopper, Gadgets, Auto, Metals, Drug, Food and Bundling, and Medical services, each exhibiting unique demands and growth drivers. The Shopper segment leverages vision systems for enhanced retail analytics and customer experience optimization, while the Auto sector heavily relies on these technologies for safety and efficiency in manufacturing processes. The Metals and Manufacturing industries benefit from automation and quality assurance through vision systems, which are crucial for maintaining production standards.

In the healthcare field, Medical services utilize these systems for imaging and diagnostic processes, illustrating the technology's versatility. Additionally, the Food and Bundling sector focuses on ensuring product safety and quality control, fulfilling stringent regulatory requirements. The US's commitment to innovation and automation, driven by advancements in camera technology and software solutions, enhances the significance of the Vertical segment, positioning it as critical for market growth and transformation across various industrial sectors.The overall market dynamics reflect a trend of increased integration of Industrial Vision technologies, ultimately leading to improved operational efficiencies and outcomes.

US Industrial Vision Market Key Players and Competitive Insights:

The US Industrial Vision Market is a rapidly evolving sector that plays a pivotal role in automation, quality control, and inspection processes across numerous industries, including manufacturing, automotive, and pharmaceuticals. It is characterized by heightened competition driven by technological advancements, increasing demand for quality assurance, and the integration of artificial intelligence and machine learning capabilities into vision systems. Companies within this market strive to innovate, focusing on developing high-performance imaging systems, smart cameras, and sophisticated algorithms that enhance industrial operations.

The market dynamics are influenced by factors such as the growing trend of automation, increased efficiency requirements, and the need for precise quality monitoring, creating a vibrant landscape for both established players and new entrants.Prophesee has established a notable presence within the US Industrial Vision Market, primarily through its cutting-edge event-based vision technology, which leverages neuromorphic engineering principles to process visual information more efficiently. The company’s approach to vision sensing provides real-time processing with low latency, enabling application across a wide spectrum of industrial scenarios.

By focusing on high-speed inspection, machine learning capabilities, and efficient power consumption, Prophesee has carved out a niche that sets it apart from traditional image processing systems. Its strengths lie in its innovation and adaptability, responding effectively to the needs of various industries for enhanced inspection and automation.

This adaptability is critical in the competitive landscape, where clients prioritize speed, accuracy, and the seamless integration of vision systems into existing workflows.National Instruments has a comprehensive foothold in the US Industrial Vision Market, offering a blend of hardware and software solutions that cater to different facets of automated testing, measurement, and vision applications. The company excels through its versatile platform that allows users to utilize integrated vision solutions for a variety of industrial applications, from quality assurance to production line automation.

With a continuously expanding catalog of key products and services that includes image processing hardware, software development kits, and vision development modules, National Instruments is well-positioned to address the diverse needs of its clientele. The company's strengths lie in its long-standing reputation for reliability and innovation, further bolstered by strategic mergers and acquisitions that enhance its technological capabilities and market reach. National Instruments effectively leverages its extensive industry knowledge and partnerships to create a robust ecosystem that supports its position in the US Industrial Vision Market.

Key Companies in the US Industrial Vision Market Include:

US Industrial Vision Market Industry Developments

The US Industrial Vision Market has seen significant developments recently, particularly with companies like Cognex and Keyence reporting strong quarterly results driven by increased automation in manufacturing. Omron has introduced advanced machine vision systems aimed at enhancing production efficiency, while Prophesee has made strides in neuromorphic vision technology, expanding its application in various sectors. In terms of mergers and acquisitions, Basler acquired an advanced camera technology firm in October 2022, strengthening its position in the market, whereas Sony has been active in expanding its industrial imaging product line.

The valuation of several companies, including FLIR Systems and Datalogic, has surged due to heightened demand for automation solutions, with projections indicating continuous growth influenced by ongoing advancements in artificial intelligence and machine learning applications within vision systems. Over the past two to three years, the overall market dynamics have shifted significantly, with increased investments in Research and Development and the adaptation of vision technology in logistics and supply chain management, highlighting its critical role in enhancing operational effectiveness and data analytics capabilities.

As of mid-2023, the landscape continues to evolve, reinforcing the importance of innovative vision systems in the US industry.

US Industrial Vision Market Segmentation Insights

Industrial Vision Market Product Outlook

Industrial Vision Market Technology Outlook

Industrial Vision Market Component Outlook

Industrial Vision Market Vertical Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.28(USD Billion) |

| MARKET SIZE 2024 |

2.5(USD Billion) |

| MARKET SIZE 2035 |

5.7(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

7.78% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Prophesee, National Instruments, Omron, Basler, Sony, Cognex, FLIR Systems, Vision Components, Datalogic, SICK, JAI, Keyence, Zebra Technologies, Matrox, Teledyne Technologies |

| SEGMENTS COVERED |

Product, Technology, Component, Vertical |

| KEY MARKET OPPORTUNITIES |

AI integration for quality control, Increased demand for automation, Growth in smart factories, Expansion of machine vision systems, Rising need for remote monitoring |

| KEY MARKET DYNAMICS |

Advancements in machine vision technology, Increasing demand for automation, Rising quality control requirements, Growth in artificial intelligence integration, Expanding applications across industries |

| COUNTRIES COVERED |

US |

Frequently Asked Questions (FAQ):

The US Industrial Vision Market is expected to be valued at 2.5 billion USD in 2024.

By 2035, the US Industrial Vision Market is projected to be valued at 5.7 billion USD.

The expected compound annual growth rate (CAGR) for the US Industrial Vision Market from 2025 to 2035 is 7.78%.

Key players in the US Industrial Vision Market include Prophesee, National Instruments, Omron, Basler, Sony, and Cognex among others.

The market value for the installed product segment in 2035 is expected to reach 3.3 billion USD.

The PC-based product segment is expected to be valued at 1.0 billion USD in 2024.

The main applications driving growth in the US Industrial Vision Market include quality control, automation, and inspection processes.

Current global trends, including technological advancements, are likely to positively affect the growth rate of the US Industrial Vision Market.

The installed product segment of the US Industrial Vision Market is expected to grow significantly during the 2025 to 2035 period.

Challenges may include the rapid evolution of technology and competition from newer entrants in the US Industrial Vision Market.