Rising Diabetes Prevalence

The increasing prevalence of diabetes in the United States is a primary driver for the insulin delivery-devices market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million Americans, or 10.5% of the population, have diabetes. This growing patient population necessitates effective insulin management solutions, thereby propelling demand for advanced delivery devices. As the number of individuals diagnosed with diabetes continues to rise, the insulin delivery-devices market is expected to expand significantly. Furthermore, the aging population, which is more susceptible to diabetes, contributes to this trend. The need for reliable and user-friendly insulin delivery systems is paramount, as patients seek to manage their condition effectively and maintain a good quality of life.

Growing Awareness and Education

There is a notable increase in awareness and education regarding diabetes management among patients and healthcare professionals, which is positively influencing the insulin delivery-devices market. Educational initiatives by organizations and healthcare providers are equipping patients with the knowledge necessary to manage their diabetes effectively. This heightened awareness leads to increased adoption of insulin delivery devices, as patients become more informed about their options. Furthermore, the emphasis on self-management and patient empowerment is driving demand for user-friendly devices that facilitate better control of blood glucose levels. As a result, the insulin delivery-devices market is likely to experience growth as more patients seek out these solutions to improve their health outcomes.

Supportive Reimbursement Policies

Supportive reimbursement policies in the United States are playing a crucial role in the growth of the insulin delivery-devices market. Insurance coverage for advanced insulin delivery systems, including insulin pumps and smart pens, is becoming more prevalent, making these devices more accessible to patients. The Centers for Medicare & Medicaid Services (CMS) and private insurers are increasingly recognizing the importance of these devices in managing diabetes effectively. As reimbursement policies evolve to support innovative technologies, patients are more likely to invest in insulin delivery devices that enhance their quality of life. This trend is expected to drive market growth, as financial barriers are reduced, allowing for broader adoption of advanced insulin delivery solutions.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in the United States is influencing the insulin delivery-devices market. Healthcare providers are increasingly advocating for proactive management of diabetes to prevent complications associated with the disease. This shift towards preventive care encourages patients to utilize insulin delivery devices that facilitate better glucose control and reduce the risk of long-term health issues. As healthcare systems prioritize preventive measures, the demand for effective insulin delivery solutions is likely to rise. This trend aligns with broader public health goals aimed at reducing the burden of diabetes on the healthcare system, thereby fostering growth in the insulin delivery-devices market.

Technological Innovations in Delivery Systems

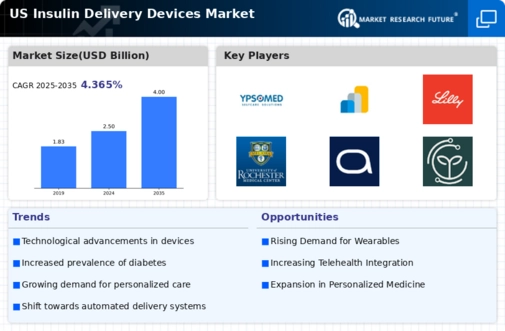

Technological advancements in insulin delivery devices are transforming the insulin delivery-devices market. Innovations such as smart insulin pens, continuous glucose monitors (CGMs), and automated insulin delivery systems are enhancing patient experience and adherence to treatment. For instance, the integration of mobile applications with insulin delivery devices allows for real-time monitoring and data sharing with healthcare providers. This trend is likely to improve patient outcomes and satisfaction. The market for insulin delivery devices is projected to reach approximately $10 billion by 2026, driven by these technological innovations. As patients increasingly demand more sophisticated and efficient solutions, manufacturers are compelled to invest in research and development to stay competitive in the evolving landscape.

.png)