US InsurTech Market Overview

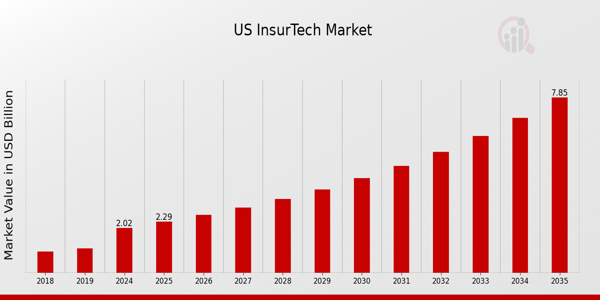

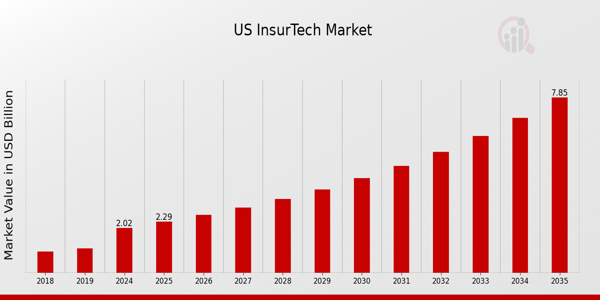

As per MRFR analysis, the US InsurTech Market Size was estimated at 2.4 (USD Billion) in 2023. The US InsurTech Market Industry is expected to grow from 2.7(USD Billion) in 2024 to 10 (USD Billion) by 2035. The US InsurTech Market CAGR (growth rate) is expected to be around 12.64% during the forecast period (2025 - 2035).

Key US InsurTech Market Trends Highlighted

The US InsurTech market is witnessing significant trends driven by technological advancements and changing consumer expectations. One of the key market drivers is the increased adoption of digital platforms that enhance customer experience. Insurers are leveraging artificial intelligence, machine learning, and data analytics to streamline operations, improve underwriting processes, and personalize insurance products. This shift towards digital solutions is reshaping how consumers interact with insurance services, creating a demand for more convenient and efficient services.

Opportunities are emerging in areas such as on-demand insurance, microinsurance, and usage-based insurance models.These innovations cater to the growing population of gig economy workers and the younger demographic, who prefer flexible insurance solutions that align with their lifestyles. The regulatory landscape in the US is also evolving, with states exploring sandbox initiatives to foster innovation while ensuring consumer protection. This environment presents a unique chance for startups and established insurers to collaborate and test new models. Recently, there has been a noticeable trend of partnerships between InsurTech firms and traditional insurance companies.

These collaborations enable incumbents to stay relevant while benefiting from the agility and innovation inherent in startups.Moreover, a shift towards sustainable insurance practices is gaining momentum, with an increased focus on environmental, social, and governance (ESG) factors. The convergence of technology, regulatory flexibility, and consumer expectations is creating a dynamic landscape that shapes the future of the US InsurTech market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

US InsurTech Market Drivers

Increased Adoption of Digital Solutions in Insurance

The US InsurTech Market Industry is experiencing significant growth due to the rising demand for digital solutions among consumers. Surveys from the American Insurance Association indicate that over 63% of consumers prefer digital interactions for policy management and claims filing. This trend has driven established players like State Farm and Allstate to enhance their digital offerings significantly.

As a result, the integration of Artificial Intelligence (AI) and Machine Learning (ML) in customer service has transformed traditional insurance paradigms, allowing companies to personalize user experiences effectively.With approximately 56% of insurers reporting substantial investments in technology, as documented in industry trade reports, it is clear that digital transformation is pivotal in reshaping the US insurance landscape.

Regulatory Support for Innovation

Favorable regulatory conditions in the United States are acting as a catalyst for the growth of the US InsurTech Market Industry. The regulatory sandbox initiatives introduced by several state insurance regulators allow startups to experiment with new technologies and business models without immediate compliance burdens. For instance, the Colorado Division of Insurance launched an innovation program that has facilitated over 20 InsurTech startups.This approach not only encourages innovation but also ensures consumer protection standards are maintained.

Such initiatives have led to an increasing number of insured individuals, with recent statistics indicating a 15% rise in customer acquisition for tech-driven insurance solutions.

Rising Consumer Expectations for Customization

The demand for personalized insurance products is driving the growth of the US InsurTech Market Industry. A report by the Insurance Information Institute shows that 78% of consumers are more likely to purchase from companies that offer tailored insurance solutions. Companies like Lemonade and Metromile have capitalized on this trend by providing highly customizable policies that cater to individual needs. This shift towards personalization is reflected in the growing consumer base, with an estimated 30% increase in users opting for customized insurance products over traditional offerings within the last four years.

Impact of Big Data and Analytics on Risk Management

The utilization of Big Data and Analytics within the US InsurTech Market Industry is revolutionizing risk assessment and management processes. According to the National Association of Insurance Commissioners, insurers using advanced data analytics have seen up to a 20% reduction in fraudulent claims and an estimated 15% improvement in underwriting efficiency. Major players like Progressive have integrated telematics to assess driving behavior, which allows for more accurate premium pricing.This trend not only benefits insurers by minimizing losses but also provides consumers with fairer pricing based on actual risk profiles.

US InsurTech Market Segment Insights

InsurTech Market Service Type Insights

The Service Type segment of the US InsurTech Market has emerged as a critical component, highlighting the importance of technology-driven solutions in transforming traditional insurance practices. As the industry continues to evolve, the demand for services such as Policy Administration, Claim Management, Risk Assessment, and Billing and Payments is experiencing significant growth. Policy Administration is essential as it streamlines the management of insurance policies, enhancing operational efficiency and customer satisfaction. This service allows insurers to quickly issue, modify, and renew policies, which is vital in a fast-paced environment where customer expectations are high.

Claim Management plays a pivotal role in customer experience, as this service ensures that claims are processed promptly and efficiently, reducing turnaround times and enhancing customer trust. In a landscape where speed and accuracy are paramount, InsurTech innovations in Claim Management are becoming increasingly significant. Furthermore, Risk Assessment is fundamental to the insurance industry, allowing insurers to accurately evaluate risks and set appropriate premiums.

Technological advancements in data analytics and artificial intelligence are making it possible to obtain more precise risk profiles, enabling businesses to optimize their underwriting processes.Billing and Payments services offer convenience and efficiency, allowing customers to manage their transactions easily through digital platforms. This segment's growth is driven by consumer preference for seamless, quick payment solutions and improved financial management capabilities. The integration of automated billing systems and digital payment gateways aligns with the broader trend of digitization across the financial services spectrum.

Overall, the Service Type segment is instrumental in defining the trajectory of the US InsurTech Market, as it supports operational improvements and fosters enhanced customer interactions through innovative technology deployment. These services are not only reshaping the way insurers operate but are also setting new standards for service delivery in the insurance domain. The increasing reliance on technology and data-driven approaches positions the US InsurTech Market for robust growth, making it a dynamic field to watch.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

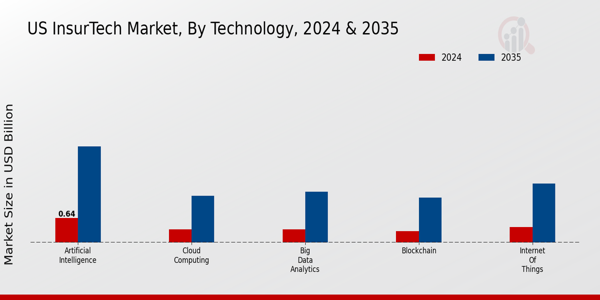

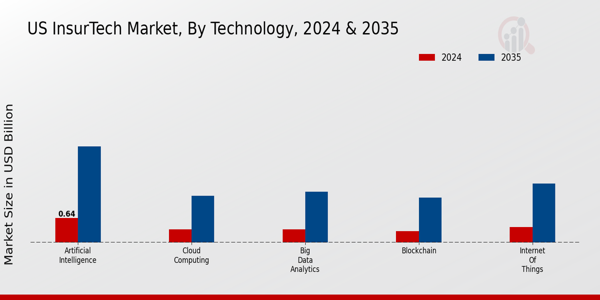

InsurTech Market Technology Insights

The Technology segment within the US InsurTech Market has emerged as a pioneering force, significantly enhancing operational efficiencies and customer engagement across the insurance landscape. Technologies such as Artificial Intelligence are playing a crucial role in automating claims processes and enhancing underwriting accuracy, leading to improved customer experiences. Blockchain is fundamentally reshaping transaction security and transparency, fostering trust among stakeholders by reducing fraud potential.

Big Data Analytics enables insurers to leverage vast amounts of data for risk assessment and personalized pricing, thus driving competition.The Internet of Things is transforming how data is collected, allowing for real-time risk monitoring and tailored insurance solutions. The impact of these technologies is profound, as they not only streamline operations but also cater to changing consumer expectations, thereby reshaping the entire US InsurTech Market by facilitating innovation and efficiency. Overall, the integration of these technologies signifies a paradigm shift in how insurance services are delivered, indicating significant growth potential in a rapidly evolving industry.

InsurTech Market End Use Insights

The US InsurTech Market is experiencing significant growth driven by its diverse End Use segments, which include Individual, Small Enterprises, and Large Enterprises. Individual consumers are increasingly adopting InsurTech solutions for personalized insurance products that cater to their unique needs, facilitating a shift from traditional coverage methods. Small Enterprises leverage InsurTech platforms to enhance operational efficiency and gain competitive advantages through innovative insurance solutions tailored for their specific challenges.Meanwhile, Large Enterprises are adopting advanced technologies to optimize risk management and streamline claim processing, often benefiting from predictive analytics and artificial intelligence capabilities.

This segmentation allows for a nuanced approach to addressing the varied demands of consumers and businesses in the US, paving the way for market growth. With rising digitalization and increasing awareness of InsurTech's potential advantages, the market continues to show robust momentum and expansion opportunities across these critical segments.Factors driving this growth include the increasing penetration of technology in everyday transactions and the demand for efficient, transparent, and customer-focused services, further emphasizing the importance of each segment in shaping the overall landscape of the US InsurTech Market.

InsurTech Market Distribution Channel Insights

The Distribution Channel segment of the US InsurTech Market plays a crucial role in ensuring that insurance products are accessible to consumers efficiently and effectively. Within this segment, Direct Sales are gaining traction as they allow insurers to interact closely with customers, providing personalized experiences and increasing customer engagement.

Brokerage platforms continue to be fundamental as they connect clients with a variety of insurance options, leveraging their expertise to guide consumers in selecting the best products to meet their needs.Furthermore, Online Platforms are transforming the landscape by offering a streamlined approach to purchasing insurance, driving convenience and accessibility for tech-savvy consumers, especially in a market increasingly influenced by digital behavior. Together, these channels reflect the growing trend of customer-centric strategies in the insurance space, underscoring the importance of adapting to user preferences in the competitive landscape of the US InsurTech Market.

As market dynamics shift towards greater transparency and ease of access, effective utilization of these distribution channels will be essential for sustaining growth and enhancing customer satisfaction.

US InsurTech Market Key Players and Competitive Insights

The US InsurTech market is experiencing rapid evolution, characterized by a landscape that is increasingly competitive and innovative. The integration of technology into insurance services is transforming how consumers interact with insurers, shifting from traditional models to agile, tech-driven solutions. This market seeks to address various pain points, such as customer experience, pricing, and claims processing, enabling InsurTech companies to gain a significant foothold in the insurance sector. As traditional insurers strive to adapt to digital advancements, new entrants equipped with technology-driven offerings are challenging established players.

The competitive dynamics are shaped by a blend of startups and larger entities, each attempting to carve out a niche by leveraging data analytics, artificial intelligence, and customer-centric platforms. Within this vibrant market, Lemonade stands out for its unique approach to digital insurance solutions. The company emphasizes transparency and social responsibility through its business model, which is designed to benefit policyholders while promoting charitable causes. Lemonade harnesses artificial intelligence to streamline everything from the application process to claims management, thereby reducing operational costs and enhancing customer satisfaction.

This focus on technology enables Lemonade to offer competitive pricing along with an engaging user experience. The brand's strong presence in renters and homeowners insurance provides an effective response to shifting consumer preferences, distinguishing it in a saturated market. The company's proficiency in leveraging peer-to-peer insurance concepts sets it apart, allowing for a more collaborative relationship with its customer base, fostering loyalty, and building a unique brand identity.Hippo Insurance is another key player in the US InsurTech landscape, aiming to revolutionize home insurance by focusing on the needs of modern homeowners.

The company offers comprehensive homeowners insurance that covers a wide range of incidents, demonstrating a commitment to understanding customers' evolving expectations. Hippo's strengths lie in its transparency and efficiency, as well as its technology-driven approach that utilizes smart home devices to provide additional coverage options and risk assessments. Through strategic mergers and acquisitions, Hippo has expanded its market presence and enhanced its product offerings, making significant strides in establishing a solid foothold within the industry. Notably, Hippo also promotes a seamless user experience with quick and straightforward policy management, ensuring that customers find value in their services.

Overall, its commitment to modernizing insurance services, along with innovative strategies for customer engagement, positions Hippo Insurance competitively in the US market.

Key Companies in the US InsurTech Market Include

US InsurTech Market Industry Developments

Recent news developments in the US InsurTech market have seen companies like Lemonade and Hippo Insurance expanding their service offerings, aimed at enhancing customer experience through technology-driven solutions. In July 2023, Zego announced its entry into the US market, targeting the growing demand for commercial auto insurance in gig economies. In the mergers and acquisitions space, Policygenius acquired a tech startup in August 2023 to bolster its product features, while Next Insurance raised significant funding in May 2023, further consolidating its market position.

Oscar Health has been adapting its models to integrate more health-focused insurance offerings, reflecting a broader trend in health technology. The market has also seen a marked increase in valuations, driven by heightened investor interest in digital insurance solutions and increased consumer demand for seamless online experiences. Some notable changes in the past few years include Metromile's acquisition by Lemonade for approximately $500 million in April 2022, which impacted the car insurance landscape significantly. As the regulatory environment continues to evolve, these InsurTech firms are navigating new challenges, shaping the future of insurance in the US.

US InsurTech Market Segmentation Insights

InsurTech Market Service Type Outlook

InsurTech Market Technology Outlook

InsurTech Market End Use Outlook

InsurTech Market Distribution Channel Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.4(USD Billion) |

| MARKET SIZE 2024 |

2.7(USD Billion) |

| MARKET SIZE 2035 |

10.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

12.64% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Lemonade, Hippo Insurance, Bold Penguin, Ladder Life, Zego, Next Insurance, Policygenius, EverQuote, Oscar Health, Zensurance, Snapsheet, Metromile, Coterie Insurance, Clearcover, Root |

| SEGMENTS COVERED |

Service Type, Technology, End Use, Distribution Channel |

| KEY MARKET OPPORTUNITIES |

AI-driven underwriting solutions, On-demand insurance products, Seamless digital claims processing, Personalized customer engagement tools, Automated regulatory compliance solutions |

| KEY MARKET DYNAMICS |

Digital transformation adoption, Data analytics utilization, Regulatory compliance challenges, Customer-centric innovation, Competition from traditional insurers |

| COUNTRIES COVERED |

US |

Frequently Asked Questions (FAQ):

The expected market size of the US InsurTech Market in 2024 is valued at approximately 2.7 billion USD.

By 2035, the US InsurTech Market is projected to reach a size of around 10.0 billion USD.

The expected CAGR for the US InsurTech Market from 2025 to 2035 is estimated to be 12.64%.

The Policy Administration segment is expected to grow from 0.9 billion USD in 2024 to 3.4 billion USD by 2035.

The Claim Management segment of the US InsurTech Market is estimated to be valued at 0.7 billion USD in 2024.

Key players in the US InsurTech Market include Lemonade, Hippo Insurance, Bold Penguin, and Next Insurance among others.

The Risk Assessment segment is expected to reach an estimated value of 2.5 billion USD by 2035.

The Billing and Payments segment is forecasted to be valued at 0.5 billion USD in 2024.

Key growth drivers for the US InsurTech Market include technological advancements, increased consumer demand, and regulatory changes.

The US InsurTech Market faces challenges such as regulatory hurdles, competition from traditional insurers, and technological integration issues.