Insurtech Market Summary

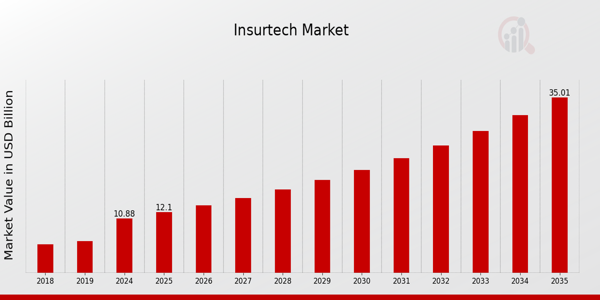

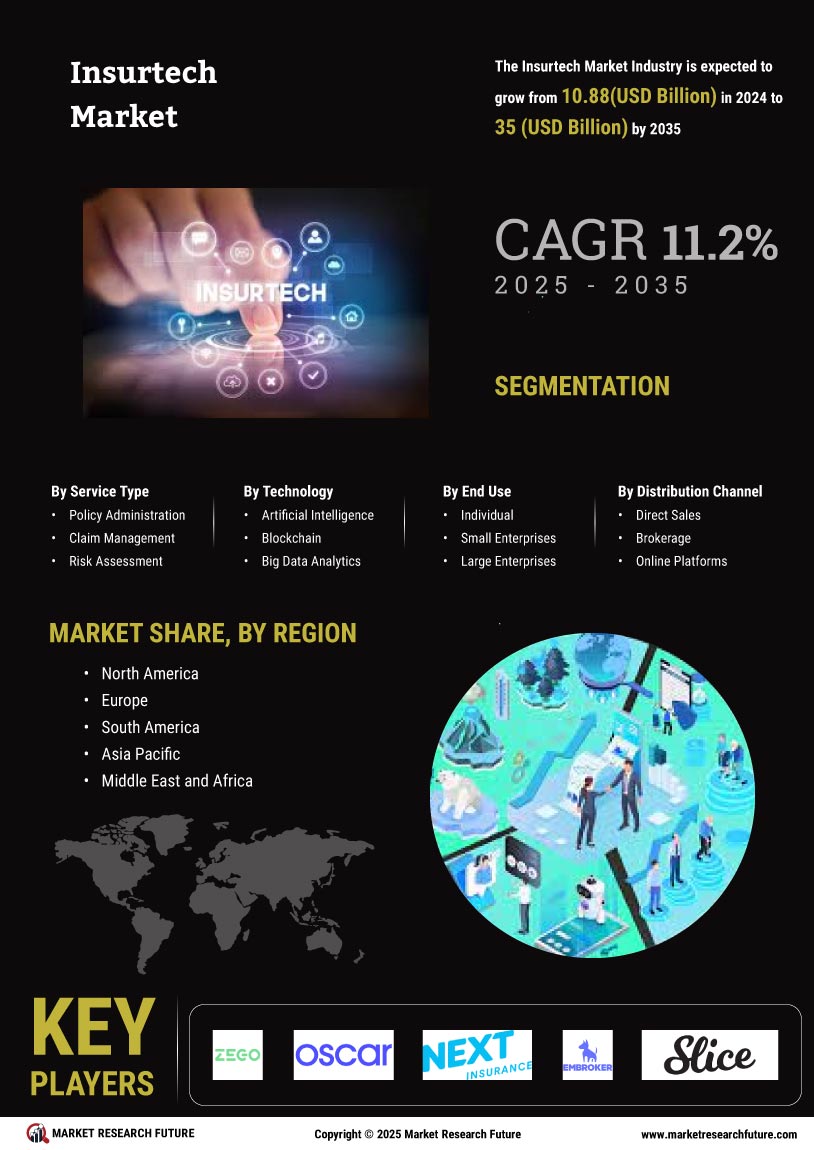

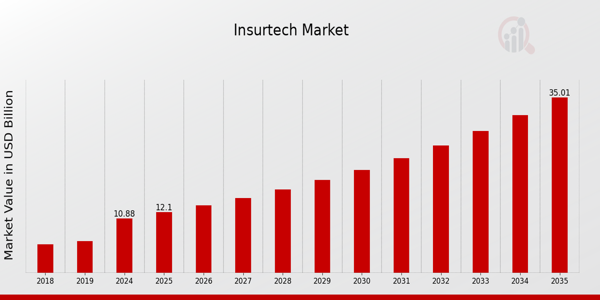

As per Market Research Future Analysis, the Insurtech Market was valued at 9.79 USD Billion in 2023 and is projected to grow to 35.0 USD Billion by 2035, reflecting a CAGR of 11.2% from 2025 to 2035. The market is driven by technological advancements, evolving customer expectations, and regulatory support, leading to increased operational efficiency and personalized insurance solutions.

Key Market Trends & Highlights

The Insurtech Market is witnessing transformative trends driven by technology and customer demands.

- Artificial intelligence and machine learning are enhancing underwriting processes, improving efficiency and reducing costs.

- The demand for personalized insurance solutions is rising, with 80% of consumers seeking tailored offerings.

- Regulatory support, such as the UK's Regulatory Sandbox, is fostering innovation and market entry for new players.

- Digital transformation initiatives have accelerated, with over 85% of insurance firms enhancing their digital capabilities.

Market Size & Forecast

2023 Market Size: USD 9.79 Billion

2024 Market Size: USD 10.88 Billion

2035 Market Size: USD 35.0 Billion

CAGR (2025-2035): 11.2%

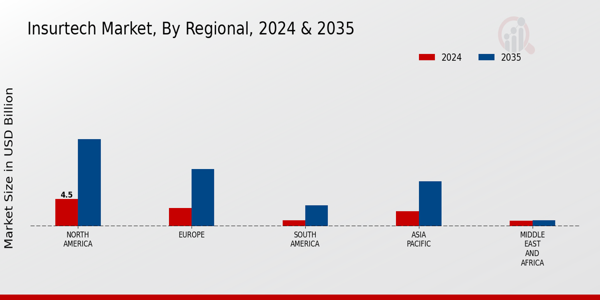

Largest Regional Market Share in 2024: North America.

Major Players

Key players include Zego, Oscar Health, Next Insurance, Embroker, Slice Labs, WeFox, Metromile, Root Insurance, Policygenius, Hippo Insurance, Tractable, Cuvva, Brolly, LemonaBy 2035, the Insurtech Market is projected to reach a value of 35.0 USD Billion.de, and Clearcover.

Key Insurtech Market Trends Highlighted

The global insurtech industry is evolving dramatically due to a number of important factors, including as shifting customer demands, legislative changes, and technology breakthroughs. Insurance companies may improve client experiences and optimize processes by focusing on digitalization.

The increasing need for customized insurance products is being met by innovations like artificial intelligence, machine learning, and big data analytics, which enable insurers to provide more individualized and effective services.A lot of insurers have improved their online platforms in response to the COVID-19 epidemic, which has also sped up the use of digital channels and made it simpler for customers to obtain information and buy insurance.

The Insurtech Market offers a wealth of options for investigation. Insurtechs have an opportunity to provide easily accessible and reasonably priced insurance solutions to underserved populations, especially in emerging economies.Partnerships between Internet startups and traditional insurers are also becoming more common, giving established companies the flexibility and creativity they need to take advantage of emerging technology. The focus on environmental responsibility and sustainability also creates opportunities for the creation of insurance plans that include coverage for eco-friendly projects and green technology.

Trends like the increased dependence on usage-based insurance models, which satisfy customer demands for flexibility and cost, have been seen recently. Notably, the move to digital customer interaction tactics has brought attention to how crucial relationship management and user experience are to keeping consumers.

These days, insurtech businesses are concentrating on developing smooth user interfaces and streamlining claim procedures via automation. All things considered, these patterns show a larger worldwide trend toward an insurance market that is more technologically advanced and customer-focused, adapted to the changing demands of both businesses and consumers.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Insurtech Market Drivers

Technological Advancements Driving Efficiency in the Insurtech Market

The rapid advancement of technology is significantly driving growth in the Insurtech Market. With an increasing reliance on artificial intelligence, machine learning, and big data analytics, companies are enabling more efficient operations and better customer experiences.

An estimated 98% of businesses worldwide are expected to adopt digital technologies by 2025. This shift is facilitated by leading organizations such as Allianz and AXA, which have invested heavily in Research and Development to integrate AI and other technologies into their service offerings.

Furthermore, the International Telecommunication Union reported a rise in global internet users, reaching over 4.9 billion in 2021. Improved connectivity enables better data collection, processing, and ultimately, personalized insurance solutions, reinforcing the necessity of digital transformation in the industry.

Growing Customer Demand for Personalized Insurance Products

A pronounced shift towards personalized insurance products is serving as a critical market driver for the Insurtech Market. As consumers become increasingly tech-savvy, they seek insurance solutions tailored to their individual needs. A survey conducted by the International Insurance Society found that 76% of consumers favor personalized services, showing a clear demand for customization.

Prominent companies like Lemonade and Policygenius have tapped into this growing demand by utilizing advanced data analytics to create personalized offerings. These organizations have reported increases in customer satisfaction rates, further illustrating how tailored insurance not only enhances customer experiences but also drives growth in the overall market.

Regulatory Support Encouraging Innovation in the Insurance Sector

Regulatory changes designed to support innovation in the insurance sector are playing a significant role in the growth of the Insurtech Market. For instance, in 2020, the European Commission committed to promoting insurtech innovation through regulatory sandboxes and streamlined compliance procedures.

This approach supports startups and established companies alike, fostering an environment conducive to technological advancements. Established companies such as Zurich and MetLife have benefited from these supportive regulations, enabling them to experiment with new ideas without the usual constraints.

The World Economic Forum has noted that favorable regulatory contexts can increase investments in technology-driven insurance solutions by as much as 15% annually, indicating robust growth potential.

Insurtech Market Segment Insights

Insurtech Market Service Type Insights

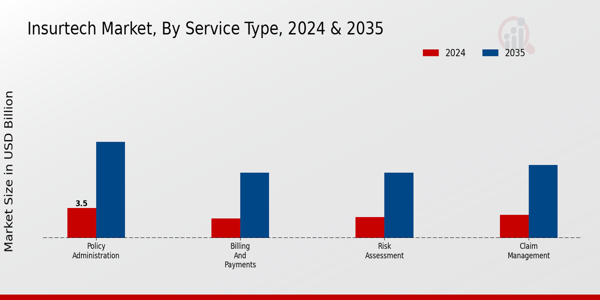

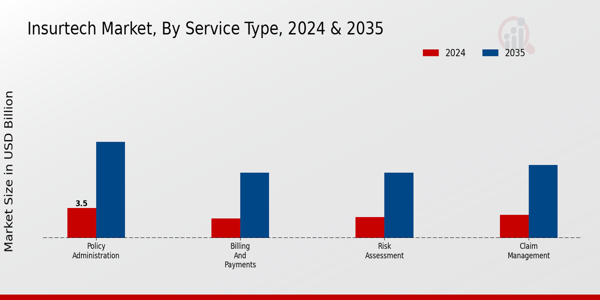

The Service Type segment of the Insurtech Market played a crucial role in shaping the industry's landscape, contributing significantly to the overall market dynamics.Within this framework, the policy administration segment was particularly noteworthy, forecasted to value at 3.5 USD Billion in 2024 and projected to expand to 11.24 USD Billion by 2035. This growth underscored its importance in streamlining policy management and customer interactions, making it a major component of the Insurtech Market revenue.

On the other hand, the Claim Management segment was also substantial, holding a value of 2.7 USD Billion in 2024 and anticipated to escalate to 8.53 USD Billion by 2035. The significance of Claim Management lies in its ability to improve customer satisfaction through faster and more efficient claim processing, thus addressing a critical pain point for insurers and policyholders alike.

Moreover, the Risk Assessment segment is anticipated to witness growth from a valuation of 2.4 USD Billion in 2024 to 7.62 USD Billion by 2035. This segment was essential for facilitating more informed underwriting decisions and improving overall risk management strategies, ultimately contributing to the sustainability of the insurance industry.

Billing and Payments, valued at 2.28 USD Billion in 2024, enhanced its impact, growing to a valuation of 7.61 USD Billion by 2035. This service was vital for improving cash flow and operational handling within insurance companies, thus appealing to both insurers and customers by ensuring seamless financial transactions.

Collectively, these services reflected a broader trend within the Insurtech Market segmentation, wherein technology integration promotes operational efficiency, enhances customer experiences, and fosters a more agile insurance ecosystem. The substantial projected growth rates across these segments demonstrated the rising demand for technological solutions to meet evolving market needs and customer expectations on a global scale. The increasing focus on digital transformation in insurance is driving these trends, facilitating a more transparent, efficient, and customer-centric approach within the industry.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Insurtech Market Technology Insights

The growth is driven by advancements in technology, primarily segmented into key areas such as Artificial Intelligence, Blockchain, Big Data Analytics, and the Internet of Things. Artificial Intelligence plays a crucial role in automating claims processing and underwriting, significantly improving efficiency and customer experience.

Blockchain technology is gaining traction due to its ability to enhance transparency and security in transactions, which is essential for building trust in the insurance sector. Big Data Analytics enables insurers to harness vast amounts of data for informed decision-making, risk assessment, and personalized offerings.

The Internet of Things contributes by facilitating real-time data gathering, leading to better risk prevention strategies and customized policies. Collectively, these technological advancements fundamentally reshape the Insurtech Market landscape, offering new opportunities, addressing challenges like fraud, and optimizing operational effectiveness across the industry.As governments and institutions worldwide recognize these benefits, the adoption rates are expected to increase, further propelling market growth.

Insurtech Market End-use Insights

The segmentation of the market within the end-use category includes Individual, Small Enterprises, and Large Enterprises, each playing a crucial role in the market's dynamics. Individuals are becoming increasingly reliant on technology-driven insurance solutions to manage personal risks effectively, indicating a growing preference for convenience and customization.

Small Enterprises are also leveraging Insurtech innovations to enhance their risk management capabilities, enabling them to access insurance solutions that were previously unattainable due to cost and complexity. Meanwhile, Large Enterprises often require sophisticated, scalable solutions to address their complex risk profiles, making them significant contributors to the market.

These distinct End-uses highlight the versatility and adaptability of the Insurtech Market, which is influenced by technological advancements, regulatory changes, and shifting consumer preferences, thereby presenting various opportunities and challenges in meeting the evolving demands of these segments.

Insurtech Market Distribution Channel Insights

The Insurtech Market showcases a dynamic landscape driven by diverse distribution channels. The market segmentation highlights three prominent channels: Direct Sales, Brokerage, and Online Platforms, each playing a crucial role in the overall growth. Direct Sales continues to be vital, delivering personalized service and building trust with consumers. Brokerages provide essential market expertise, guiding customers through the complexities of insurance products while leveraging their extensive networks.

Online Platforms have transformed the industry with their technological advancements, enabling quick access to services and streamlined purchasing processes, appealing especially to tech-savvy consumers. The increasing digitization and usage of mobile applications are further heightening the significance of these channels, facilitating seamless experiences for end-users.

Ultimately, the Insurtech Market data reflects a robust evolution in how insurance services are distributed, with these channels responding to the changing demands of consumers, positioning them as valuable players in an ever-progressing industry dynamic. With growth drivers such as enhanced technology adoption and shifting consumer preferences, the landscape is poised for significant advancement over the coming years, as evidenced by Insurtech Market statistics.

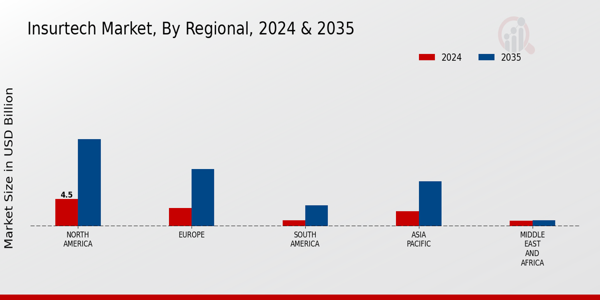

Insurtech Market Regional Insights

North America led this sector with a market valuation of 4.5 USD Billion in 2024 and is projected to grow to 14.5 USD Billion by 2035, indicating its majority holding in the Insurtech Market. Europe held a significant position as well, slated to reach 3.0 USD Billion in 2024, expected to expand to 9.5 USD Billion by 2035. Meanwhile, South America and Asia Pacific were valued at 1.0 USD Billion and 2.5 USD Billion in 2024, respectively, with anticipated growth up to 3.5 USD Billion and 7.5 USD Billion by 2035, suggesting rising interest and investment in these regions.

The Middle East and Africa represented a smaller niche in the market, valued at 0.88 USD Billion in 2024 and projected to grow to 0.95 USD Billion by 2035. This indicated a slower growth rate, likely due to limited investment and market penetration in these regions. The diversification across these regions presented unique opportunities for tailored product offerings, driven by local consumer needs and regulatory adaptations, indicating robust potential in the Insurtech Market landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Insurtech Market Key Players and Competitive Insights

The Insurtech Market has emerged as a dynamic and rapidly evolving sector within the insurance industry, characterized by the integration of technology with traditional insurance practices. The competitive landscape is populated by a host of innovators and established players who are leveraging advancements in artificial intelligence, machine learning, big data, and blockchain to enhance customer experiences, streamline operations, and reduce costs. Companies in this space are focused on transforming the way insurance products are developed, marketed, and delivered, creating a more customer-centric model that is responsive to the evolving needs of consumers.

This has led to increased investment and a surge in partnerships that seek to combine technical expertise with insurance knowledge, thereby fostering an environment ripe for competition and collaboration. Slice Labs brings a refreshing approach to the Insurtech Market with its specialized focus on on-demand insurance products tailored for the gig economy and other emerging business models. The company is known for its innovative offerings like Slice Insurance, which allows users to purchase insurance on a flexible basis according to their specific needs, particularly in sectors like home-sharing and ride-sharing.

Slice Labs has amassed a solid market presence through strategic partnerships with established insurance carriers, enhancing its distribution capabilities.

The strength of Slice Labs lies in its cutting-edge technology platform that enables rapid product development and deployment, as well as data-driven insights that improve risk assessment. Recent mergers and acquisitions further illustrate Slice Labs' commitment to expanding its global reach and enhancing its product portfolio to cater to evolving market demands within the insurtech space.

Key Companies in the Insurtech Market Include

- Slice Labs

- Lemonade

- Metromile

- Hippo Insurance

- Zego

- Root Insurance

- Trov

- Next Insurance

- Policygenius

- Oscar Health

- Bowtie

Insurtech Market Developments

Lemonade expanded its buildings and contents insurance in the UK with Aviva in July 2024 after launching homeowners insurance in France in April 2024 in collaboration with BNP Paribas Cardif. In order to support Lemonade Car's growth, it announced in November 2023 a fronting partnership with Home State Insurance Group to underwrite vehicle premiums in Texas.

Lemonade paid over $500 million to acquire Metromile in July 2022, merging its pay-per-mile auto-insurance business. Metromile is still in operation under Lemonade's ownership, even if this happened before 2023. Hippo Insurance partnered with regional underwriters to develop in the U.S. market and secured $50 million in expansion investment in September 2023 to scale its homeowner-focused insurtech solutions.

In an effort to increase underwriting profitability, Root Insurance stated in March 2025 that it was leaving non-core state markets and concentrating on stationary vehicle insurance. Next Insurance struck a reinsurance arrangement with Munich Re to increase capacity and launched its new AI-powered small business claims platform in May 2025, which reduced claim processing time by 30%.

Insurtech Market Segmentation Insights

Insurtech Market Service Type Outlook

- Policy Administration

- Claim Management

- Risk Assessment

- Billing and Payments

Insurtech Market Technology Outlook

- Artificial Intelligence

- Blockchain

- Big Data Analytics

- Internet of Things

Insurtech Market End-use Outlook

- Individual

- Small Enterprises

- Large Enterprises

Insurtech Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

Insurtech Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

9.79(USD Billion)

|

|

Market Size 2024

|

10.88(USD Billion)

|

|

Market Size 2035

|

35.0(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

11.21% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Slice Labs, Lemonade, Metromile, Hippo Insurance, Zego, Root Insurance, Trov, Next Insurance, Policygenius, Oscar Health, Bowtie

|

|

Segments Covered

|

Service Type, Technology, End-use, Distribution Channel, Regional

|

|

Key Market Opportunities

|

Digital transformation in traditional insurance, Personalized insurance products and services, Advanced data analytics for risk assessment, Enhanced customer engagement through technology, Increased demand for on-demand coverage

|

|

Key Market Dynamics

|

Digital transformation, Customer-centric solutions, Regulatory changes, Increasing investment, Data analytics utilization

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Insurtech Market Highlights:

Frequently Asked Questions (FAQ):

The Insurtech Market was valued at 10.88 USD Billion by the year 2024.

The anticipated compound annual growth rate (CAGR) for the Insurtech Market from 2025 to 2035 is 11.21%.

North America is expected to dominate the Insurtech Market with a value of 14.5 USD Billion by 2035.

The Claim Management service segment was valued at 2.7 USD Billion in the year 2024.

Major players in the Insurtech Market include Lemonade, and Hippo Insurance among others.

The Risk Assessment segment is expected to reach a market size of 7.62 USD Billion by 2035.

The Policy Administration segment is projected to be valued at 11.24 USD Billion by the year 2035.

The Asia Pacific region's Insurtech Market was valued at 2.5 USD Billion in 2024.

South America is expected to reach a market value of 3.5 USD Billion by 2035, indicating significant growth.