Regulatory Support for IPTV Services

Regulatory frameworks are increasingly supporting the growth of the iptv market in the US. Recent policy changes have aimed at promoting competition and ensuring consumer protection within the telecommunications sector. The Federal Communications Commission (FCC) has implemented measures to facilitate the entry of new service providers, thereby enhancing consumer choice. This regulatory environment is conducive to innovation, as it encourages companies to develop unique offerings and improve service quality. Furthermore, the push for net neutrality ensures that all content is treated equally, fostering a level playing field for IPTV providers. As a result, the market is likely to see an influx of new entrants, which could lead to more competitive pricing and diverse content options for consumers. This regulatory support is essential for the sustainable growth of the iptv market.

Increased Focus on Original Content Production

The emphasis on original content production is becoming a defining characteristic of the iptv market. Major players are investing heavily in creating exclusive programming to attract and retain subscribers. This trend is evident as companies allocate substantial budgets for original series and films, with estimates suggesting that spending on original content could exceed $20 billion in the US by 2025. Such investments not only enhance the value proposition for consumers but also differentiate service providers in a crowded marketplace. As competition intensifies, the ability to offer unique and compelling content will likely become a critical factor in subscriber acquisition and retention. Consequently, the iptv market is evolving, with content quality and exclusivity emerging as key drivers of growth.

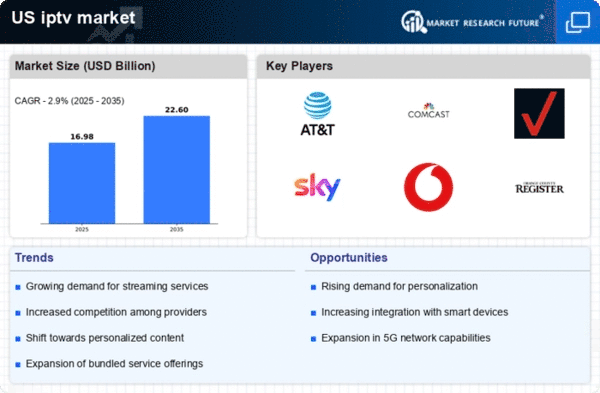

Rising Consumer Preference for Streaming Services

The growing inclination of consumers towards streaming services is a pivotal driver in the iptv market. As traditional cable subscriptions decline, more viewers are opting for flexible, on-demand content. Recent data indicates that approximately 70% of households in the US have subscribed to at least one streaming service, reflecting a shift in viewing habits. This trend is likely to continue, as consumers seek personalized viewing experiences and diverse content offerings. The iptv market is thus positioned to benefit from this transition, as providers adapt to meet the evolving demands of consumers. Enhanced user interfaces and content curation strategies are becoming essential for service providers to capture and retain subscribers. Consequently, the competitive landscape is intensifying, with new entrants and established players vying for market share in this dynamic environment.

Technological Advancements in Streaming Infrastructure

Technological innovations play a crucial role in shaping the iptv market. The deployment of high-speed internet and advancements in streaming technology have significantly improved the quality and reliability of IPTV services. With the increasing availability of 5G networks, consumers can expect faster data transmission and enhanced viewing experiences. Moreover, the integration of artificial intelligence and machine learning in content delivery systems is optimizing user engagement and satisfaction. As a result, service providers are investing heavily in infrastructure upgrades to support these technologies. The US market is witnessing a surge in investments, with projections indicating that spending on IPTV infrastructure could reach $10 billion by 2026. This focus on technology not only enhances service quality but also fosters innovation, enabling providers to differentiate themselves in a competitive landscape.

Growing Demand for Interactive and Personalized Viewing Experiences

The demand for interactive and personalized viewing experiences is reshaping the iptv market. Consumers are increasingly seeking services that offer tailored content recommendations and interactive features. This trend is driven by advancements in data analytics and user interface design, enabling providers to deliver customized experiences. Recent surveys indicate that over 60% of viewers prefer platforms that allow for personalized content curation. As a result, service providers are investing in technologies that enhance user engagement, such as interactive applications and social viewing features. This focus on personalization not only improves customer satisfaction but also fosters loyalty among subscribers. The iptv market is thus likely to see continued growth as providers adapt to meet these evolving consumer preferences.