Increased Focus on Patient Safety

The medical carts market is significantly influenced by the heightened focus on patient safety within healthcare settings. Hospitals are increasingly prioritizing the implementation of safety protocols to minimize errors and enhance patient care. Medical carts equipped with safety features, such as secure storage for medications and easy access to emergency supplies, are becoming essential tools in this endeavor. The medical carts market is responding to this demand by offering products that comply with stringent safety regulations. As a result, the market is expected to expand, with projections indicating a growth rate of around 7% annually. This emphasis on safety not only improves patient outcomes but also fosters trust in healthcare systems.

Regulatory Compliance and Standardization

Regulatory compliance and standardization are critical factors influencing the medical carts market. Healthcare facilities are required to adhere to strict regulations regarding the storage and handling of medical supplies. As a result, the demand for medical carts that meet these regulatory standards is on the rise. The medical carts market is adapting by developing products that not only comply with existing regulations but also anticipate future changes in healthcare policies. This proactive approach is expected to drive market growth, with a projected increase in market size to approximately $1.2 billion by 2026. Compliance with regulations not only ensures patient safety but also enhances the operational efficiency of healthcare providers.

Rising Demand for Efficient Healthcare Delivery

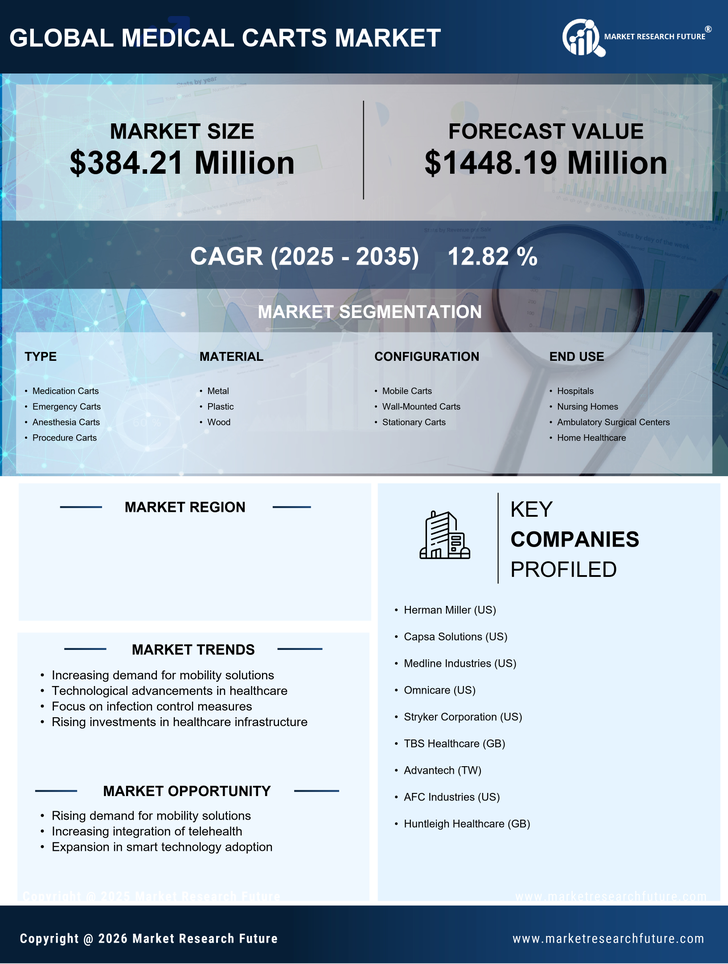

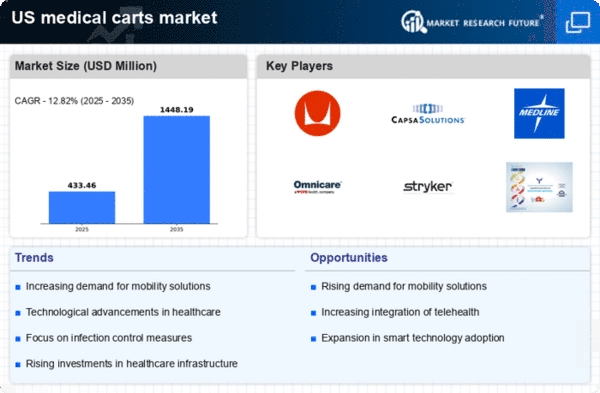

The medical carts market experiences a notable surge in demand driven by the increasing need for efficient healthcare delivery systems. As healthcare facilities strive to enhance patient care, the integration of medical carts becomes essential. These carts facilitate the organization and accessibility of medical supplies, thereby streamlining workflows. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of the healthcare sector's commitment to improving operational efficiency, which is crucial in a fast-paced environment. The medical carts market is thus positioned to benefit from this trend, as hospitals and clinics invest in solutions that promote better patient outcomes and staff productivity.

Technological Advancements in Medical Equipment

Technological advancements play a pivotal role in shaping the medical carts market. Innovations such as integrated electronic health record systems and mobile computing capabilities enhance the functionality of medical carts. These advancements not only improve the efficiency of healthcare delivery but also ensure that medical professionals have immediate access to critical patient information. The medical carts market is witnessing a shift towards smart carts equipped with features like RFID tracking and telemedicine capabilities. This evolution is expected to drive market growth, with estimates suggesting an increase in market value to over $1 billion by 2026. As healthcare providers adopt these technologies, the demand for advanced medical carts is likely to rise significantly.

Growing Aging Population and Chronic Disease Prevalence

The demographic shift towards an aging population in the US is a significant driver of the medical carts market. As the elderly population increases, so does the prevalence of chronic diseases, necessitating more frequent medical interventions. Medical carts serve as vital tools in managing the care of these patients, providing healthcare professionals with the necessary equipment and supplies at their fingertips. The medical carts market is likely to see a substantial uptick in demand, with estimates suggesting that the market could reach $1.5 billion by 2027. This trend underscores the importance of efficient healthcare delivery systems that cater to the needs of an aging demographic.