Rising Threat Levels

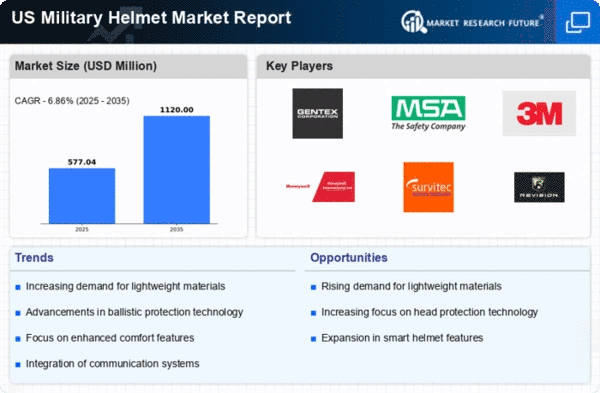

The military helmet market is influenced by the rising threat levels faced by armed forces. With geopolitical tensions escalating, there is an urgent need for enhanced protective gear. The US military is increasingly engaged in various operations, necessitating the use of advanced helmets that can withstand ballistic threats and shrapnel. This demand is reflected in the market, which is projected to grow at a CAGR of around 5% over the next few years. As threats evolve, the military helmet market must adapt, leading to innovations in materials and design. Consequently, manufacturers are likely to focus on developing helmets that provide better protection against emerging threats.

Increased Defense Budgets

The market is experiencing growth due to increased defense budgets in the US. The government has allocated substantial funds to enhance military capabilities, which includes upgrading personal protective equipment. In recent years, defense spending has risen, with the US Department of Defense requesting a budget of approximately $740 billion for fiscal year 2025. This financial commitment indicates a strong focus on improving soldier safety, thereby driving demand for advanced military helmets. As a result, manufacturers are likely to invest in research and development to create helmets that offer superior protection and comfort. The military helmet market is thus positioned to benefit from this upward trend in defense expenditure.

Emphasis on Soldier Well-being

This sector is significantly impacted by the growing emphasis on soldier well-being. There is a heightened awareness of the physical and psychological effects of combat on service members. As a result, the military is prioritizing the development of helmets that not only protect but also enhance comfort and reduce fatigue. This trend is evident in the integration of lightweight materials and ergonomic designs. The market is expected to see a shift towards helmets that incorporate features aimed at improving the overall experience of soldiers in the field. This focus on well-being is likely to drive innovation within the military helmet market.

Advancements in Materials Science

The military helmet market is benefiting from advancements in materials science, which are leading to the development of lighter and more durable helmets. Innovations in composite materials and ballistic fibers are enabling manufacturers to produce helmets that offer enhanced protection without compromising comfort. For instance, the introduction of aramid fibers and polyethylene composites has revolutionized helmet design, making them more effective against ballistic threats. This trend is expected to continue, with the military helmet market projected to reach a value of $1.5 billion by 2027. As research progresses, the potential for new materials to further improve helmet performance remains a key driver.

Growing Demand for Modular Systems

The military helmet market is witnessing a growing demand for modular systems that allow for customization and adaptability. Modern warfare requires equipment that can be tailored to specific missions and environments. Modular helmets enable soldiers to attach various accessories, such as communication devices and night vision goggles, enhancing operational effectiveness. This trend is reflected in the increasing number of contracts awarded to manufacturers specializing in modular helmet systems. The military helmet market is likely to expand as armed forces seek versatile solutions that can be modified according to mission requirements. This adaptability is becoming a crucial factor in helmet procurement strategies.