Growing Focus on Cost Reduction in Healthcare

The pharmacy automation market is being propelled by a growing emphasis on cost reduction within the healthcare sector. As healthcare costs continue to rise, pharmacies are seeking ways to minimize expenses while maintaining quality service. Automation can lead to significant cost savings by reducing labor costs and minimizing medication errors, which can be financially burdensome. It is estimated that pharmacies can save up to $1 million annually by implementing automated systems. This financial incentive is likely to drive more pharmacies to adopt automation solutions, thereby contributing to the growth of the pharmacy automation market.

Regulatory Support for Automation Implementation

Regulatory frameworks are increasingly supporting the adoption of automation in the pharmacy sector. Government initiatives aimed at improving healthcare delivery are encouraging pharmacies to invest in automated solutions. For example, the Drug Enforcement Administration (DEA) has established guidelines that facilitate the use of automated dispensing systems, thereby promoting compliance and safety. This regulatory support is expected to drive growth in the pharmacy automation market, as pharmacies seek to align with best practices and enhance operational efficiency. The potential for reduced regulatory burdens may also incentivize smaller pharmacies to adopt automation technologies, further expanding the market.

Technological Advancements in Automation Solutions

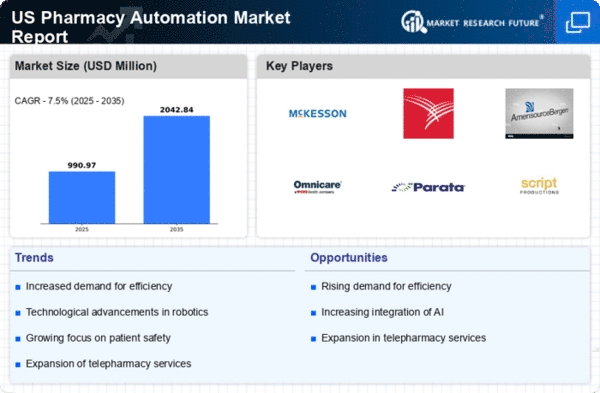

Technological innovations are significantly shaping the pharmacy automation market. The introduction of advanced robotics and artificial intelligence (AI) is enhancing the capabilities of automated systems. For instance, AI-driven software can analyze prescription patterns and optimize inventory management, reducing waste and costs. The market for pharmacy automation is expected to reach $5 billion by 2027, reflecting the growing reliance on technology to improve pharmacy operations. These advancements not only streamline processes but also enhance accuracy, which is crucial in a sector where precision is paramount. As technology continues to evolve, it is likely to further transform the pharmacy automation market.

Rising Demand for Efficiency in Pharmacy Operations

The pharmacy automation market is seeing a surge in demand for improved operational efficiency. As pharmacies face increasing pressure to reduce wait times and improve service delivery, automation technologies are becoming essential. This can reduce medication errors by up to 50%, which improves patient safety. Furthermore, This growth is driven by the need for more streamlined workflows. This trend indicates that pharmacies are increasingly recognizing the value of automation in optimizing their operations, which is likely to propel the pharmacy automation market forward.

Increasing Patient Population and Prescription Volume

The pharmacy automation market is growing due to an increasing patient population and rising prescription volumes. As the population ages and chronic diseases become more prevalent, the demand for prescription medications is expected to rise. This trend places additional pressure on pharmacies to manage higher volumes efficiently. Automation technologies can help pharmacies handle increased workloads without compromising service quality. The market is projected to expand as pharmacies seek to accommodate this growing demand, with estimates suggesting a potential increase in prescription volume by 20% over the next five years. This demographic shift is likely to be a key driver for the pharmacy automation market.

.png)