Supportive Regulatory Environment

A supportive regulatory environment is crucial for the growth of the rapid diagnostics market. Regulatory bodies in the US are increasingly streamlining the approval processes for diagnostic tests, which facilitates quicker market entry for innovative products. This trend is evident in the FDA's initiatives to expedite the review of diagnostic tools, particularly those that address urgent healthcare needs. The favorable regulatory landscape encourages investment in research and development, fostering innovation within the rapid diagnostics market. As companies navigate the regulatory framework more efficiently, they are better positioned to introduce new and improved diagnostic solutions. This supportive environment is likely to enhance the competitiveness of the rapid diagnostics market, driving growth and expanding access to essential diagnostic services.

Rising Consumer Awareness and Demand

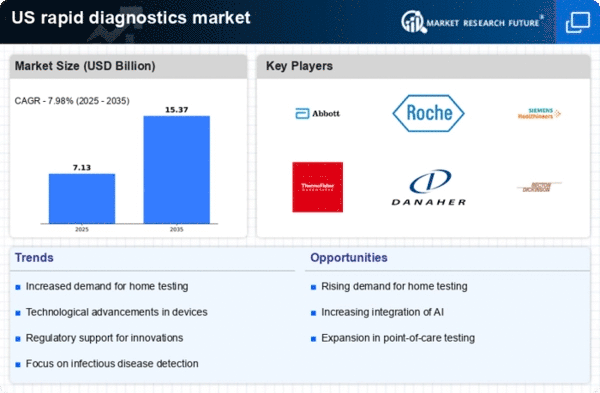

Consumer awareness regarding health and wellness is on the rise, significantly impacting the rapid diagnostics market. As individuals become more informed about their health, there is an increasing demand for accessible and reliable diagnostic tools. This trend is evident in the growing popularity of home testing kits and over-the-counter diagnostic products. The market for home diagnostics is expected to grow at a CAGR of around 12% over the next few years, reflecting the changing consumer preferences. This heightened awareness is driving innovation and competition within the rapid diagnostics market, as companies strive to meet the evolving needs of health-conscious consumers. The emphasis on self-monitoring and preventive care is likely to further propel the growth of the rapid diagnostics market in the coming years.

Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in the US is a pivotal driver for the rapid diagnostics market. Conditions such as diabetes, cardiovascular diseases, and infectious diseases necessitate timely diagnosis and management. According to the CDC, approximately 6 in 10 adults in the US have a chronic disease, which underscores the need for efficient diagnostic solutions. Rapid diagnostics enable healthcare providers to make informed decisions quickly, improving patient outcomes. The increasing burden of these diseases is likely to propel the demand for rapid diagnostic tools, as they facilitate early detection and monitoring. This trend indicates a robust growth trajectory for the rapid diagnostics market, as healthcare systems seek to enhance their diagnostic capabilities to address the growing healthcare challenges posed by chronic conditions.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is a significant driver for the rapid diagnostics market. As healthcare providers and patients alike recognize the importance of early detection, there is a growing emphasis on screening and monitoring. This trend is supported by initiatives aimed at reducing healthcare costs and improving population health outcomes. The rapid diagnostics market is poised to benefit from this focus, as diagnostic tools play a crucial role in identifying health issues before they escalate. The US healthcare system is increasingly investing in preventive measures, which is likely to enhance the adoption of rapid diagnostic solutions. This proactive approach to health management suggests a promising future for the rapid diagnostics market, as it aligns with the broader goals of improving healthcare efficiency and effectiveness.

Technological Innovations in Diagnostic Tools

Technological advancements are significantly influencing the rapid diagnostics market. Innovations such as point-of-care testing, microfluidics, and artificial intelligence are enhancing the accuracy and speed of diagnostic processes. The integration of these technologies allows for real-time results, which is crucial in clinical settings. For instance, the market for point-of-care testing is projected to reach approximately $50 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. These innovations not only improve diagnostic efficiency but also expand the range of tests available, catering to diverse medical needs. As technology continues to evolve, the rapid diagnostics market is expected to experience substantial growth, driven by the demand for more sophisticated and user-friendly diagnostic solutions.