Focus on Personalized Medicine

The trend towards personalized medicine is reshaping The Global Rapid Diagnostics Industry by emphasizing tailored treatment approaches based on individual patient profiles. This paradigm shift necessitates the development of diagnostic tools that can provide specific insights into a patient's genetic makeup, lifestyle, and environmental factors. As a result, there is a growing demand for rapid diagnostic tests that can deliver precise information to guide treatment decisions. Market analysis suggests that the personalized medicine segment is poised for significant growth, with projections indicating a potential increase in market size by over 15% in the next few years. This focus on customization not only enhances treatment efficacy but also fosters patient engagement, thereby driving the adoption of rapid diagnostics that align with personalized healthcare strategies.

Government Initiatives and Funding

Government initiatives and funding are instrumental in propelling The Global Rapid Diagnostics Industry forward. Various governments are increasingly recognizing the importance of rapid diagnostics in enhancing healthcare delivery and are allocating resources to support research and development in this field. Initiatives aimed at improving healthcare infrastructure, particularly in low- and middle-income countries, are expected to drive demand for rapid diagnostic solutions. Furthermore, public-private partnerships are emerging as a viable strategy to foster innovation and expedite the commercialization of new diagnostic technologies. Market data suggests that government funding in the healthcare sector is projected to increase, which could further stimulate growth in the rapid diagnostics market. This supportive environment is likely to encourage the development of novel diagnostic tools that address pressing healthcare challenges.

Shift Towards Point-of-Care Testing

The increasing preference for point-of-care testing (POCT) is significantly influencing The Global Rapid Diagnostics Industry. POCT allows for immediate results, which is crucial in emergency situations and for chronic disease management. The convenience of conducting tests at the patient's location reduces the need for laboratory visits, thereby streamlining the diagnostic process. Market data indicates that the POCT segment is expected to account for a substantial share of the overall market, driven by the rising demand for rapid and accurate testing solutions. This shift is particularly evident in areas such as infectious disease testing and glucose monitoring, where timely results can lead to better patient outcomes. Consequently, the growth of POCT is likely to propel the market forward, as healthcare systems increasingly adopt these technologies to enhance patient care.

Rising Incidence of Infectious Diseases

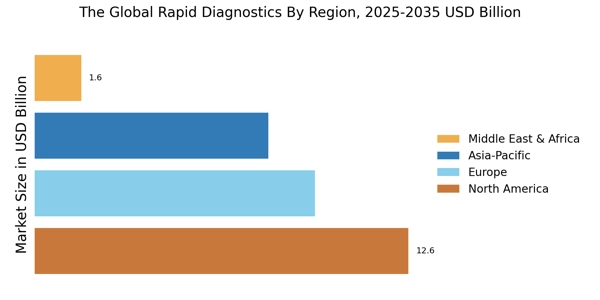

The escalating incidence of infectious diseases is a critical driver of The Global Rapid Diagnostics Industry. With the emergence of new pathogens and the resurgence of existing ones, there is an urgent need for rapid diagnostic solutions that can facilitate timely detection and management. Data from health organizations indicate that infectious diseases account for a substantial burden on global health systems, leading to increased healthcare expenditures. This scenario creates a favorable environment for the development and adoption of rapid diagnostic tests, particularly in regions with limited access to traditional laboratory facilities. The market is likely to expand as healthcare providers seek efficient tools to combat infectious diseases, thereby enhancing public health responses and improving patient outcomes.

Technological Advancements in Diagnostics

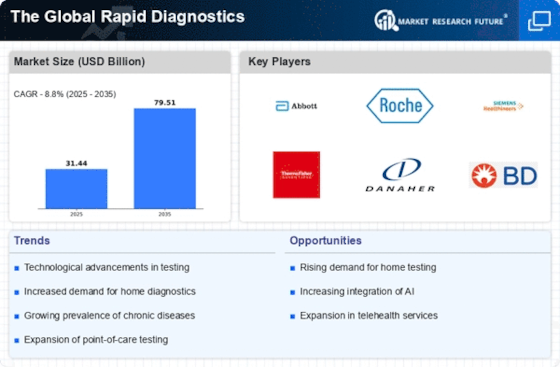

The rapid evolution of technology plays a pivotal role in shaping The Global Rapid Diagnostics Industry. Innovations such as microfluidics, biosensors, and artificial intelligence are enhancing the accuracy and speed of diagnostic tests. For instance, the integration of AI algorithms in diagnostic tools has been shown to improve the detection rates of various diseases, potentially increasing market demand. Furthermore, advancements in mobile health technologies are facilitating remote diagnostics, thereby expanding access to healthcare services. As a result, the market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This technological momentum is likely to drive the development of more sophisticated diagnostic solutions, ultimately benefiting patients and healthcare providers alike.