Rising Demand for Point-of-Care Testing

The rapid diagnostics market in South America is experiencing a notable surge in demand for point-of-care testing solutions. This trend is driven by the need for immediate results in clinical settings, particularly in rural and underserved areas. The convenience of on-site testing reduces the time to diagnosis, which is crucial for effective patient management. According to recent estimates, the point-of-care testing segment is projected to grow at a CAGR of approximately 12% over the next five years. This growth is indicative of a broader shift towards decentralized healthcare, where rapid diagnostics play a pivotal role in enhancing patient outcomes. As healthcare providers increasingly adopt these technologies, the rapid diagnostics market is likely to witness significant advancements in product offerings and service delivery.

Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare measures is significantly influencing the rapid diagnostics market in South America. As populations become more health-conscious, there is an increasing emphasis on early detection and management of diseases. This shift is reflected in the growing demand for rapid diagnostic tests that enable timely interventions. Surveys indicate that approximately 70% of individuals in urban areas are now prioritizing regular health screenings, which is likely to drive the adoption of rapid diagnostics. Furthermore, public health campaigns aimed at educating citizens about the benefits of early diagnosis are expected to bolster market growth. The rapid diagnostics market is thus benefiting from a cultural shift towards proactive health management, which may lead to increased sales and innovation in diagnostic technologies.

Regulatory Support for Diagnostic Innovations

Regulatory frameworks in South America are increasingly supportive of innovations in the rapid diagnostics market. Governments are recognizing the importance of timely and accurate diagnostics in improving public health outcomes. As a result, there has been a push to streamline the approval processes for new diagnostic tests, which encourages innovation and market entry. Recent policy changes have reduced the time required for regulatory approvals by up to 30%, facilitating faster access to new products. This regulatory environment not only fosters competition among manufacturers but also enhances the availability of cutting-edge diagnostic solutions for healthcare providers. Consequently, the rapid diagnostics market is likely to benefit from a more dynamic and responsive regulatory landscape, which could lead to accelerated growth and diversification of product offerings.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems is a pivotal factor propelling the rapid diagnostics market in South America. Innovations such as artificial intelligence, machine learning, and telemedicine are being increasingly incorporated into diagnostic processes. These technologies enhance the accuracy and efficiency of rapid diagnostic tests, making them more appealing to healthcare providers. For example, AI-driven analytics can significantly reduce the time required for result interpretation, thereby streamlining patient care. The market for AI in healthcare is projected to grow at a CAGR of 40% over the next five years, indicating a strong trend towards technological adoption. As these technologies become more prevalent, the rapid diagnostics market is likely to evolve, offering more sophisticated and reliable testing solutions.

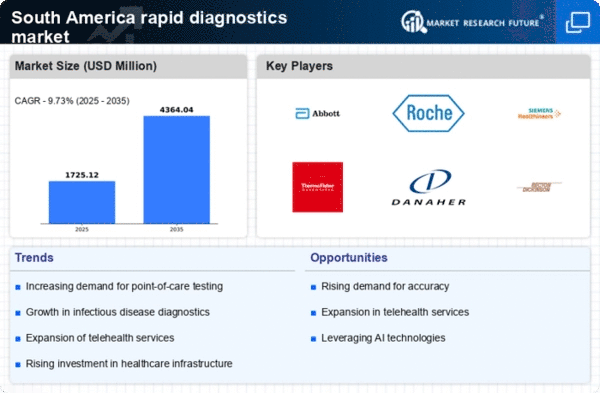

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is a critical driver for the rapid diagnostics market. Governments and private entities are channeling resources into enhancing laboratory facilities and diagnostic capabilities. This influx of capital is expected to improve access to rapid diagnostic tools, particularly in regions where healthcare services are limited. For instance, recent reports indicate that healthcare spending in South America is anticipated to reach $500 billion by 2026, with a substantial portion allocated to diagnostic services. This investment not only supports the development of innovative rapid diagnostic technologies but also fosters partnerships between local manufacturers and international firms, thereby strengthening the overall market landscape. Consequently, the rapid diagnostics market is poised for robust growth as infrastructure improvements facilitate wider adoption of these essential tools.