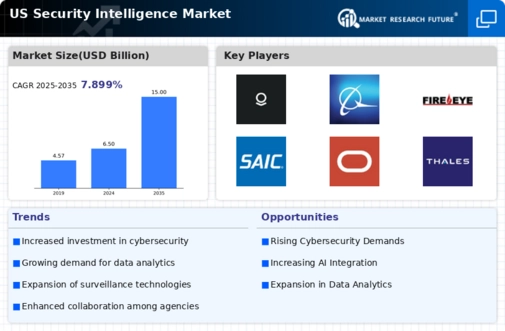

The US Security Intelligence Market is highly dynamic and competitive, characterized by rapid technological advancements and an increasing demand for sophisticated security solutions. As concerns over national security grow, coinciding with the rise of cyber threats and geopolitical tensions, companies in this sector are working diligently to innovate and provide advanced intelligence capabilities. The competitive landscape is marked by a diverse range of players, each contributing unique technologies and services aimed at enhancing situational awareness and strategic decision-making.

Companies leverage cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics to stay ahead, with their efforts focused on addressing complex security challenges faced by government and military entities.Raytheon Technologies stands as a significant player in the US Security Intelligence Market, boasting a robust portfolio of defense and intelligence solutions. The company possesses extensive expertise in areas such as missile systems, advanced surveillance technologies, and cybersecurity measures. Its strengths lie in its deep-rooted relationships with government agencies and military organizations, allowing for a prominent market presence.

Raytheon Technologies is known for its commitment to innovation, consistently investing in research and development to enhance its defense technologies. Their emphasis on operational readiness and compliance ensures that they remain a leading force in providing security intelligence solutions tailored to the unique needs of US defense operations.Palantir Technologies has carved a niche for itself in the US Security Intelligence Market by offering advanced data analytics and integration services designed to enhance intelligence gathering and operational effectiveness.

The company's flagship products, such as Palantir Foundry and Palantir Gotham, are extensively utilized for data integration, analysis, and visualization, making them essential tools for intelligence agencies and defense organizations. Palantir’s market presence is strengthened by its ability to facilitate collaboration across various governmental entities, enabling seamless sharing of information and streamlining responses to threats. The company has made strategic advancements through mergers and partnerships that expand its capabilities in data-driven intelligence. With a strong focus on user-centric designs and maintaining operational security, Palantir Technologies continues to reinforce its position as a preferred partner for US intelligence applications.