Growing Environmental Awareness

There is a notable increase in environmental awareness among consumers and businesses, which is significantly impacting the smart waste-management market. As sustainability becomes a priority, organizations are seeking innovative solutions to minimize their ecological footprint. This shift is reflected in the rising demand for smart waste management systems that promote recycling and waste reduction. According to recent surveys, approximately 70% of consumers prefer companies that demonstrate a commitment to sustainability. This trend is pushing municipalities to invest in smart waste-management technologies, which are perceived as essential for achieving environmental goals. Consequently, the market is likely to witness substantial growth as stakeholders prioritize eco-friendly practices.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the smart waste-management market. Various federal and state programs are being implemented to promote sustainable waste management practices. For example, the Environmental Protection Agency (EPA) has introduced funding opportunities for municipalities to adopt smart waste technologies. These initiatives not only provide financial support but also encourage collaboration between public and private sectors. The smart waste-management market is expected to benefit from these policies, as they create a favorable environment for innovation and investment. With an estimated $1 billion allocated for waste management improvements in the next five years, the market is poised for growth driven by governmental support.

Urbanization and Population Growth

Urbanization and population growth are significant drivers of the smart waste-management market. As cities expand, the volume of waste generated increases, necessitating more efficient waste management solutions. The U.S. Census Bureau projects that urban populations will rise by 15% by 2030, leading to heightened demand for smart waste management systems. These systems are designed to handle larger waste volumes while minimizing environmental impact. The integration of smart technologies allows for better tracking and management of waste, which is essential in densely populated areas. Consequently, the smart waste-management market is likely to see increased investment as urban centers seek to modernize their waste management infrastructure.

Economic Incentives for Waste Reduction

Economic incentives are increasingly influencing the smart waste-management market. Many municipalities are implementing pay-as-you-throw programs, which charge residents based on the amount of waste they generate. This model encourages waste reduction and recycling, aligning with the goals of the smart waste-management market. Additionally, businesses are recognizing the financial benefits of adopting smart waste solutions, such as reduced disposal costs and improved resource recovery. The potential for cost savings is driving more organizations to invest in smart technologies. As these economic incentives gain traction, the smart waste-management market is expected to expand, fostering a culture of sustainability and efficiency.

Technological Advancements in Waste Management

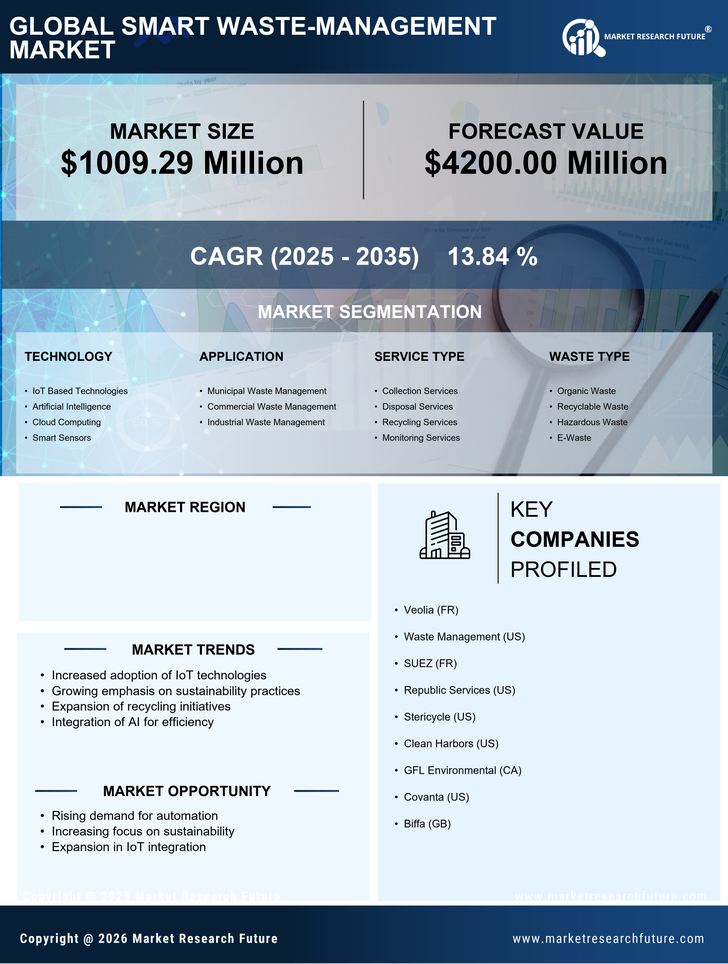

The smart waste-management market is experiencing a surge due to rapid technological advancements. Innovations such as AI, machine learning, and IoT are transforming traditional waste management practices. These technologies enable real-time monitoring and data analytics, which enhance operational efficiency. For instance, the integration of smart sensors in waste bins allows for optimized collection routes, reducing fuel consumption and operational costs. The market is projected to grow at a CAGR of 20% from 2025 to 2030, indicating a robust demand for smart solutions. As municipalities and private companies increasingly adopt these technologies, the smart waste-management market is likely to expand significantly, driven by the need for efficient waste disposal and resource recovery.