Rise of Social Media Platforms

The proliferation of social media platforms is a significant driver for the social business-intelligence-bi market. As more individuals engage with various social media channels, the volume of data generated presents both challenges and opportunities for businesses. In the US, over 80% of adults are active on social media, creating a vast pool of data that organizations can analyze for insights. This trend is prompting businesses to invest in analytics tools that can effectively harness social data to inform marketing strategies and product development. Consequently, the social business-intelligence-bi market is likely to experience robust growth as companies seek to capitalize on the wealth of information available through social media.

Advancements in Technology and Tools

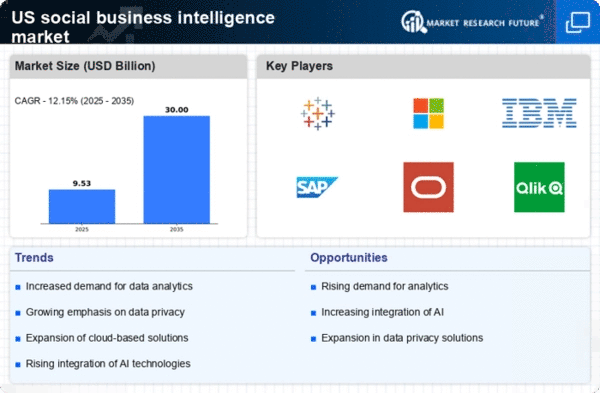

Technological advancements play a crucial role in shaping the social business-intelligence-bi market. The emergence of innovative tools and platforms that facilitate the collection, analysis, and visualization of social data is transforming how businesses operate. For instance, the integration of artificial intelligence and machine learning into business intelligence solutions allows for more accurate predictions and deeper insights. In the US, the market for AI-driven analytics tools is projected to grow at a CAGR of 25% over the next five years. This technological evolution not only enhances the capabilities of existing tools but also encourages new entrants into the social business-intelligence-bi market, thereby expanding the overall landscape.

Increased Focus on Customer Engagement

The heightened focus on customer engagement is significantly influencing the social business-intelligence-bi market. Companies are increasingly utilizing social data to understand customer preferences and behaviors, which in turn informs their marketing strategies. In the US, businesses that effectively engage with customers through social media channels report a 30% increase in customer retention rates. This trend underscores the importance of integrating social insights into business intelligence frameworks. As organizations seek to enhance their customer relationships, the demand for solutions that provide actionable insights from social data is likely to grow, driving further expansion in the social business-intelligence-bi market.

Growing Demand for Data-Driven Decision Making

The increasing emphasis on data-driven decision making is a pivotal driver for the social business-intelligence-bi market. Organizations across various sectors are recognizing the necessity of leveraging data to enhance operational efficiency and strategic planning. In the US, a survey indicated that approximately 70% of businesses are prioritizing data analytics to inform their decisions. This trend is likely to propel the adoption of business intelligence tools that integrate social data, enabling companies to gain insights into customer behavior and market trends. As organizations strive to remain competitive, the demand for sophisticated analytics solutions that can process and analyze social data is expected to rise, thereby fueling growth in the social business-intelligence-bi market.

Regulatory Compliance and Data Privacy Concerns

Regulatory compliance and data privacy concerns are emerging as critical drivers in the social business-intelligence-bi market. With the implementation of stringent data protection regulations in the US, businesses are compelled to adopt solutions that ensure compliance while effectively managing social data. The need for transparency and accountability in data usage is prompting organizations to invest in business intelligence tools that prioritize data security. As a result, the social business-intelligence-bi market is witnessing a shift towards solutions that not only provide insights but also adhere to regulatory standards, thereby fostering trust among consumers and stakeholders.