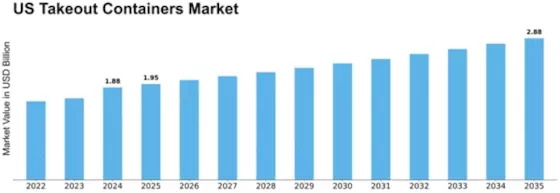

Us Takeout Containers Size

US Takeout Containers Market Growth Projections and Opportunities

The US market for takeout containers is influenced by a variety of factors that affect its size and nature. One of the most important factors driving market growth is the changing lifestyle of consumers characterized by convenience and on-the-go food consumption. On top of those considerations, environmental aspects are also instrumental in shaping this industry. As awareness about the ecological impacts of single-use plastics grows, there is an inclination towards more environmentally friendly and recyclable materials in making takeout containers. Another determinant of this market is innovations revolving around packaging materials and designs through technological advancements. For instance, manufacturers are continuously searching for new ways to improve insulation, durability, and overall user experience regarding takeout container performance. Moreover, changing tastes among food service providers and restaurant owners highly affect the competitive landscape. Since differentiation has become one of the major themes in crowded markets, the choice of takeout containers becomes fundamental to customer experiences and branding strategies at these firms. Consequently, demand has increased significantly for custom-designed packages with attractive appearances. Also worth noting is that economic factors such as fluctuations in raw material prices as well as general market conditions have an impact on cost structure associated with production processes involved in the manufacture of these products; hence, companies must consider economic variables while setting pricing levels in order to maintain quality standards at affordable rates. Events like global pandemics such as COVID-19 greatly affect the takeout container market globally. The thing about safety measures today have made disposable packages so popular among businesses and customers who go for them because they do not want infections spreading through reused products; thus, buying those cannot be shared with others or used twice due to possible contamination risks. Additionally, distribution channels play a crucial role in some other market issues that affect America's takeout containers sector. In recent times, online food delivery platforms have grown together 3rd third-party aggregators, which have transformed the way people look at food, prompting the need for specific types of packaging to fit the needs of these kinds of businesses. Lastly demographic characteristics that include the age and lifestyle of target customers also influence market preferences for takeout containers. As such, younger generations, who are very eco-conscious and prefer convenient options, drive the demand for such packaging products.

Leave a Comment