Rising Demand for Efficiency

The workflow management-system market is experiencing a notable surge in demand for efficiency across various sectors. Organizations are increasingly recognizing the need to streamline operations, reduce redundancies, and enhance productivity. This trend is particularly evident in industries such as manufacturing and healthcare, where operational efficiency can lead to significant cost savings. According to recent data, companies that implement effective workflow management systems can achieve productivity improvements of up to 30%. As businesses strive to remain competitive, the adoption of these systems is likely to continue growing, driving the workflow management-system market forward.

Focus on Remote Work Solutions

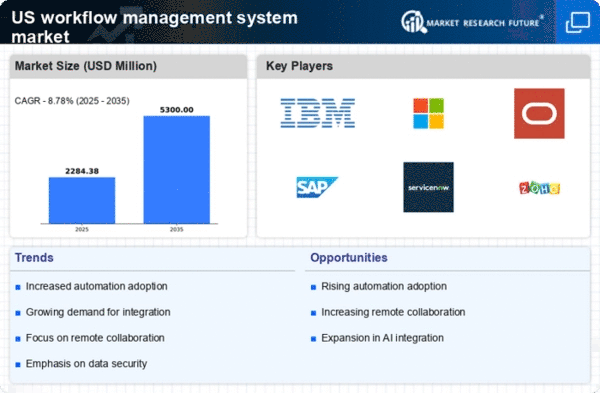

The shift towards remote work has significantly impacted the workflow management-system market. Organizations are seeking solutions that facilitate collaboration and communication among distributed teams. Workflow management systems that offer cloud-based functionalities are particularly appealing, as they allow employees to access tools and resources from anywhere. This trend is reflected in the market, with cloud-based workflow management solutions expected to account for over 50% of total market revenue by 2026. As remote work becomes a permanent fixture in many industries, the demand for effective workflow management systems is likely to increase.

Regulatory Compliance Requirements

Regulatory compliance is a critical driver in the workflow management-system market. Organizations across various sectors, including finance and healthcare, must adhere to stringent regulations that govern their operations. Workflow management systems play a vital role in ensuring compliance by automating documentation, tracking changes, and maintaining audit trails. The increasing complexity of regulatory requirements is pushing organizations to invest in robust workflow management solutions. It is estimated that companies that fail to comply with regulations face fines averaging $3 million, underscoring the importance of effective workflow management systems in mitigating compliance risks.

Integration of Advanced Technologies

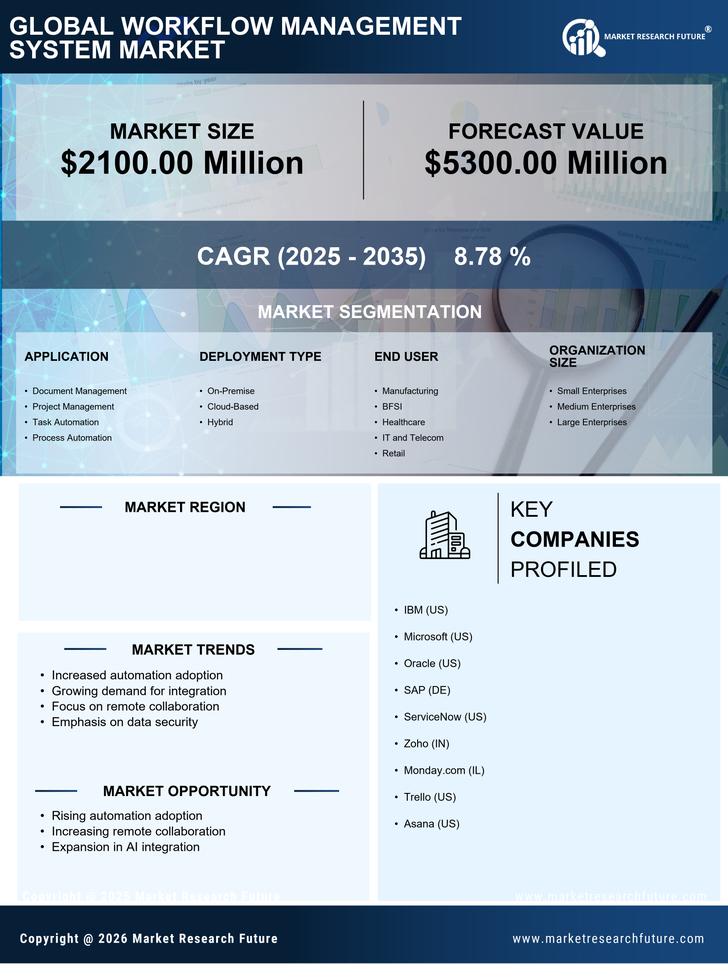

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is transforming the workflow management-system market. These technologies enable organizations to automate complex processes, analyze vast amounts of data, and make informed decisions in real-time. For instance, AI-driven analytics can identify bottlenecks in workflows, allowing for timely interventions. The market for AI in workflow management is projected to reach $2 billion by 2026, indicating a robust growth trajectory. As organizations increasingly leverage these technologies, the workflow management-system market is poised for substantial expansion.

Growing Emphasis on Customer Experience

The growing emphasis on customer experience is reshaping the workflow management-system market. Organizations are recognizing that efficient workflows directly impact customer satisfaction and loyalty. By optimizing processes, businesses can respond more quickly to customer inquiries, reduce service delivery times, and enhance overall service quality. Data suggests that companies with streamlined workflows can improve customer satisfaction scores by up to 25%. As customer expectations continue to rise, the demand for workflow management systems that enhance service delivery is likely to grow, further propelling the market.