Technological Advancements in Analytics Tools

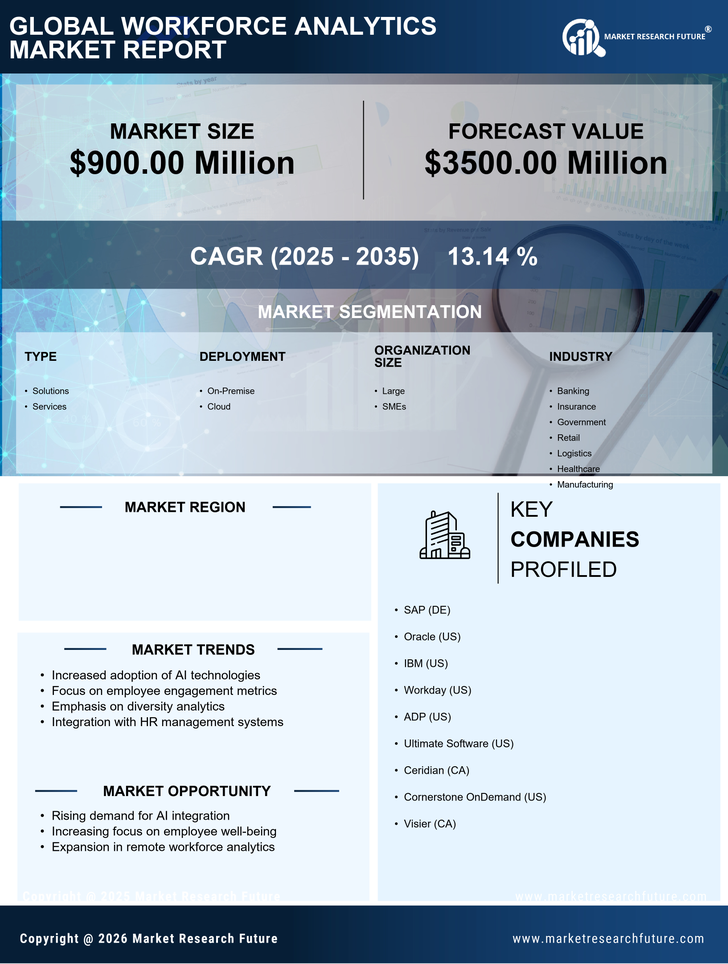

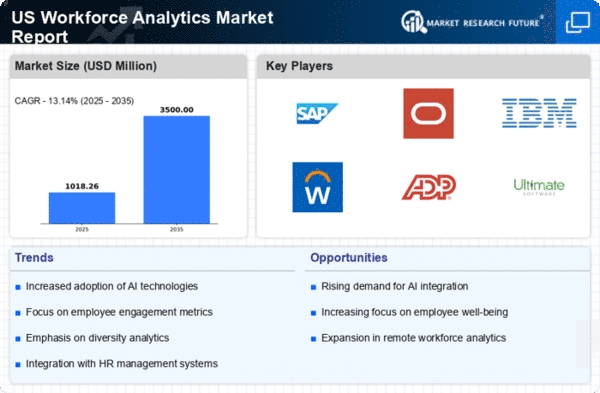

Technological advancements are playing a pivotal role in shaping the workforce analytics market. The introduction of sophisticated analytics tools, including machine learning and artificial intelligence, is enhancing the capabilities of workforce analytics solutions. In 2025, it is anticipated that the market for advanced analytics tools will grow by approximately 20%. These innovations allow organizations to process vast amounts of workforce data more efficiently, leading to more accurate insights and predictions. As companies increasingly adopt these advanced technologies, the demand for workforce analytics solutions is expected to rise, driving market growth and transformation.

Growing Demand for Data-Driven Decision Making

The workforce analytics market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging data to inform their human resource strategies. This trend is evidenced by a reported increase in investment in analytics tools, with companies allocating approximately $2.5 billion to workforce analytics solutions in 2025. The ability to analyze employee performance, retention rates, and recruitment efficiency is becoming essential for organizations aiming to enhance productivity and reduce turnover. As businesses strive to remain competitive, the integration of data analytics into workforce management is likely to become a standard practice, thereby driving growth in the workforce analytics market.

Regulatory Compliance and Reporting Requirements

Regulatory compliance is a critical driver for the workforce analytics market, particularly in the context of labor laws and employment regulations. Organizations are mandated to adhere to various compliance standards, which necessitates the collection and analysis of workforce data. In 2025, it is estimated that compliance-related expenditures will account for approximately 15% of total HR budgets. This growing emphasis on compliance is pushing companies to adopt advanced analytics solutions that can streamline reporting processes and ensure adherence to legal requirements. Consequently, the workforce analytics market is likely to expand as organizations seek tools that facilitate compliance while optimizing workforce management.

Emphasis on Talent Management and Retention Strategies

The workforce analytics market is significantly influenced by the increasing focus on talent management and retention strategies. Companies are recognizing that retaining skilled employees is crucial for maintaining competitive advantage. In 2025, it is projected that organizations will invest around $1.8 billion in analytics tools specifically designed for talent management. These tools enable businesses to identify high-potential employees, assess engagement levels, and develop targeted retention strategies. By utilizing workforce analytics, organizations can create a more engaged workforce, thereby reducing turnover rates and enhancing overall productivity. This trend is likely to propel the growth of the workforce analytics market as companies prioritize effective talent management.

Shift Towards Remote Work and Flexible Employment Models

The shift towards remote work and flexible employment models is significantly impacting the workforce analytics market. As organizations adapt to new work environments, there is a growing need for analytics tools that can monitor employee performance and engagement in remote settings. In 2025, it is estimated that around 30% of the workforce will be engaged in remote work, necessitating the use of analytics to ensure productivity and collaboration. This trend is prompting companies to invest in workforce analytics solutions that provide insights into remote work dynamics, thereby driving growth in the workforce analytics market as businesses seek to optimize their workforce strategies.