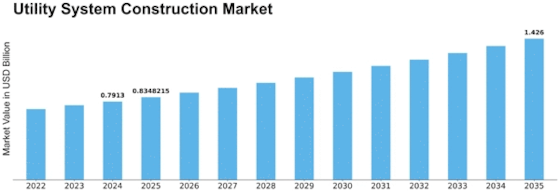

Utility System Construction Size

Utility System Construction Market Growth Projections and Opportunities

The rising global demand for reliable and efficient utility services drives this sector. Water, electricity, and telecommunications systems must be strong as populations rise and urbanize. Demand for utility system construction is rising, offering opportunities for organizations who design and build these vital infrastructure projects. The utility system construction industry is expected to increase from USD 0.75 Billion in 2023 to USD 1.15 Billion in 2032, a CAGR of 5.50%.

Utility system construction is also shaped by government laws and regulations. Government regulations affect project feasibility and profitability, affecting industry investment decisions. Environmental regulations and the push for sustainable practices advance utility system construction methods and technologies. An environmentally sensitive market favors companies that can adapt and comply with these rules.

Technology is another important market component. Innovations in materials, equipment, and construction methods have transformed utility system construction. Companies who adopt and apply these technologies first have a market advantage.

Economic factors like investment trends and finance affect utility system construction. Infrastructure projects require significant investment, which can affect building speed and magnitude. The financial landscape that shapes the sector includes economic stability, interest rates, and government infrastructure expenditure plans.

The utility system building business is worldwide, therefore geopolitics can present difficulties and possibilities. Trade relations, geopolitical tensions, and international cooperation affect industrial resource, material, and expertise migration. Multi-regional companies must handle geopolitical hurdles to be stable and seize possibilities.

Additional influences include market competitiveness and industry consolidation. Companies compete for utility system construction contracts and projects. Firms wanting to strengthen their market position, develop their capabilities, or enter new geographic areas sometimes merge or acquire. In the competitive industry, strategic partnerships and alliances can be crucial.

Finally, climatic change is changing utility system construction. This has changed design and building techniques to emphasize climate resilience and adaptation. Climate-sensitive projects address a global issue and position companies as leaders in sustainable infrastructure development.

Leave a Comment