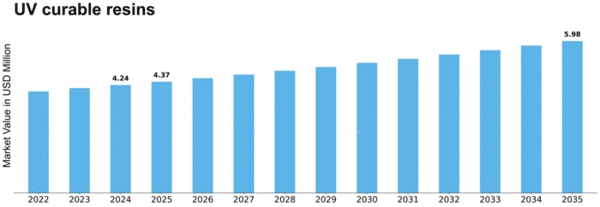

Uv Curable Resins Size

UV curable resins Market Growth Projections and Opportunities

The UV curable resins market is influenced by several key factors that shape its growth and dynamics. UV curable resins are widely used in various industries, including coatings, adhesives, inks, and electronics, due to their fast curing time, low volatile organic compound (VOC) emissions, and excellent performance properties.

One of the primary drivers of the UV curable resins market is the increasing demand for environmentally friendly and sustainable coatings and adhesives. As regulatory authorities impose stricter limits on VOC emissions and hazardous air pollutants, manufacturers are turning to UV curable resins as an alternative to traditional solvent-based systems. UV-cured coatings and adhesives offer significant advantages in terms of reduced emissions, energy consumption, and waste generation, driving their adoption across different industries.

Technological advancements in UV curing technology drive market growth by improving efficiency, performance, and versatility. Innovations such as LED UV curing systems, photoinitiators, and resin formulations enable manufacturers to develop UV curable resins with enhanced properties, such as faster curing speeds, improved adhesion, and durability. These advancements expand the application possibilities of UV curable resins and drive their adoption in new markets and industries.

The growing demand for high-performance and durable coatings and adhesives in automotive, aerospace, and electronics industries also fuels the growth of the UV curable resins market. UV-cured coatings offer superior scratch resistance, chemical resistance, and weatherability compared to conventional coatings, making them ideal for demanding applications where durability and performance are critical. Similarly, UV-curable adhesives provide excellent bond strength, fast curing times, and resistance to heat and moisture, meeting the stringent requirements of electronic devices and assemblies.

Regulatory standards and environmental regulations play a significant role in shaping the UV curable resins market. Governments worldwide are implementing regulations to reduce emissions, promote sustainability, and protect human health and the environment. Compliance with these regulations is driving the adoption of UV curable resins as a more environmentally friendly alternative to solvent-based systems, especially in regions with stringent environmental policies.

Market consolidation and competitive strategies influence the competitive landscape of the UV curable resins market. Major players in the industry invest in research and development, mergers, acquisitions, and strategic partnerships to strengthen their market position and expand their product portfolios. Innovation and differentiation are key strategies employed by companies to stay competitive and meet the evolving needs of customers in various industries.

Raw material prices and availability are significant factors affecting the UV curable resins market. Raw materials such as monomers, oligomers, photoinitiators, and additives are derived from petrochemicals and other sources, and fluctuations in raw material prices can impact production costs and product pricing. Supply chain disruptions, geopolitical factors, and changes in demand also influence raw material availability and pricing, affecting market dynamics.

Economic conditions and industrial activity influence the demand for UV curable resins. Economic growth, infrastructure development, and manufacturing output drive the demand for coatings, adhesives, and other products that utilize UV curable resins. Conversely, economic downturns and recessions can lead to reduced consumer spending and demand for industrial products, affecting the UV curable resins market.

Consumer preferences and market trends also shape the UV curable resins market. Increasing awareness of sustainability, health, and safety concerns drive consumer demand for products with low VOC emissions and environmental impact. Manufacturers are responding by developing eco-friendly and sustainable UV curable resins to meet consumer preferences and market trends.

Leave a Comment