Veterinary Artificial Insemination Size

Veterinary Artificial Insemination Market Growth Projections and Opportunities

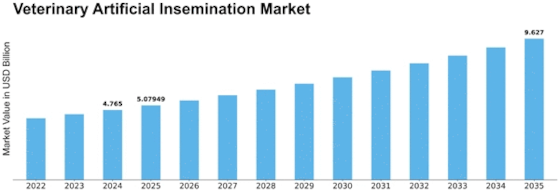

In the forecast period, Veterinary artificial insemination is anticipated to reach $7.46 billion by 2032 with a CAGR of 6.6%. Various factors influence the growth patterns and dynamics of the veterinary artificial insemination market. One of the reasons for expanding this market is that the animal husbandry sector needs better breeding techniques. In addition, changes in eating behavior patterns and consumer tastes lead to an increase in business for the veterinary artificial insemination market. This has necessitated efficient rearing methods that can keep up with increasing demands from the food industry due to escalating demand for animal products such as milk, meat, and dairy products. By adopting commercial systems, genetic improvement through AI may be achieved, thereby leading to increased productivity and improvement in quality traits. Besides, technological advancements have played a key role in boosting this market. To start with, innovations in cryopreservation methods, semen processing, and the use of specific equipment have considerably raised success rates among vet clinics that offer AI services. The global focus on animal welfare combined with disease prevention measures also contributes significantly towards the growth of this market. It brings about controlled breeding, where diseases can't be transmitted through the natural mating process. Artificial insemination is becoming more popular because it is seen as cost-effective compared to natural mating. Due to less risk during mating, optimal management of nutrition or reproduction will limit the negative effect on heterosis, as well as ensure safer semen application. Also, they influence the Veterinary Artificial Insemination Market. Government policies: regulations play major roles in influencing the Veterinary Artificial Insemination Market. Plenty of countries have formulated guidelines and standards for reproductive technologies used on animals so as to ensure safe use and, thus, humane considerations during processes. Artificial insemination practice should also consider increasing global awareness regarding environmentally sustainable practices as well as the impact livestock has on the environment. Therefore, compared to conventional methods characterized by largely unpredictable heat periods, relatively lower footprints and resource consumption are obtained from using artificial inseminations. This has been in line with the trend towards agroecology and sustainable animal production.

Leave a Comment