Veterinary Diagnostics Market Overview

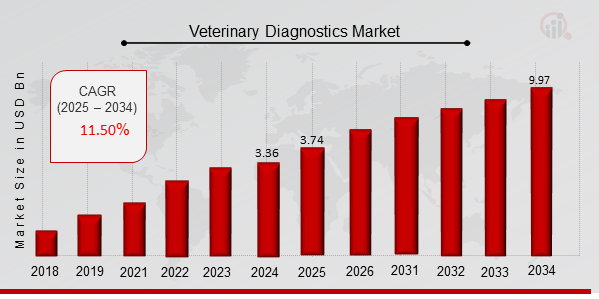

As per MRFR analysis, the Veterinary Diagnostics Market Size was estimated at 3.36 (USD Billion) in 2024. The Veterinary Diagnostics Market Industry is expected to grow from 3.74 (USD Billion) in 2025 to 9.97 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 11.50% during the forecast period (2025 - 2034). Rising costs for animal health and better disease prevention are the key market drivers boosting the market growth.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Veterinary Diagnostics Market Trends

-

Growing veterinarian disease prevalence is driving the market growth

Market CAGR for veterinary diagnostics is being driven by the increasing veterinarian disease prevalence. Zooplanet health, companion animals, and wild animals are all impacted by veterinary infectious illnesses. The use of molecular and immunodiagnostic techniques frequently achieves complex disease diagnosis. These elements are contributing to the market's expansion. Moreover, the veterinary diagnostics market is anticipated to increase due to rising pet insurance demand and the opening of new diagnostic labs by numerous industry participants worldwide.

Additionally, emergencies of livestock diseases can pose a serious financial threat to nations whose economies rely heavily on livestock. It becomes imperative to diagnose animals in a timely manner. This is expected to add to the growing need for diagnostic veterinary procedures. The market is expected to rise as a result of the government's active support and livestock owners' growing awareness, which raised demand for diagnostic tests and kits for animal diseases. The expanding tendency of nuclear families and the quick uptake of modern lifestyles are the primary causes of the growing pet ownership rate.

When it comes to pets, most homes would rather pet a dog or cat than another animal. The primary causes of the increase in pet ownership are rising disposable money and a growing fondness for domesticated animals.

The expanding trend of foster pet adoption is another reason driving up pet ownership. Alongside the increase in the number of pets held, a major factor driving the demand for veterinary diagnostics is the increased investment placed in animals by pet owners. Pet ownership and spending are expected to rise, propelling the market's expansion. One of the main barriers to the market's growth is the need for more skilled workers for veterinary diagnostics, especially in sizable developing countries. Usually, experts with the required education and experience run very advanced diagnostic equipment.

The need for more qualified workers is one of the biggest challenges facing the industry. Many livestock owners in developed and developing countries consequently still need complete access to veterinary care. Veterinary tests are therefore required less frequently since many animals still need access to veterinary treatment.

For instance, Covetrus announced the successful conclusion of its previously disclosed acquisition by funds connected to Clayton, Dubilier & Rice and TPG Capital, the sizable US and European private equity platform of international alternative asset management company TPG. As a result, it is expected that throughout the projection period, demand for veterinary diagnostics is due to the increasing popularity of foster pet adoption. Thus driving the veterinary diagnostics market revenue.

Veterinary Diagnostics Market Segment Insights

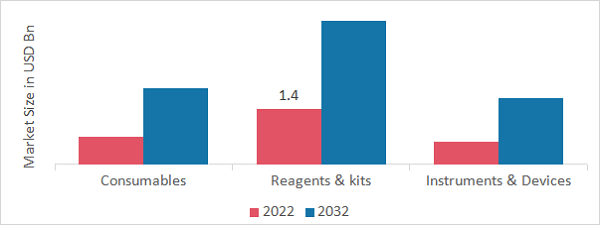

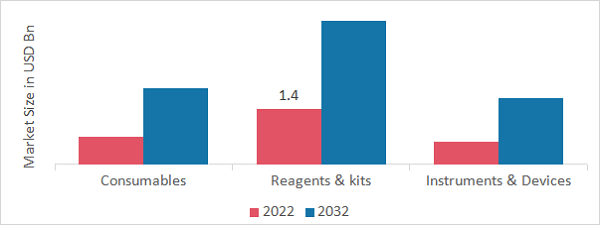

Veterinary Diagnostics Product Insights

The veterinary diagnostics market segmentation, based on product, includes consumables, reagents & kits, and instruments & devices. The reagents & kits segment dominated the market, accounting for 45% of market revenue (79.56 Billion). In developing economies, increased frequency and a spike in spending on veterinary services and testing are reasons for the segment's expansion.

Figure 1: Veterinary Diagnostics Market, by Product, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Veterinary Diagnostics Species Insights

The veterinary diagnostics market segmentation, based on species, includes cattle, canine, feline, caprine, equine, ovine, porcine, avian, and others. In 2022, the canine segment sector held the highest market share globally, accounting for over 30% of the total revenue because dog species are as a result of rising expenditures in developed countries on animal healthcare. One of the most important trends driving the market is the rising prevalence of serious disorders such as obesity, diabetes, and cancer.

Veterinary Diagnostics Testing Type Insights

The veterinary diagnostics market segmentation, based on testing type, includes analytical services, diagnostic imaging, bacteriology, pathology, molecular diagnostics, immunoassays, parasitology, serology, and virology. In 2022, the worldwide veterinary diagnostics market share was dominated by the pathology category because it provides a comprehensive range of diagnostic options, including a battery of laboratory, imaging, and specialist testing.

Veterinary Diagnostics End-Use Insights

The veterinary diagnostics market segmentation, based on end-use, includes laboratories, veterinary hospitals & clinics, point-of-care/In-house testing, research institutes and universities. The laboratories segment dominated the market. The segment's rise is ascribed to reference laboratories' increasing significance as a result of their strict guidelines for reliable data and diagnostic procedures.

Veterinary Diagnostics Disease Type Insights

The veterinary diagnostics market segmentation, based on disease type, includes infectious diseases, non-infectious diseases, hereditary, congenital & acquired diseases, general ailments, and structural & functional diseases. In 2022, the non-infectious diseases category held a dominant market share of over 25% because of the development of diagnostics utilizing novel technology for the early diagnosis of animal diseases.

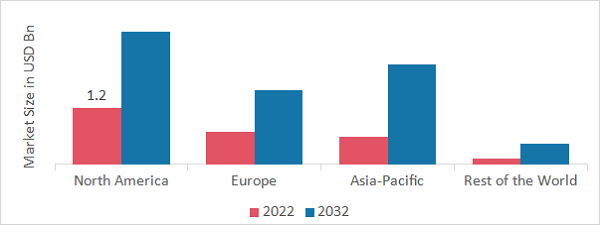

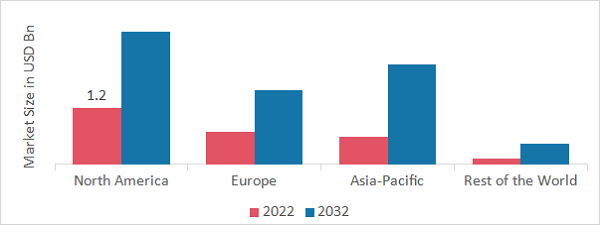

Veterinary Diagnostics Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American veterinary diagnostics market area will dominate this market, owing to expanding veterinarian employment and good reimbursement conditions. In addition, the proliferation of hospitals and other medical centers bodes well for the regional economy.

Further, the major countries studied in the market report are The US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: VETERINARY DIAGNOSTICS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe’s veterinary diagnostics market accounts for the second-largest market share due to better medical facilities and a greater use of veterinary diagnostics for the prompt detection of animal illnesses. Further, the German veterinary diagnostics market held the largest market share, and the UK veterinary diagnostics market was the fastest-growing market in the European region.

The Asia-Pacific veterinary diagnostics Market is predicted to grow at the highest CAGR from 2023 to 2032. This is due to expanding awareness of veterinary diagnostics and increasing businesses' capacities by offering specific software that facilitates end-user workflow. Moreover, China’s veterinary diagnostics market held the largest market share, and the Indian veterinary diagnostics market was the fastest-growing market in the Asia-Pacific region.

Veterinary Diagnostics Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the veterinary diagnostics market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the veterinary diagnostics industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the veterinary diagnostics industry to benefit clients and increase the market sector. In recent years, the veterinary diagnostics industry has offered some of the most significant advantages to medicine. Major players in the veterinary diagnostics market, including Zoetis, Heska Corp., IDEXX Laboratories Inc., Agrolabo S.p.A., IDvet, Virbac, Thermo Fisher Scientific Inc, Neogen Corp, Covetrus, and iM3Vet Pty Ltd.

Heska is currently a part of Antech. Heska gives veterinary professionals access to cutting-edge technologies through invention, innovation, and strategic collaborations with leaders in diagnostics and therapies. Chemistry, Hematology, Immunodiagnostics, Artificial Intelligence-guided Urine and fecal, Digital Cytology, Heartworm tests, and more are among the in-house lab diagnostic solutions offered by Heska. Test for allergies with the utmost sensitivity possible using Heska's immunotherapy kits. The newest innovations in High-Definition Digital Radiography and Digital Ultrasound, together with Cloud-Based data management, sharing, and archiving services, are featured in Heska's digital imaging lineup.

In April 2023, Heska was successfully acquired by Mars, Incorporated, who declared the news. According to the official agreement the firms announced, Mars will buy Heska for $120.00 per share. Heska is now a part of Mars Petcare's Science & Diagnostics division, which allows for increasing access to pet healthcare solutions globally, speeding up research and development, and enabling broader coverage across diagnostics and technologies.

Covetrus is a multinational provider of technology and services for animal health that aims to enable veterinary practice partners to achieve better financial and health outcomes. Covetrus is a leading provider of veterinary practice management software and services around the world. In our platform, we integrate products, services, and technology. Over 5,700 workers at Covetrus, which has its headquarters in Portland, Maine, provide services to over 100,000 veterinarian clients worldwide. In June 2023, Covetrus®, a pioneer in animal health technology and services globally, is expanding GreatPetCareTM, an all-in-one engagement and pet health education platform.

The company's connected care goal—improving the relationship between veterinarians and pet parents—is advanced by this action.

Key Companies in the Veterinary Diagnostics market include

Veterinary Diagnostics Industry Developments

-

Q2 2024: Zoetis Launches Vetscan Imagyst, a Revolutionary Diagnostic Platform for Veterinary Clinics Zoetis announced the launch of Vetscan Imagyst, an AI-powered diagnostic platform designed to assist veterinary clinics with rapid and accurate analysis of fecal, blood, and cytology samples.

-

Q2 2024: IDEXX Laboratories Expands Reference Laboratory Network with New Facility in Texas IDEXX Laboratories opened a new reference laboratory in Texas to enhance its diagnostic testing capacity and support veterinary practices in the region.

-

Q2 2024: Antech Diagnostics Announces Strategic Partnership with PetDx for Liquid Biopsy Cancer Testing Antech Diagnostics entered a partnership with PetDx to offer liquid biopsy cancer testing for dogs, expanding its portfolio of advanced veterinary diagnostics.

-

Q3 2024: Heska Corporation Receives FDA Clearance for New Point-of-Care Hematology Analyzer Heska Corporation received FDA clearance for its new point-of-care hematology analyzer, enabling faster and more accurate blood diagnostics in veterinary clinics.

-

Q3 2024: Zoetis Acquires Biomed Diagnostics to Expand Infectious Disease Testing Portfolio Zoetis completed the acquisition of Biomed Diagnostics, strengthening its capabilities in infectious disease diagnostics for companion animals and livestock.

-

Q3 2024: IDEXX Laboratories Appoints Dr. Jane Smith as Chief Scientific Officer IDEXX Laboratories announced the appointment of Dr. Jane Smith as Chief Scientific Officer, responsible for leading research and development in veterinary diagnostics.

-

Q4 2024: Vetscan Diagnostics Secures $25 Million Series B Funding to Accelerate Product Development Vetscan Diagnostics raised $25 million in Series B funding to support the development and commercialization of new diagnostic products for veterinary practices.

-

Q4 2024: Antech Diagnostics Opens New State-of-the-Art Laboratory in Florida Antech Diagnostics opened a new laboratory in Florida, expanding its geographic reach and increasing capacity for advanced veterinary diagnostic testing.

-

Q1 2025: Zoetis Announces Partnership with Covetrus to Integrate Diagnostic Solutions into Practice Management Software Zoetis partnered with Covetrus to integrate its diagnostic solutions into Covetrus' veterinary practice management software, streamlining workflows for clinics.

-

Q1 2025: IDEXX Laboratories Launches New PCR-Based Test for Early Detection of Canine Parvovirus IDEXX Laboratories launched a new PCR-based test for the early detection of canine parvovirus, aiming to improve outcomes for affected dogs.

-

Q2 2025: Heska Corporation Announces $40 Million Investment Round to Expand Diagnostic Product Line Heska Corporation secured a $40 million investment round to fund the expansion of its diagnostic product line and support global market growth.

-

Q2 2025: Antech Diagnostics Receives USDA Approval for New Livestock Disease Diagnostic Test Antech Diagnostics received USDA approval for its new diagnostic test targeting a major livestock disease, enabling broader adoption in agricultural settings.

Veterinary Diagnostics Market Segmentation

Veterinary Diagnostics Product Outlook

- Consumables

- Reagents & Kits

- Instruments & Devices

Veterinary Diagnostics Species Outlook

- Cattle

- Canine

- Feline

- Caprine

- Equine

- Ovine

- Porcine

- Avian

- Others

Veterinary Diagnostics Testing Type Outlook

- Analytical Services

- Diagnostic Imaging

- Bacteriology

- Pathology

- Molecular Diagnostics

- Immunoassays

- Parasitology

- Serology

- Virology

Veterinary Diagnostics Disease Type Outlook

- Infectious Diseases

- Non-Infectious Diseases

- Hereditary

- Congenital & Acquired Diseases

- General Ailments

- Structural & Functional Diseases

Veterinary Diagnostics End-use Outlook

- Laboratories

- Veterinary Hospitals and Clinics

- Point-of-care/In-House Testing

- Research Institutes and Universities

Veterinary Diagnostics Regional Outlook

North America

Europe

Asia-Pacific

Rest of the World

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

3.36 (USD Billion)

|

|

Market Size 2025

|

3.74 (USD Billion)

|

|

Market Size 2034

|

9.97 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

11.50 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Species, Testing Type, Disease Type, End-Use, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Zoetis, Heska Corp., IDEXX Laboratories Inc., Agrolabo S.p.A., IDvet, Virbac, Thermo Fisher Scientific Inc, Neogen Corp, Covetrus,and iM3Vet Pty Ltd. |

| Key Market Opportunities |

Expanded application of PCR testing panels |

| Key Market Dynamics |

Increase in health awareness Increasing spending on animal care |

Frequently Asked Questions (FAQ):

The veterinary diagnostics market size was valued at USD 2.7 Billion in 2022.

The market is projected to grow at a CAGR of 11.50% during the forecast period, 2025-2034.

North America had the largest share of the market.

The key players in the market are including Zoetis, Heska Corp., IDEXX Laboratories Inc., Agrolabo S.p.A., IDvet, Virbac, Thermo Fisher Scientific Inc, Neogen Corp, Covetrus, and iM3Vet Pty Ltd.

The reagents & kits category dominated the market in 2022.

The laboratories had the largest share of the market.