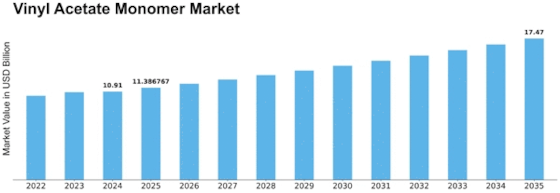

Vinyl Acetate Monomer Size

Vinyl Acetate Monomer Market Growth Projections and Opportunities

The vinyl acetate monomer (VAM) market is influenced by several key market factors that drive its supply, demand, and pricing dynamics. Firstly, the growth of end-use industries plays a significant role in shaping the market for VAM. Industries such as adhesives, coatings, textiles, and packaging heavily rely on VAM as a crucial ingredient in their manufacturing processes. As these industries expand or contract, they directly impact the demand for VAM. For instance, the construction sector's growth drives the demand for adhesives and coatings, which in turn boosts the demand for VAM.

Vinyl Acetate Monomer (VAM) is a flammable mobile liquid that is colorless, volatile, and characteristic with a sweet ethereal odor. It is a dangerous solution when exposed to heat.

Moreover, macroeconomic factors such as GDP growth rates, inflation, and industrial production levels influence the VAM market. During periods of economic prosperity, there is typically higher demand for products requiring VAM, leading to increased production and consumption of VAM. Conversely, economic downturns can result in decreased demand for VAM-based products, affecting market growth. Additionally, currency fluctuations and geopolitical tensions can impact the cost of raw materials and transportation, thereby affecting VAM prices and market dynamics.

Furthermore, environmental regulations and sustainability initiatives have become increasingly important market factors for VAM. Governments worldwide are implementing stricter regulations to reduce harmful emissions and promote eco-friendly products. This has led to a shift towards the adoption of bio-based VAM and the development of sustainable manufacturing processes within the industry. Companies operating in the VAM market need to adapt to these regulatory changes to remain compliant and competitive.

Technological advancements also play a crucial role in shaping the VAM market. Continuous innovation in manufacturing processes has led to improved efficiency, reduced production costs, and enhanced product quality. Additionally, research and development efforts focus on developing new applications for VAM, expanding its market potential. Companies investing in research and innovation gain a competitive edge by offering innovative products and capturing new market segments.

Supply chain dynamics, including raw material availability, production capacities, and distribution networks, significantly influence the VAM market. Any disruptions in the supply chain, such as natural disasters or geopolitical conflicts, can lead to supply shortages and price volatility. Moreover, changes in feedstock prices, particularly ethylene and acetic acid, directly impact VAM production costs and ultimately affect market prices.

Competitive landscape and market consolidation also shape the dynamics of the VAM market. The market is characterized by several key players competing based on factors such as product quality, price, and technological capabilities. Mergers, acquisitions, and strategic partnerships among companies can impact market competition and influence pricing strategies. Additionally, market players often invest in capacity expansions or plant upgrades to meet growing demand and gain a competitive advantage.

Consumer preferences and trends also drive the demand for VAM-based products. With increasing awareness about environmental sustainability and health concerns, there is a growing demand for eco-friendly and non-toxic products. This has led to the development of VAM-based products with improved sustainability profiles, such as water-based adhesives and low-VOC coatings, catering to changing consumer preferences.

Leave a Comment