Global Virtual Currency Market Overview

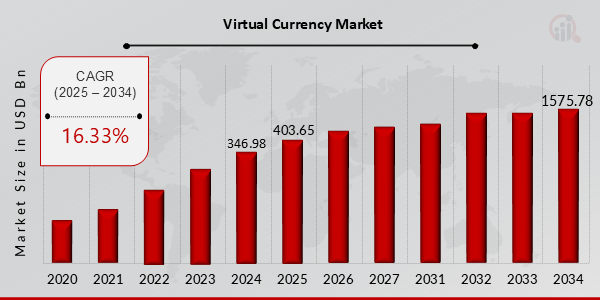

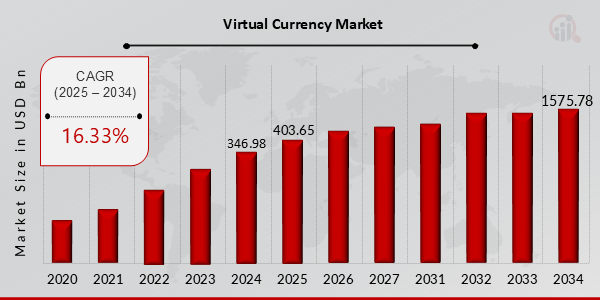

Virtual Currency Market Size was estimated at 346.98 (USD Billion) in 2024. The Virtual Currency Market Industry is expected to grow from 403.65 (USD Billion) in 2025 to 1575.78 (USD Billion) till 2034, exhibiting a compound annual growth rate (CAGR) of 16.33% during the forecast period (2025 - 2034).

Key Virtual Currency Market Trends Highlighted

The Virtual Currency Market keeps expanding as there is a shift in the mindsets of people and businesses towards accepting digital assets. An increase in the number of online users of digital assets, investment opportunities, and growth of DeFi are key market motivators. As more individuals become cognizant of virtual currencies, there has been an influx in the need for a variety of creative financial solutions, prompting governments and financial institutions to seek possible regulations that could be used to help stabilize the market.

Also, the boom in technology including blockchain technology cannot be overlooked as it helps to stabilize the market, hence enhancing the interest in virtual currencies in the first place.

There are multiple unexplored opportunities in the Virtual Currency Market. As the ecosystem advances, businesses can use the likes of blockchain technology to build products and services according to consumer needs. The focus of a great deal of cross-border payments and remittances has been received in less developed regions that have the potential for payment systems. Moreover, virtual currencies can be used with existing e-commerce systems which can give an advantage, providing merchants with wider audiences and enhanced customer experience.

Also, the evolution of stablecoins offers businesses the opportunity to harness the benefits of stablecoins while avoiding volatility associated with conversion to other forms of currency.

Currently, the market is moving towards clarity in regulation as various governments try to put up structures that protect the consumer and promote development. The emphasis towards moving that way is also increasing with some companies and projects trying to cut the carbon footprint associated with cryptocurrency mining. With the increased penetration of digital assets across various institutions, there is a heightened need for educational endeavours that will orient users towards the complexities of the virtual currency world.

In all, the foreign market for virtual currency is in transition and has potential for development and growth in diverse areas while addressing new market and regulatory challenges that periodically emerge.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Virtual Currency Market Drivers

Rising Adoption of Blockchain Technology

The growing adoption of blockchain technology is a major driver for the Virtual Currency Market Industry. Organizations across various sectors are increasingly recognizing the potential of blockchain to improve transparency and reduce fraud. This innovative technology underpins most virtual currencies, providing a decentralized and secure manner for transactions. As more businesses and individuals pursue greater efficiency and cost savings, the demand for virtual currencies powered by blockchain technology is expected to rise significantly. Furthermore, the rise of decentralized finance (DeFi) platforms is enabling users to access financial services without traditional intermediaries, increasing the appeal and utility of virtual currencies.

Consequently, investments in blockchain startups and ongoing advancements in smart contracts will further contribute to the expansion of the Virtual Currency Market. As institutional interest grows, more entities are looking to integrate virtual currencies into their operations, driving growth in this sector. With these factors at play, it is likely that the Virtual Currency Market will continue on its upward trajectory, influenced profoundly by the shift towards blockchain technology.

Increasing Investment in Institutional Players

The increasing investment from institutional players is propelling the growth of the Virtual Currency Market Industry. With hedge funds, banks, and other financial institutions beginning to allocate portions of their portfolios to virtual currencies, this trend is creating a perception of legitimacy and stability for digital assets. The ongoing entry of large entities adds significant liquidity to the market and boosts investor confidence. Moreover, as regulations continue to evolve, institutions feel more secure in navigating the virtual currency landscape, which further drives investment. Ultimately, this trend signifies a broader acceptance of virtual currencies within mainstream finance.

Growing Focus on Financial Inclusion

The Virtual Currency Market Industry is also witnessing growth due to the increasing focus on financial inclusion. Virtual currencies offer unique solutions for unbanked and underbanked populations, providing access to financial services in regions lacking traditional banking infrastructure. With more individuals gaining access to mobile devices and internet connectivity, the use of virtual currencies can empower these populations by enabling secure transactions, savings, and credit services. By breaking down barriers to financial access, virtual currencies are not only enhancing economic participation but are also driving demand and market growth in the Virtual Currency Market.

Virtual Currency Market Segment Insights

Virtual Currency Market Type Insights

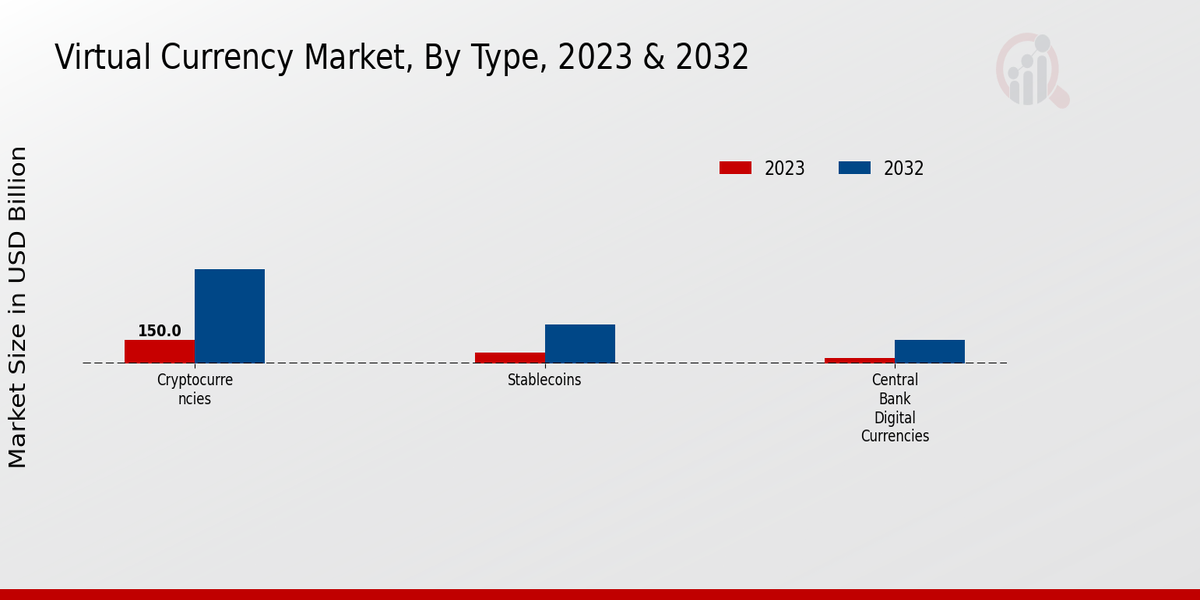

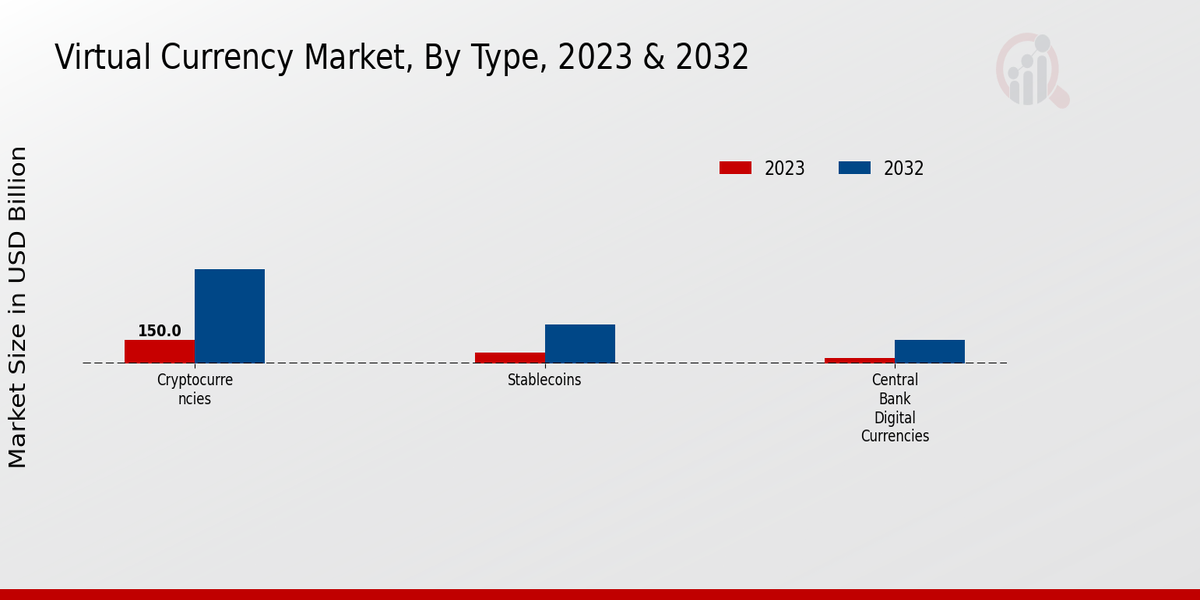

The Virtual Currency Market is a rapidly evolving field characterized by various types, which include Cryptocurrencies, Stablecoins, and Central Bank Digital Currencies. In 2023, the entire market is valued at 256.39 billion USD, marking a significant milestone in this industry. Among the types, Cryptocurrencies hold a majority share, with a valuation of 150.0 billion USD in 2023, growing to 600.0 billion USD by 2032. This dominance reflects the increasing acceptance and utility of decentralized currencies within mainstream finance and investment sectors, making Cryptocurrencies a pivotal segment driving overall market revenue.

Stablecoins, with a valuation of 70.0 billion USD in 2023, are also noteworthy, particularly due to their ability to maintain a stable value relative to traditional currencies. This stability makes them attractive for both investors seeking less volatility and for businesses that require reliable transaction mediums. With a projected growth to 250.0 billion USD by 2032, Stablecoins are becoming essential for bridging the gap between traditional finance and digital currencies, thus expanding use cases in cross-border transactions and remittances.

Central Bank Digital Currencies (CBDCs) are a crucial segment that is gaining traction, valued at 36.39 billion USD in 2023, and expected to rise to 150.0 billion USD by 2032. The emphasis on CBDCs stems from central banks' need to modernize payment systems while ensuring financial stability. As regulatory frameworks and consumer acceptance grow, CBDCs are likely to play a significant role in the future of the global financial system, fostering greater financial inclusion and streamlining monetary policies.

In terms of market statistics, the segmentation of the Virtual Currency Market reveals the diverse preferences of users and investors as they seek options that align with their strategies and needs. The varying degrees of market growth across these types emphasize the ongoing advancements in technology, changing consumer behavior, and the responses of traditional financial institutions to the digital currency landscape. Combined, these insights contribute to the broader understanding of market trends, growth drivers, challenges, and opportunities, serving as a catalyst for ongoing developments within the Virtual Currency Market industry.

Overall, the significant valuations within these segments highlight their critical roles in shaping the future of the global economy and the way transactions are conducted worldwide.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Virtual Currency Market Technology Insights

The Virtual Currency Market is experiencing remarkable growth within the Technology segment, boasting a valuation of approximately 256.39 USD billion in 2023. This sector is driven by various innovations that incorporate Blockchain, Distributed Ledger Technology, and Smart Contracts, making them integral parts of the virtual currency ecosystem. Blockchain technology serves as the backbone of many cryptocurrencies, ensuring security and transparency in transactions, which has significantly boosted its adoption. Distributed Ledger Technology enhances data integrity and consensus across networks, further strengthening its position within the market.

Smart Contracts automate and enforce agreements without intermediaries, streamlining processes and reducing operational costs, which is vital in both financial and non-financial applications. The interplay of these technologies is pivotal, providing solutions that meet increasing demands for efficiency, security, and scalability within the Virtual Currency Market. As market growth persists, the importance of these technologies continues to expand, offering numerous opportunities for innovation and development that shape the future of virtual currencies.

Virtual Currency Market End User Insights

The Virtual Currency Market, valued at approximately 256.39 USD Billion in 2023, shows significant growth attributed to its various end user segments, which include Retail Consumers, Institutional Investors, and Merchants. Retail Consumers represent a dynamic portion of the market as they increasingly adopt virtual currencies for everyday transactions and investments, demonstrating the growing acceptance of digital assets in personal finance. Institutional Investors have also gained traction, drawn by the potential for diversification and high returns, contributing substantially to market stability and driving overall market growth.

Merchants are essential as they create an environment for the practical application of virtual currencies, facilitating a seamless exchange for goods and services. This engagement underscores the importance of the retail sector in advancing the virtual currency ecosystem. The synergy among these end users fosters new opportunities while also presenting challenges such as regulatory scrutiny and market volatility. Overall, the segmentation reveals a balanced interplay between consumer adaptation, institutional involvement, and merchant engagement that shapes the trajectory of the Virtual Currency Market industry.

Virtual Currency Market Application Insights

In 2023, the Virtual Currency Market is valued at 256.39 USD Billion, exhibiting robust growth potential across various applications. This segment encompasses critical areas such as Trading, Remittances, and Investment, each contributing significantly to the overall market landscape. Trading is a vital application in the virtual currency ecosystem, facilitating a dynamic environment for investors to exchange assets, reflecting the market's liquidity and accessibility. Remittances, on the other hand, present a significant opportunity for cost-effective money transfers across borders, promoting financial inclusion for underserved populations.

Lastly, Investment in virtual currencies showcases the increasing interest from individual and institutional investors, as these assets are perceived as alternative investment opportunities amidst traditional finance. The collective strength of these applications highlights the diverse opportunities within the Virtual Currency Market, underscored by increasing adoption, regulatory developments, and technological advancements. Overall, the market is positioned for noteworthy advancement, as it meets the growing demand for innovative financial solutions.

Virtual Currency Market Regional Insights

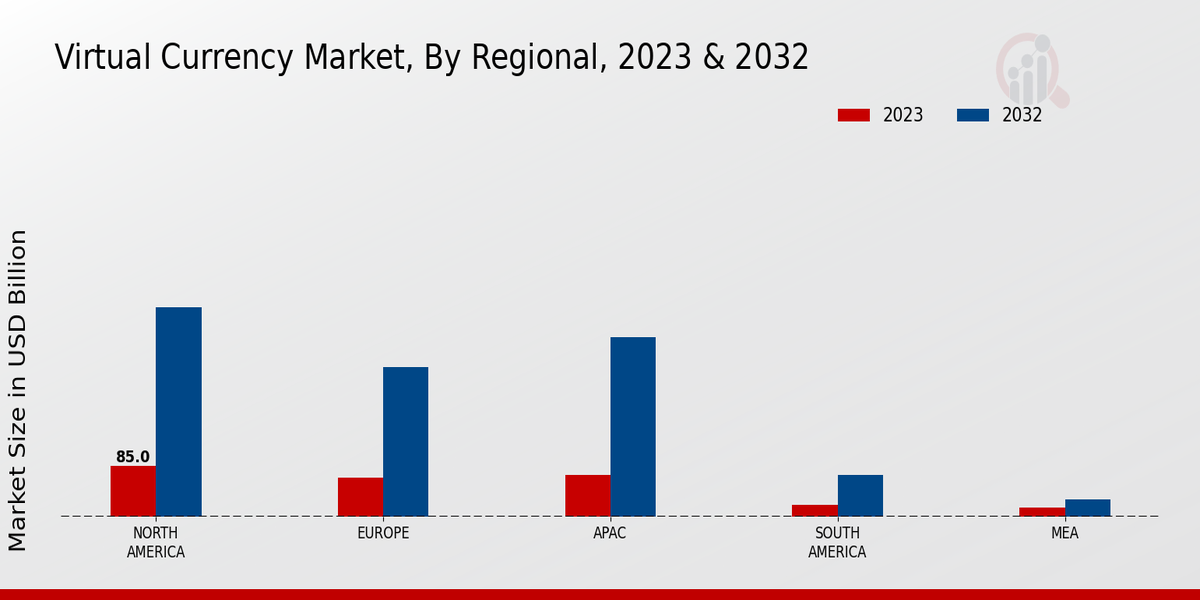

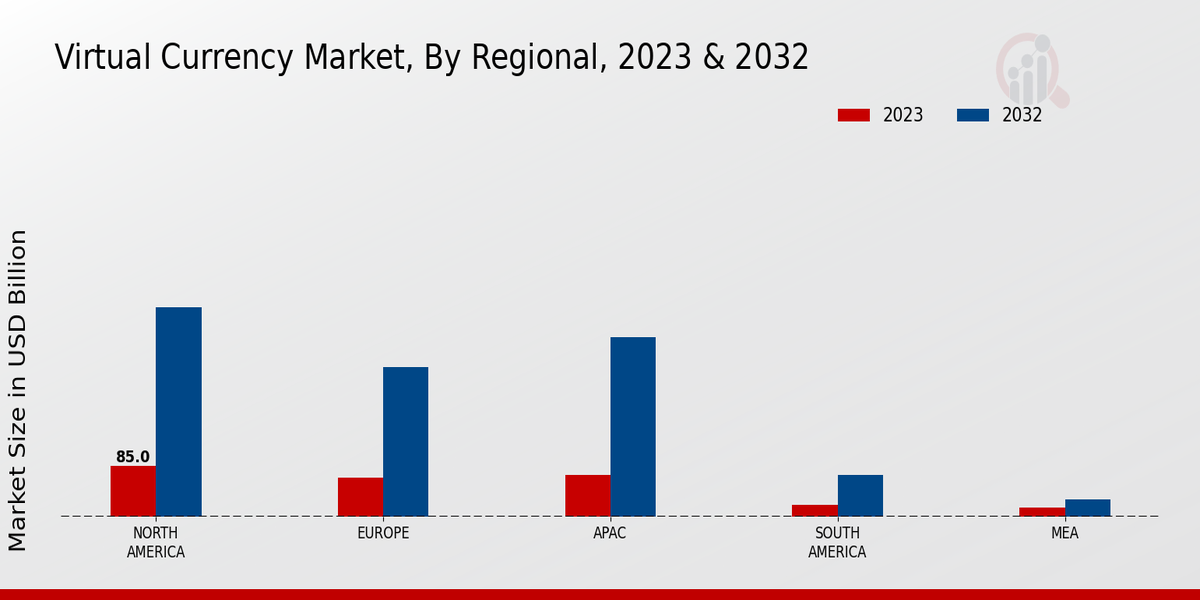

The Virtual Currency Market is witnessing substantial growth across various regions, driven by increasing adoption of digital currencies and advancements in technology. In 2023, the North America region leads with a significant valuation of 85.0 USD Billion, highlighting its dominant position, which is expected to rise to 350.0 USD Billion by 2032. Europe follows with a valuation of 65.0 USD Billion in 2023, reaching 250.0 USD Billion by 2032, reflecting strong consumer interest and regulatory advancements in cryptocurrency.

The APAC region holds a notable valuation of 70.0 USD Billion in 2023, projected to expand to 300.0 USD Billion, as countries in this region heavily explore blockchain innovations and digital currency solutions. In contrast, South America and MEA present smaller market sizes, with valuations of 20.0 USD Billion and 16.39 USD Billion in 2023, respectively. South America's expected growth to 70.0 USD Billion by 2032 showcases the region's increasing inclination towards virtual transactions, while MEA's rise to 30.0 USD Billion indicates emerging opportunities in digital finance and investment.

Overall, the Virtual Currency Market revenue underscores a significant upward trajectory influenced by regional dynamics and consumer acceptance.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Virtual Currency Market Key Players and Competitive Insights

The Virtual Currency Market has become a focal point for innovation and competition as digital currencies continue to garner significant attention from both investors and the general public. This market consists of various virtual currencies that are traded in decentralized financial systems, and it has witnessed unprecedented growth driven by advancements in blockchain technology and increasing consumer interest in alternative payment systems. Within this dynamic landscape, competition is steep as various players strive to capture market share, establish brand loyalty, and offer unique features.

The advent of virtual currencies presents both opportunities and challenges as regulatory scrutiny increases globally and users demand greater security, faster transaction speeds, and improved accessibility in the management of their digital assets. Companies operating in this space continually evolve their strategies while navigating the complexities of technological developments and market fluctuations. Within the Virtual Currency Market, Bitcoin has emerged as a pioneering force, establishing itself as the leading cryptocurrency since its inception. It boasts the largest market capitalization and undeniable first-mover advantage, which has solidified its dominance in the market.

Bitcoin's strength lies in its robust decentralized network, garnering widespread acceptance and recognition as a digital store of value often referred to as "digital gold." Its secure blockchain technology and limited supply, capped at twenty-one million coins, contribute to its appeal among investors seeking a hedge against inflation. Furthermore, Bitcoin has garnered substantial institutional investment, and its integration into various financial services has established it as a legitimate asset class. The global acceptance and increasing number of merchants who accept Bitcoin for payments further enhance its market presence, making it a prominent player in the virtual currency ecosystem.

Litecoin, often dubbed the silver to Bitcoin's gold, holds a significant position in the Virtual Currency Market due to its innovative nature and fast transaction capabilities. Designed as a peer-to-peer cryptocurrency, Litecoin enhances blockchain efficiency, enabling quicker processing times and lower transaction fees when compared to Bitcoin. Its primary strength lies in the adoption of an algorithmic adjustment mechanism that allows users to mine coins with standard hardware, making it more accessible to a broader audience. This position has led to a loyal community of users and miners who appreciate the operational advantages that Litecoin offers.

Additionally, Litecoin benefits from its close ties to Bitcoin's codebase, allowing it to implement technological advancements swiftly while maintaining a distinct identity. Its scalability solutions and ongoing development efforts contribute to a strong market reputation, ensuring that Litecoin remains a competitive option for those seeking alternatives in the virtual currency space.

Key Companies in the Virtual Currency Market Include

Virtual Currency Industry Developments

In recent developments within the Virtual Currency Market, Bitcoin has seen a resurgence in interest as institutions are increasing their holdings, contributing to a rise in its market valuation. Ethereum continues to dominate the decentralized finance (DeFi) space with ongoing advancements in scalability and network upgrades. Litecoin has gained traction, particularly amid growing concerns about transaction speed and efficiency. Tether remains a critical component of liquidity in trading across exchanges, affected by broader regulatory scrutiny. Chainlink's partnerships for data feeds are expanding its ecosystem and potentially driving adoption.

There have been no significant merger or acquisition announcements recently among the target companies, with firms like Kraken and Gemini focusing on expanding their service offerings and geographic reach instead. Polkadot is gaining attention for its multichain technology, which is expected to enhance interoperability. Regulatory pressures continue to shape the landscape of virtual currencies, influencing operational strategies among parties like Huobi and Bitfinex. As the market valuation of these companies evolves, it creates a dynamic environment which reflects ongoing technological innovations and market responses to regulatory developments.

Virtual Currency Market Segmentation Insights

-

Virtual Currency Market Type Outlook

- Central Bank Digital Currencies

-

Virtual Currency Market Technology Outlook

- Distributed Ledger Technology

-

Virtual Currency Market End User Outlook

-

Virtual Currency Market Application Outlook

-

Virtual Currency Market Regional Outlook

-

Europe

-

South America

-

Asia Pacific

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 346.98 Billion |

| Market Size 2025 |

USD 403.65 Billion |

| Market Size 2034 |

USD 1575.78 Billion |

| Compound Annual Growth Rate (CAGR) |

16.33% (2025-2034) |

| Base Year |

2024 |

| Market Forecast Period |

2025-2034 |

| Historical Data |

2020-2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Bitcoin, Litecoin, Cardano, Chainlink, Gemini, Kraken, Bitfinex, Polkadot, Bitstamp, Tether, Ethereum, Ripple, Huobi, Solana, Binance |

| Segments Covered |

Type, Technology, End User, Application, Regional |

| Key Market Opportunities |

Increasing acceptance by merchants, Growing demand for decentralized finance, Expansion of blockchain technology applications, Rising interest in NFTs, Enhanced regulatory frameworks and clarity |

| Key Market Dynamics |

Regulatory developments, Technological advancements, Market volatility, Consumer adoption trends, Investment trends |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Virtual Currency Market is expected to reach a value of 1575.78 USD Billion by 2034.

The projected CAGR for the Virtual Currency Market from 2025 to 2034 is 16.33%.

North America is expected to hold the largest market share, valued at 350.0 USD Billion in 2032.

The market size of Cryptocurrencies is projected to be 600.0 USD Billion by 2032.

Key players in the Virtual Currency Market include Bitcoin, Ethereum, Ripple, Binance, and Tether.

The expected market value for Stablecoins in 2032 is 250.0 USD Billion.

The market size for Central Bank Digital Currencies is anticipated to reach 150.0 USD Billion by 2032.

The expected value of the Virtual Currency Market in North America is 85.0 USD Billion in 2023.

The Virtual Currency Market in the APAC region is projected to reach 300.0 USD Billion by 2032.

The expected value of the Virtual Currency Market in Europe is 65.0 USD Billion in 2023.