Market Share

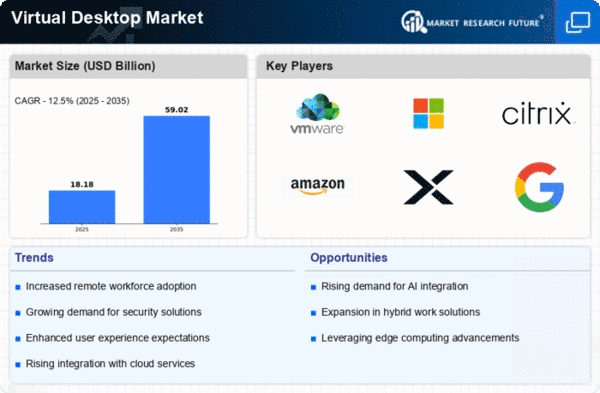

Virtual Desktop Market Share Analysis

In the aggressive landscape of the virtual desktop marketplace, businesses hire diverse market proportion positioning techniques to gain a foothold and differentiate themselves. One commonplace method is differentiation through features and performance. Virtual desktop vendors attempt to provide specific and advanced features, such as stepped-forward photos, seamless user studies, and more advantageous safety protocols. By differentiating their merchandise based on capability and overall performance, businesses intend to attract clients who prioritize unique components of virtual desktop solutions. Another key strategy is pricing competitiveness. In a marketplace wherein fee performance is a sizeable motive force, agencies strategically role themselves by presenting aggressive pricing fashions. Some vendors focus on supplying budget-pleasant alternatives that are attractive to fee-conscious companies looking for effective virtual desktop answers without breaking the bank. This method allows groups to capture a broader market proportion by catering to a wide variety of budgetary concerns within their customer base. Market segmentation is a method often employed to goal particular industries or consumer segments. Virtual desktop companies recognize that one-of-a-kind businesses have unique wishes and requirements. Therefore, they broaden tailor-made answers that cater to precise industries, including healthcare, finance, or schooling. This market segmentation method allows groups to put themselves as professionals in a specific area, addressing the wonderful demanding situations and needs of unique sectors extra efficiently. Partnerships and collaborations also play a vital role in marketplace share positioning inside the virtual desktop landscape. Companies frequently form strategic alliances with technology partners, software companies, or cloud carrier carriers to enhance the overall value proposition of their virtual desktop solutions. By integrating complementary technologies or offerings, businesses can offer an extra comprehensive and compelling virtual desktop, positioning themselves as properly-rounded and versatile solutions inside the market. Geographical growth is a strategy employed by virtual desktop companies to develop their market percentage. Companies apprehend that the demand for virtual desktop answers is not constrained to unique areas or industries. By increasing their presence globally, providers can tap into new markets and cater to a wide range of customers. This strategy entails knowledge of regional alternatives, compliance necessities, and adapting offerings to meet the specific needs of different geographic markets.

Leave a Comment