- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

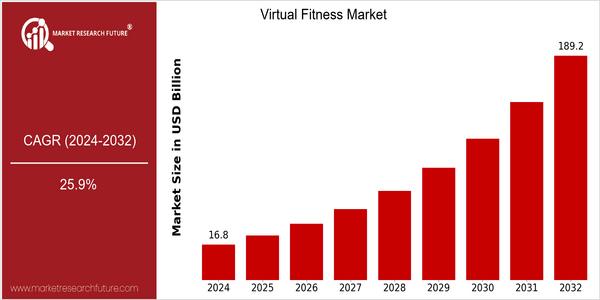

Virtual Fitness Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 16.8 Billion |

| 2032 | USD 189.2 Billion |

| CAGR (2024-2032) | 25.9 % |

Note – Market size depicts the revenue generated over the financial year

The global virtual fitness market is expected to experience a considerable growth, with a current market size of $16.8 billion in 2024, which is expected to reach $189.2 billion by 2032. A CAGR of 25.9 percent is expected to be achieved over the forecast period. This growth can be attributed to the growing adoption of digital fitness solutions, which is in turn driven by the changing consumer preferences for convenience and flexibility in fitness routines. In the last few years, the number of fitness wearables, mobile fitness applications, and virtual training platforms has increased considerably, thus making fitness more accessible to a wider audience. The virtual fitness industry has seen the entry of several new players, such as Peloton, Fitbit, and Mirror, who have been expanding their offerings to capture the market. Strategic initiatives, such as collaborations with fitness and health brands, investment in advanced technology, and the launch of new virtual fitness programs, are also driving market growth. In the near future, the virtual fitness market is expected to experience tremendous growth, which will lead to a fundamental shift in the way consumers approach their health and well-being.

Regional Deep Dive

The Virtual Fitness Market is experiencing significant growth in several regions, mainly driven by increasing health awareness, technological advancements, and the rise of digital platforms. In North America, the market is characterized by the high penetration of fitness applications and wearables, while in Europe the virtual fitness market is characterized by the combination of a long-standing fitness culture with digital innovations. In the Asia-Pacific region, the rapid uptake of virtual fitness is driven by a young population and increasing smartphone penetration. The Middle East and Africa are slowly embracing virtual fitness through government initiatives and local startups. Latin America, with its diverse culture, is characterized by the rise of community-driven fitness platforms. In general, the market dynamics of each region are influenced by unique cultural, economic, and technological factors that influence consumer preferences and thus drive growth potential.

North America

- The pandemic of Covid-19 led to a rapid increase in the use of virtual fitness solutions. Peloton and Beachbody expanded their offerings.

- The new fitness programs are based on the augmented and virtual reality, the fitness companies like Supernatural are leading the way in this area.

- The recent changes in the regulations on the prevention of occupational diseases have prompted companies to invest in virtual fitness solutions for their employees.

Europe

- The hybrid gym is on the rise in Europe, where the classic gym is combined with virtual classes. Les Mills and its on-demand service are a good example of this.

- This is where the European Association of Sports and Health comes into play. It has launched an initiative for sustainable sports and health.

- Various government health and fitness programmes, such as the UK’s Change4Life, are increasingly integrating virtual fitness into their activities to reach a wider audience.

Asia-Pacific

- The rapid spread of the smart phone in countries such as China and India has increased the popularity of virtual fitness applications. In these countries the leaders are companies like Fittr and Keep.

- The virtual world is gaining ground in terms of fitness, and the Internet has become a major platform for sharing information about fitness and for organising fitness challenges.

- Government initiatives to improve the public’s health have encouraged the development of virtual fitness centres, particularly in urban areas.

MEA

- The UAE is becoming a hub for virtual fitness, with the arrival of such new ventures as GymNation, which offers affordable and accessible fitness solutions for the entire population.

- The government is now encouraging the virtual participation of its residents in a fitness programme and a culture of health and well-being.

- Culture is important. Virtual fitness classes have developed a lot.

Latin America

- It is not surprising that the fitness industry in the Middle East is seeing a rise in community-based fitness platforms. Companies like Gympass offer virtual fitness classes, tailored to the local culture and preferences.

- Economic considerations, such as the increasing cost of gym memberships, are pushing consumers towards more cost-effective virtual fitness solutions.

- Social media are crucial in spreading virtual fitness trends. Local influencers and fitness fans create content that appeals to their audience.

Did You Know?

“In 2022 it was estimated that over 80% of all the sport enthusiasts in North America were using at least one of the virtual fitness platforms. This shows the great move towards digital fitness.” — Statista, 2022

Segmental Market Size

The Virtual Exercise Market is experiencing rapid growth, driven by the increasing demand for convenient and flexible fitness solutions. The increasing health awareness of consumers, the availability of smart devices and the digitalization of the fitness industry are the main growth drivers of the Virtual Exercise Market. Moreover, with the growing demand for individualized training, virtual fitness platforms are becoming an essential tool for achieving and maintaining physical health and well-being.

Peloton, Zwift and Mirror are the companies currently leading the virtual fitness revolution. These platforms offer a range of interactive exercise options, from cycling to yoga, to suit all preferences. The main applications of this industry are home-based training, company health programmes and community fitness challenges. The COVID-19 pandemic has further accelerated the trend towards virtual fitness. Lockdowns and isolation have led to consumers seeking alternative ways to stay active. Moreover, technological developments in augmented reality and artificial intelligence are driving the virtual fitness industry forward, enhancing the experience for users.

Future Outlook

The Virtual Fitness Market is projected to experience tremendous growth from 2024 to 2032, with a CAGR of 25.9 percent. This expansion is driven by an increase in the demand for convenient and accessible fitness solutions, especially in the wake of the COVID-19 pandemic, which has permanently changed the fitness habits of the population. By 2032, it is estimated that over 60 percent of fitness enthusiasts will be engaging with virtual fitness platforms, indicating a significant shift in the way individuals are approaching their health and well-being.

AI, augmented reality and wearable fitness devices are expected to improve the user experience and the level of engagement. These innovations will make it easier to provide a bespoke, personalised service, with real-time feedback, making virtual fitness more accessible to a wider audience. Further, the development of fitness communities and the introduction of gamification will encourage users to continue with their training. The market will also benefit from the increasing awareness of the importance of health and the government’s initiatives to encourage physical activity.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 3.5 Billion |

| Market Size Value In 2023 | USD 16.8 Billion |

| Growth Rate | 5.80% (2022-2030) |

Virtual Fitness Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.