Market Trends

Key Emerging Trends in the Virtual Kitchen Market

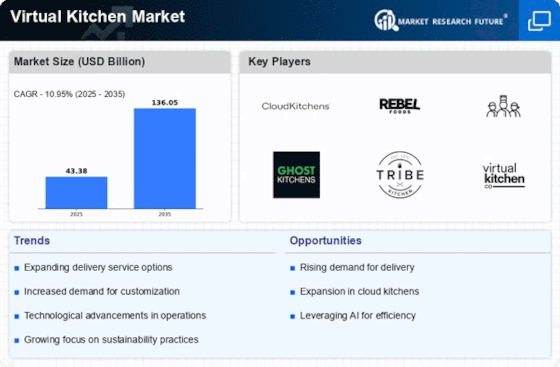

In recent years, the growing popularity of digital platforms and changing consumer preferences have led to strong growth in E-commerce companies. It's a completely new concept in the food industry: virtual kitchens--cloud kitchen or ghost kitchen. These kitchens do not have a traditional storefront, but only accept orders online for delivery or takeout. Convenience and speed are two of the biggest market trends in the virtual kitchen space. Increasingly picky consumers looking for fast and undisruptive dining experiences have found their answer in virtual kitchens. Also, the COVID-19 pandemic has spurred on virtual kitchens even more than before: as lockdowns and safety concerns led to a surge in online delivery of food.

During this period, many traditional restaurants and entrepreneurs also turned to virtual kitchens as a way of leveraging digital channels in order to broaden their customer base. The end result was that both supply and demand for the virtual kitchen market grew, with increasing competition from various players answering consumers 'changing requirements. Focus on data-based insights and analysis is also characteristic of the virtual kitchen trend.

As advanced technologies such as artificial intelligence and machine learning are integrated, virtual kitchens can improve their operating procedures, add dishes to the menu, and become even more streamlined. Through data analytics, virtual kitchen operators obtain information on their customers 'preferences and order patterns, as well as inventory management systems. With this valuable knowledge at hand, they make practical decisions in an always changing marketplace.

Another noteworthy trend in the market for virtual kitchens is collaborations and partnerships. Virtual kitchen operators often team up with successful food brands, chefs, or internet celebrities to come out with special and attractive concepts for virtual restaurants. These collaborations not only increase the credibility and fame of virtual kitchens but can also generate interesting, popular menus to attract more customers. Furthermore, sustainability is emerging as a key consideration in the virtual kitchen market trends.

Consumers are increasingly conscious of environmental impact, and virtual kitchens have the opportunity to address this concern by implementing eco-friendly practices in their operations. From sustainable packaging solutions to locally sourced ingredients, virtual kitchens are exploring ways to reduce their carbon footprint and align with the growing demand for environmentally responsible dining options.

Leave a Comment