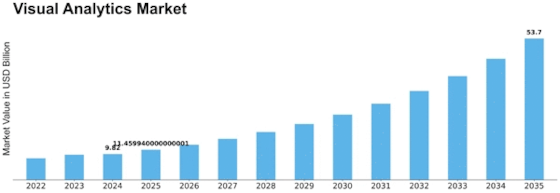

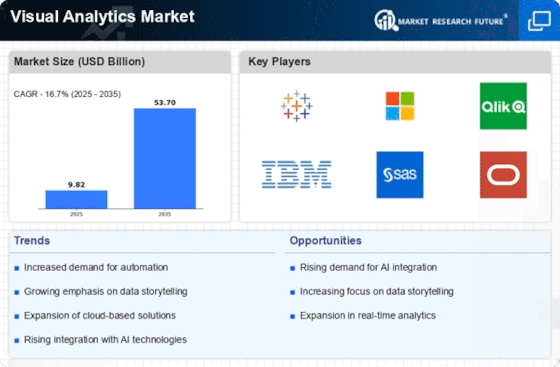

Visual Analytics Size

Visual Analytics Market Growth Projections and Opportunities

The Visual Analytics Market has been transformed into a vigorous and intense field and a lot of players are trying to get a big piece of the market share. Organizations that are active in this area are equipped with diverse positioning strategies to be different and able to get hold the attention of their intended audience. Another common approach is data segmentation which concentrates on providing meaningful and creative visuals analytics offerings. Such representation could contain strong points like high level elements, state of the art advancements, or user friendliness that provide clear superiority over the competition. These credits help companies make a unique selling proposition to customers who are looking for special functionalities or uncompromised experience.

An additional successful means is found in what is called situating. While Visual Analytics market players take the direction of cost inventors and strive to bring down the prices without degrading quality. Such treatment is by targeting the cost conscious clients and they intend to gain market share by giving incentives to cash buyers. On the one hand, some business operations emphasize themselves as the top-notch providers while reiterating the idea that their visual analytics apparatuses have the prevalent quality and offer super expertise level. The focus of this approach falls on clients who can actually pay more and get detailed information and precise delivery systems. Striding forward in the field of marketing nowadays promises progress and success only if we can learn how to balance evaluation and one's self-esteem.

Also in the market segmentation VAS is dominant. Orgs identify and work in cross-industry verticals or speciality markets where players within such sectors have unique challenges and their solutions can solve the problem. Through aligning their products to suit the needs of a particular group, businesses can thus create for themselves a lump sum of acceptable professionals who can then earn the people's trust by becoming well-known and giving quality services within that market. The chosen strategy of this designated way contains more engaged marketing campaigns and the highest client understanding that in the end increase the market share for the particular segments.

However, market division invention, calculating, manufacturing, and market collaborations play a tremendous role in market positioning. While the market structure of Visual Analytics is uniquely dependent on the key alliances that some companies form with innovation partners, information providers, or other industry players. They can also attract attentions, as they incorporate related devices or extend the scope of the information source. Partnering with loyal counterparts enable organizations to promote themselves as an integral part of a bigger setting which enhances the organization's visibility and credibility in the eyes of consumers.

Leave a Comment