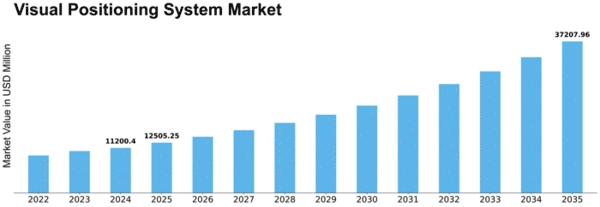

Visual Positioning System Size

Visual Positioning System Market Growth Projections and Opportunities

The visual positioning system (VPS) market is experiencing dynamic shifts driven by technological advancements and increasing demand across various industries. VPS, a cutting-edge technology, utilizes computer vision, machine learning, and sensor fusion to provide precise location information by analyzing visual data from cameras. One of the key drivers of market growth is the rapid proliferation of smartphones equipped with advanced camera capabilities, enabling the integration of VPS functionalities into mobile applications. This integration has opened up new avenues for location-based services, such as augmented reality navigation, indoor mapping, and location-based advertising, thereby expanding the market potential.

Furthermore, the adoption of VPS technology is gaining momentum in sectors like retail, logistics, and automotive. In retail, VPS enhances the shopping experience by providing personalized recommendations, indoor navigation assistance, and seamless checkout processes. Retailers are leveraging VPS to track customer movements within stores, optimize product placements, and analyze consumer behavior patterns, leading to improved operational efficiency and increased sales. Similarly, logistics companies are deploying VPS solutions to optimize warehouse management, track inventory in real-time, and streamline last-mile delivery operations, thereby reducing costs and enhancing customer satisfaction.

In the automotive industry, VPS is revolutionizing autonomous driving systems by enabling vehicles to accurately perceive and navigate complex urban environments. VPS enhances the perception capabilities of autonomous vehicles by providing precise localization and mapping data, facilitating safe and efficient navigation in challenging scenarios such as crowded streets, parking lots, and construction zones. Moreover, VPS technology plays a crucial role in advanced driver assistance systems (ADAS), enhancing collision avoidance, pedestrian detection, and lane-keeping functionalities, thereby improving overall road safety.

The competitive landscape of the VPS market is characterized by intense rivalry among key players striving to innovate and differentiate their offerings. Established technology giants, startups, and automotive manufacturers are investing heavily in research and development to enhance the accuracy, reliability, and scalability of VPS solutions. Additionally, strategic partnerships, collaborations, and mergers & acquisitions are prevalent in the market as companies seek to expand their product portfolios, enter new markets, and gain a competitive edge.

Moreover, government initiatives promoting the adoption of VPS technology, stringent regulations related to safety and compliance, and increasing consumer awareness about the benefits of location-based services are further driving market growth. However, challenges such as privacy concerns, data security risks, and technical limitations related to environmental factors such as lighting conditions and occlusions pose significant hurdles to widespread adoption."

Leave a Comment