Vitamins D Size

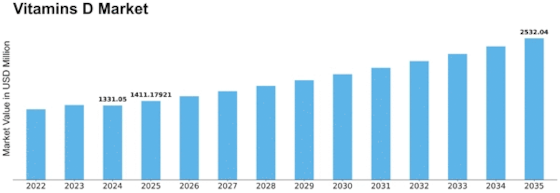

Vitamins D Market Growth Projections and Opportunities

The Vitamins D market is shaped by various factors that collectively influence its dynamics and growth. A primary driver is the growing awareness of the essential role vitamin D plays in maintaining overall health. Vitamin D is crucial for bone health, immune system function, and various physiological processes. As consumers become more health-conscious and seek preventive measures, the demand for vitamin D supplements has risen. The increased awareness of vitamin D's importance, coupled with lifestyle factors that limit sun exposure, contributes to the market's expansion.

Changing dietary habits and lifestyles contribute significantly to the Vitamins D market. Modern lifestyles, which may involve indoor work environments and sedentary behaviors, limit exposure to sunlight, a natural source of vitamin D. Additionally, dietary patterns that may not include sufficient vitamin D-rich foods prompt individuals to turn to supplements to meet their nutritional needs. This shift in dietary habits towards convenience and processed foods has led to a greater emphasis on supplementation to address potential deficiencies.

The influence of scientific research and medical recommendations is a pivotal factor shaping the Vitamins D market. Ongoing research highlighting the multifaceted benefits of vitamin D, including its role in preventing chronic diseases, has contributed to medical professionals recommending supplements. Medical advice emphasizing the importance of maintaining optimal vitamin D levels for various health outcomes has driven consumer interest and adoption of vitamin D supplements.

The impact of demographic factors, including aging populations, contributes to the growth of the Vitamins D market. As individuals age, there is a natural decline in the skin's ability to produce vitamin D from sunlight. The elderly population, often more susceptible to vitamin D deficiency, turns to supplements to support bone health, reduce the risk of fractures, and address other age-related health concerns. The aging demographic and their focus on maintaining overall health contribute to the sustained demand for vitamin D supplements.

The influence of seasonal variations and geographical factors is evident in the Vitamins D market. Regions with limited sunlight during certain seasons may experience higher rates of vitamin D deficiency. Individuals in these areas, as well as those with limited sun exposure due to geographical location, may rely on supplements to maintain adequate vitamin D levels. Seasonal fluctuations and geographic considerations impact regional market trends and consumer preferences.

The impact of health trends and the rise of preventive healthcare practices contribute to the growth of the Vitamins D market. Consumers increasingly view vitamin D supplements as a proactive measure to support immune health and prevent chronic diseases. The global emphasis on wellness and preventive healthcare aligns with the narrative of maintaining optimal vitamin D levels as part of a comprehensive health strategy.

Technological advancements in supplement formulations play a significant role in the Vitamins D market. Efforts to enhance the bioavailability, taste, and convenience of vitamin D supplements contribute to product development and consumer acceptance. Innovations such as liquid formulations, chewable tablets, and combination products catering to diverse consumer preferences further fuel market growth.

The impact of e-commerce and digital platforms transforms the accessibility and distribution of Vitamins D supplements. Consumers can easily research, compare, and purchase a variety of supplements online, making it convenient to explore different brands and formulations. The online presence of health and wellness information further influences consumer decision-making, contributing to the growth of the e-commerce segment in the vitamin D supplement market.

Regulatory factors, including quality standards and labeling requirements, significantly influence the Vitamins D market. Governments and regulatory bodies enforce guidelines to ensure the safety, quality, and efficacy of dietary supplements. Manufacturers must comply with these regulations to gain consumer trust and meet the evolving standards in the industry, contributing to a more transparent and accountable vitamin D supplement market.

Leave a Comment