Waterproof Socks Size

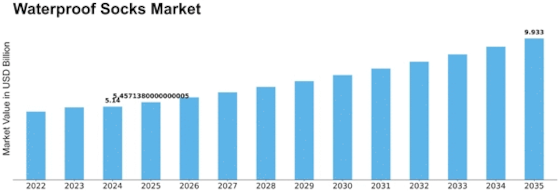

Waterproof Socks Market Growth Projections and Opportunities

The waterproof socks industry is driven by external trends, mechanical advances, and customer preferences. Waterproof socks are popular with climbers, bikers, sprinters, and outdoor enthusiasts because they keep feet dry and comfortable. Growing popularity of outdoor entertainment and need for performance-oriented gear drive market factors.

Innovative advancements drive the waterproof socks industry. Sock manufacturers are always developing new materials and methods to improve waterproofing. Adding breathable but waterproof layers like Carnage Tex to sock designs keeps moisture out while letting intensity and sweat escape, creating a balance between waterproofing and breathability that is crucial for comfort during delayed outdoor sports.

Customer preferences shape the waterproof socks industry. Outdoor enthusiasts need flexible socks for climbing in windy weather and crossing streams. Following that, the market provides lower leg length, mid-calf, and knee-high socks for different preferences and mobility needs. Buyers prioritize comfort, durability, and ease of maintenance, which affects purchase decisions and brand loyalty.

Weather patterns and occasional variants drive waterproof sock demand, reinforcing the market's cycle. In colder climates or areas with frequent rain, waterproof socks are in demand. Thus, market variables fluctuate with seasonal trends and local meteorological circumstances, altering manufacturer timetables and marketing methods.

Memorability and quality are important in the serious waterproof socks business. Trust in established companies with a history of providing durable waterproof products is common. However, newer competitors and niche brands that emphasize clear features or plan components are also rising to gain market share. Product execution, customer surveys, and marketing create brand loyalty.

Online business platforms have greatly impacted waterproof socks' delivery and availability. Online shopping lets customers compare options, read reviews, and make informed purchases, making the market more competitive. Some businesses use direct-to-customer sales techniques to improve accessibility and organize client communication, shaping market factors.

The waterproof socks industry is affected by natural supportability. As consumers grow more environmentally conscious, they want sustainable and eco-friendly outdoor gear, like waterproof socks. Makers are collecting leftover materials and harmless to the ecosystem creation works on, changing market features to include more useful contributions.

Leave a Comment