Weapons and Ammunition Market Overview

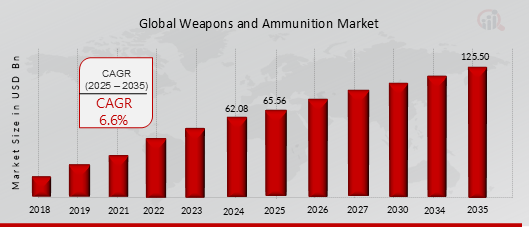

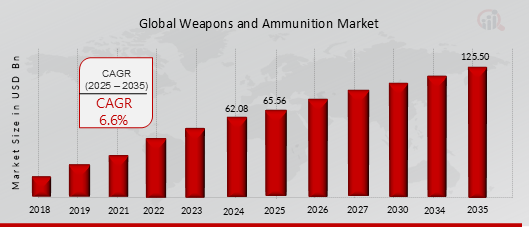

The Weapons and Ammunition Market was valued at USD 62.08 Billion in 2024. The Weapons and Ammunition Market industry is projected to grow from USD 65.56 Billion in 2025 to USD 125.50 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.6% during the forecast period (2025-2035).

The increasing global defense budgets and military modernization initiatives and rising geopolitical tensions and security threats worldwide and technological advancements leading to the development of more sophisticated weaponry are driving the growth of the Weapons and Ammunition Market.

As per the Analyst at MRFR, the global increase in defense budgets and military modernization initiatives is significantly driving growth in the weapons and ammunition industry. Governments worldwide are prioritizing national security in response to rising geopolitical tensions, regional conflicts, and evolving threats such as cyber warfare and terrorism. Major economies, including the United States, China, and India, are significantly increasing their defense spending, enabling large-scale procurement of advanced weapons and ammunition.

Military modernization programs are a key driver, as nations seek to upgrade outdated equipment and adopt cutting-edge technologies. This includes investments in precision-guided munitions, hypersonic weapons, smart ammunition, and AI-integrated systems for enhanced combat effectiveness. The ongoing transition towards fifth-generation warfare, emphasizing automation, surveillance, and advanced weaponry, has further fueled demand for high-tech munitions and weapon platforms.

FIGURE 1: WEAPONS AND AMMUNITION MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Weapons and Ammunition Market Opportunity

EXPANSION INTO EMERGING MARKETS WITH GROWING SECURITY NEEDS

The growth in emerging economies with rising security demands and defense budgets represents huge potential for the weapons and ammunition industry. Countries in Asia-Pacific, the Middle East, Africa, and Latin America are quickly expanding defense spending to handle regional crises, domestic security issues, and modernizing military capabilities. This provides fertile ground for industry players to broaden their reach. Countries in Asia-Pacific, such as India, Indonesia, and the Philippines, are strengthening their military systems in response to regional challenges and to establish their sovereignty. India, for instance, has undertaken major military modernization plans, including increased procurement of new weaponry and ammunition.

Similarly, Middle Eastern countries, motivated by geopolitical rivalries and regional instability, are spending extensively in cutting-edge defense technologies.

Africa and Latin America, despite their historically smaller markets, are experiencing increased demand for firearms and ammunition as a result of insurgencies, cross-border conflicts, and the desire to improve law enforcement capabilities. Emerging economies in these regions are also becoming more open to public-private partnerships, creating prospects for collaborative manufacturing and localized production. These markets usually favor cost-effective and adaptable solutions to fulfill their specialized defense requirements. Manufacturers must tailor their offerings to match local demands, which include a focus on small guns, non-lethal armament, and cost-effective ammunition.

Furthermore, offset agreements and technology transfers are becoming more vital for entry into these markets.

Weapons and Ammunition Market Segment Insights

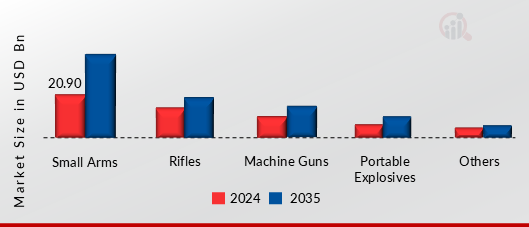

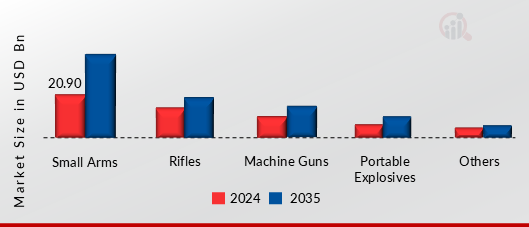

Weapons and Ammunition System by Weapon Type Insights

Based on Weapon Type, this segment includes Small Arms, Rifles, Machine Guns, Portable Explosives, and Others. The Small Arms segment dominated the global market in 2024, while the Machine Guns segment is projected to be the fastest–growing segment during the forecast period. Small arms, which include pistols and revolvers, are lightweight and compact firearms intended for personal use.

This market is seeing substantial growth as more civilians purchase these weapons out of concerns for personal safety and self-defense. Law enforcement agencies are also increasingly utilizing small arms to improve public safety and combat crime. The growth of private security services and the rising demand for home security solutions are further driving this trend. Moreover, innovations in smart gun technology, like biometric access and enhanced portability, are appealing to both civilian and professional users.

FIGURE 2: WEAPONS AND AMMUNITION MARKET SHARE BY WEAPON TYPE 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Weapons and Ammunition System by Ammunition Type Insights

Based on Ammunition Type, this segment includes Bullets, Ariel Bombs, Grenades, Artillery Shells, Mortars, and Others. The Bullets segment dominated the global market in 2024, while the Aerial Bombs segment is projected to be the fastest–growing segment during the forecast period. More people want bullets these days.

This is because more civilians’ own guns for things like protecting themselves, hunting, and shooting for fun. Cops and soldiers also need more bullets as they update and grow their weapon supplies to stay ready for action. Also, private security companies popping up all over the world need a steady supply of small bullets. What's newer bullet tech, like rounds that can pierce armor or leave a visible trail, meets special needs and helps the market grow overall.

Weapons and Ammunition System by Caliber Insights

Based on Caliber, this segment includes Small Caliber (5.56mm, 7.62mm, 9mm, Others), Medium Caliber (23mm, 30mm, Others), and Large Caliber (VSHORAD, 122mm, Others). The Small Caliber segment dominated the global market in 2024, while the Large Caliber segment is projected to be the fastest–growing segment during the forecast period.

Ammunition is made for small arms such as light machine guns rifles and pistols. This market is driven by the growing need for small arms in law enforcement military and civilian applications. Growing concerns about personal safety encourage the use of 9mm rounds by civilians. The goal of military modernization initiatives is to standardize small-caliber ammunition for infantry use such as 5. 56mm. Improvements in ballistic performance and accuracy are making the segment even more appealing.

Weapons and Ammunition System by Platform Insights

Based on Platform, this segment includes Aerial, Terrestrial, and Naval. The Terrestrial segment dominated the global market in 2024, while the Aerial segment is projected to be the fastest–growing segment during the forecast period. Ammunition and weapons used in infantry systems artillery tanks and other ground-based platforms. Support for this segment comes from an increase in land-based military operations and regional conflicts.

Growth is driven by an emphasis on updating armored vehicles and artillery systems. Growing expenditures on homeland security and counterinsurgency operations increase demand. The market is strengthened by the development of portable and mobile ground-based weapons.

Weapons and Ammunition System by Guidance Mechanism Insights

Based on Guidance Mechanism, this segment includes Non-Guided and Guided. The non-guided segment dominated the global market in 2024, while the Guided segment is projected to be the fastest–growing segment during the forecast period. Unguided bombs and artillery shells are examples of ammunition with a set trajectory.

Large-scale bombardment still uses non-guided ammunition because it is still affordable. Demand is met by its ease of use and potency in high-volume combat situations. The use of conventional non-guided munitions is improved by the modernization of artillery systems. Non-guided ammunition is a top priority for military forces when it comes to long-term operations.

Weapons and Ammunition System by Application Insights

Based on Application, this segment includes Military, Homeland Security, Hunting, Sporting, Self-Defense, and Others. The Military segment dominated the global market in 2024, while the Homeland Security segment is projected to be the fastest–growing segment during the forecast period. Ammunition that the armed forces use for offensive defensive and support missions.

The demand for military ammunition is driven by growing territorial disputes and geopolitical tensions. Advanced munitions for contemporary combat situations are given priority in global defense budgets. Its adoption is increased when ammunitions accuracy portability and versatility are prioritized. Growth is fueled by advancements in ammunition technology such as guided and smart rounds.

Weapons and Ammunition System by Lethality Insights

Based on Lethality, this segment includes Lethal, and Non-Lethal. The Lethal segment dominated the global market in 2024, while the non-lethal segment is projected to be the fastest–growing segment during the forecast period. Ammunition used in security and combat missions is intended to cause lethal damage.

Growth is driven by an increase in military operations and the need for efficient combat equipment. Demand is increased by developments in lethal ammunition technology such as armor-piercing and smart rounds. Enhancing lethality and accuracy in combat situations is becoming more and more important which helps the segment. Growth is further fueled by its expanding use in law enforcement for crucial operations.

Weapons and Ammunition System by End-Users Insights

Based on End-Users, this segment includes Defense, Civil & Commercial. The Defense segment dominated the global market in 2024, while the Civil & Commercial segment is projected to be the fastest–growing segment during the forecast period. Ammunition is used by armed forces and defense agencies for both combat and national security.

The demand for ammunition is driven by rising defense budgets worldwide and geopolitical tensions. Adoption is increased by concentrating on updating armed forces with cutting-edge munitions. Asymmetric warfare and territorial disputes also hastened this segments growth. Demand is fueled by ongoing R&D investments in next-generation ammunition technologies.

Weapons and Ammunition System Regional Insights

Based on the Region, the global Weapons and Ammunition is segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The North America dominated the global market in 2024, while the Asia-Pacific and South America are projected to be the fastest–growing segment during the forecast period. Major demand factors driving the North America market are the increasing global defense budgets and military modernization initiatives and rising geopolitical tensions and security threats worldwide and technological advancements leading to the development of more sophisticated weaponry.

North America holds the largest share of the weapons and ammunition market, which can be attributed to the presence of defence firms like Northrop Grumman and Lockheed Martin Raytheon are also there to ensure a steady supply of state-of-the-art systems. The United States leads the region especially in terms of large investments in military modernization and defense innovation. Growing geopolitical tensions and international peacekeeping commitments are driving the demand for advanced weapons and ammunition. The growing number of civilians who own firearms for recreational and self-defence hunting is another factor driving market expansion.

FIGURE 3: WEAPONS AND AMMUNITION MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, Japan, India, South Korea, Thailand, Indonesia, Singapore, Vietnam, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia and others.

Global Weapons and Ammunition Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Weapons and Ammunition Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are BAE Systems, CBC Global Ammunition, Denel SOC Ltd, General Dynamics Corporation, MBDA, Nammo As, Nexter Group, Northrop Grumman, Olin Corporation, Poongsan Corporation, Rafael Advanced Defense Systems, RUAG Group, Raytheon Technologies Corporation, Saab Ab, Thales Group are among others. The Weapons and Ammunition Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Weapons and Ammunition Market include

- BAE Systems

- CBC Global Ammunition

- Denel SOC Ltd

- General Dynamics Corporation

- MBDA

- Nammo As

- Nexter Group

- Northrop Grumman

- Olin Corporation

- Poongsan Corporation

- Rafael Advanced Defense Systems

- RUAG Group

- Raytheon Technologies Corporation

- Saab Ab

- Thales Group

Weapons and Ammunition Market Industry Developments

January 2025: Rheinmetall and MBDA to form joint venture to develop laser weapons. Rheinmetall and MBDA have been cooperating for several years in military laser technology. In 2022 and 2023, a jointly developed laser was tested on the Sachsen frigate as part of the High-Energy Laser Naval Demonstrator Working Group (ARGE).

July 2024: Patriot GEM-T missiles, made by COMLOG, a joint venture between RTX's Raytheon and MBDA valued at $5.5 billion. NATO in January said its procurement arm would support a group of member countries, including Germany, the Netherlands, Romania and Spain, with a contract to buy up to 1,000 Patriot air defense missiles.

August 2024: General Dynamics prepares to build latest version of Virginia-class submarine, weapons, and reconnaissance. The Virginia Block VI submarines are to feature technological improvements in stealth, propulsion, and weapons, and should be one of the best submarines in the world for interacting with the water column from the surface to the seabed.

October 2023: The U.S. Navy has awarded Northrop Grumman Corporation (NYSE: NOC) a development contract for the company’s newly designed 57mm guided high explosive ammunition.

December 2021: Nammo Defense Systems Inc., Mesa, Arizona, was awarded a $498,092,926 firm-fixed-price contract for the full-rate production of M72 Light Assault Weapon variants and components for shoulder-launched munitions training systems.

Weapons and Ammunition Market Segmentation

Weapons and Ammunition by Weapon Type Outlook

- Small Arms

- Rifles

- Machine Guns

- Portable Explosives

- Others

Weapons and Ammunition by Ammunition Type Outlook

- Bullets

- Aerial Bombs

- Grenades

- Artillery Shells

- Mortars

- Others

Weapons and Ammunition by Caliber Outlook

-

Small Caliber

-

Medium Caliber

-

Large Caliber

- Others

Weapons and Ammunition by Platform Outlook

Weapons and Ammunition by Guidance Mechanism Outlook

Weapons and Ammunition by Application Outlook

- Military

- Homeland Security

- Hunting

- Sporting

- Self-Defence

- Others

Weapons and Ammunition by Lethality Outlook

Weapons and Ammunition by End-Users Outlook

- Defense

- Civil & Commercial

Weapons and Ammunition Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Singapore

- Vietnam

- Australia

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South & Central America

-

Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Rest of the Middle East & Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 62.08 Billion

|

|

Market Size 2025

|

USD 65.56 Billion

|

|

Market Size 2035

|

USD 125.50 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

6.6% (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Weapon Type, By Ammunition Type, By Caliber, By Platform, By Guidance Mechanism, By Application, By Lethality, By End-Users

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, Japan, India, South Korea, Thailand, Indonesia, Singapore, Vietnam, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia.

|

|

Key Companies Profiled

|

BAE Systems, CBC Global Ammunition, Denel SOC Ltd, General Dynamics Corporation, MBDA, Nammo As, Nexter Group, Northrop Grumman, Olin Corporation, Poongsan Corporation, Rafael Advanced Defense Systems, RUAG Group, Raytheon Technologies Corporation, Saab Ab, Thales Group

|

|

Key Market Opportunities

|

· Expansion into emerging markets with growing security needs

· Diversification into non-lethal weapons and security solutions for civilian applications

· Rising focus on cybersecurity in defense

|

|

Key Market Dynamics

|

· Increasing global defense budgets and military modernization initiatives

· Rising geopolitical tensions and security threats worldwide

· Technological advancements leading to the development of more sophisticated weaponry

|

Frequently Asked Questions (FAQ):

USD 62.08 Billion is the Weapons and Ammunition Market in 2024

The Bullets segment by Product Type holds the largest market share and grows at a CAGR of 5.8 % during the forecast period.

North America holds the largest market share in the Weapons and Ammunition Market.

BAE Systems, CBC Global Ammunition, Denel SOC Ltd, General Dynamics Corporation, MBDA, Nammo As, Nexter Group, Northrop Grumman, Olin Corporation, Poongsan Corporation, Rafael Advanced Defense Systems, RUAG Group, Raytheon Technologies Corporation, Saab Ab, Thales Group are prominent players in the Weapons and Ammunition Market.

The Defense segment dominated the market in 2024.