Rising Geopolitical Tensions

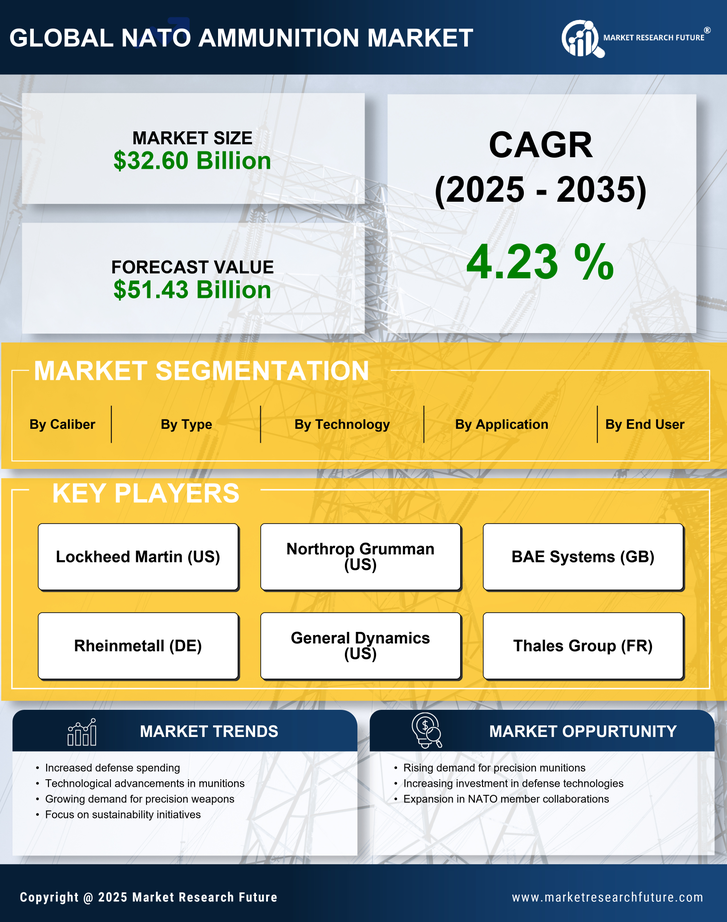

The NATO ammunition Market appears to be significantly influenced by rising geopolitical tensions across various regions. As nations face increasing threats, defense spending has escalated, leading to a heightened demand for ammunition. For instance, NATO member countries have collectively increased their defense budgets, with an estimated rise of 10% in 2025 alone. This trend suggests that the NATO Ammunition Market is poised for growth as countries prioritize military readiness and modernization. Furthermore, the ongoing conflicts in Eastern Europe and the Middle East have underscored the necessity for advanced ammunition systems, thereby driving investments in research and development. The interplay of these factors indicates a robust trajectory for the NATO Ammunition Market, as nations seek to bolster their arsenals in response to evolving security challenges.

Increased Military Collaborations

Increased military collaborations among NATO member states are fostering a more integrated approach to defense, thereby impacting the NATO Ammunition Market. Joint exercises and shared procurement initiatives are becoming commonplace, leading to standardized ammunition requirements across allied forces. This trend not only streamlines logistics but also enhances interoperability during joint operations. The NATO Ammunition Market is likely to benefit from these collaborations, as member states pool resources and expertise to develop and procure ammunition. For example, the recent establishment of collaborative defense projects has resulted in a projected 15% increase in joint ammunition procurement by 2027. Such initiatives indicate a strategic shift towards collective defense, which may further solidify the NATO Ammunition Market's position in the global defense landscape.

Emerging Markets and Defense Spending

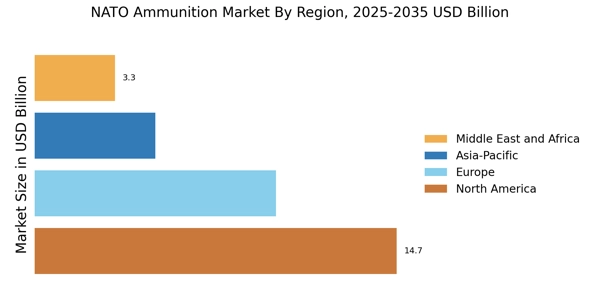

Emerging markets are increasingly contributing to the NATO Ammunition Market, as nations in these regions ramp up their defense spending. Countries in Eastern Europe and parts of Asia are modernizing their military capabilities, leading to a surge in demand for ammunition. For instance, defense budgets in Eastern European nations have seen an average increase of 8% annually, reflecting a commitment to enhancing national security. This trend suggests that the NATO Ammunition Market is not only driven by established NATO members but also by a broader spectrum of nations seeking to bolster their defense capabilities. As these emerging markets continue to invest in military infrastructure, the NATO Ammunition Market is likely to experience sustained growth, presenting opportunities for manufacturers to expand their reach.

Technological Innovations in Ammunition

Technological innovations are reshaping the NATO Ammunition Market, as advancements in materials and manufacturing processes enhance performance and reliability. The integration of smart technologies, such as precision-guided munitions, is becoming increasingly prevalent. These innovations not only improve accuracy but also reduce collateral damage, aligning with modern warfare strategies. The NATO Ammunition Market is witnessing a shift towards more sophisticated ammunition systems, with investments in R&D projected to reach $5 billion by 2026. This focus on technology is likely to drive competition among manufacturers, fostering a landscape where cutting-edge solutions become the norm. As nations strive to maintain a tactical edge, the demand for technologically advanced ammunition is expected to surge, further propelling the NATO Ammunition Market.

Focus on Sustainability and Environmental Compliance

The NATO Ammunition Market is increasingly focusing on sustainability and environmental compliance, driven by both regulatory pressures and public sentiment. As nations strive to meet international environmental standards, ammunition manufacturers are exploring eco-friendly materials and production methods. This shift is evident in the development of lead-free ammunition and biodegradable components, which are gaining traction among military forces. The NATO Ammunition Market is projected to see a 20% increase in demand for sustainable ammunition solutions by 2028. This trend not only addresses environmental concerns but also aligns with the broader defense strategy of minimizing the ecological footprint of military operations. As sustainability becomes a priority, the NATO Ammunition Market is likely to evolve, adapting to new regulations and consumer expectations.