Market Share

Web3 in Financial Services Market Share Analysis

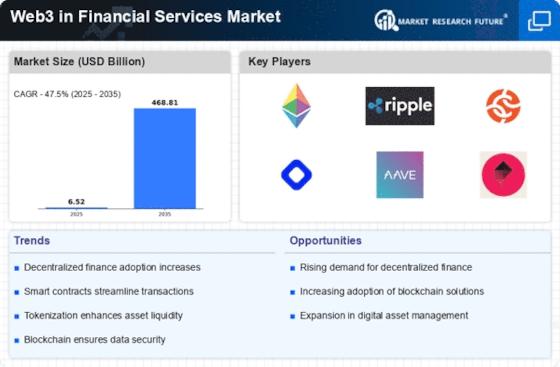

Web3 technology has began important market patterns in the financial services business, enabling creative improvements in financial exchanges and services. Decentralized finance (DeFi) stages are a Web3 financial services industry trend. These steps enable blockchain technology to provide financial services including lending, borrowing, and trading without middlemen. DeFi has become an alternative to traditional financial frameworks, attracting more clients desiring greater transparency in their financial transactions.

Financial services integration of non-fungible tokens (NFTs) is another market trend. NFTs, sophisticated resources representing craftsmanship, collectibles, and virtual land, have expanded beyond digital craftsmanship and entertainment into financial applications. Financial institutions are studying NFTs for resource tokenization, which allows certifiable resources to be represented as blockchain tokens. This trend indicates a move toward digitizing and democratizing resources using Web3 technologies.

Decentralized autonomous associations (DAOs) have also become a major Web3 and financial services business trend. DAOs are managed by ingenious agreements and local people, providing decentralized direction and asset boards. DAOs enable cooperative investment, decentralized reserve management, and local financial products and services in the financial services sector. Traditional financial institutions are seeking methods to include DAO frameworks, signifying a trend toward majority control and decentralized financial systems.

Web3's clever contracts have changed financial services. Smart agreements allow automated and trustless trades by encoding the terms in code. Smart agreements are being used for cycles like pooled lending, insurance, and exchange financing in finance, simplifying processes and lowering middlemen. This design represents Web3 technology's development toward more productive, secure, and programmable financial arrangements.

Web3-powered computerized personality has also influenced financial services market trends. Decentralized character arrangements allow individuals to better control their information and personality verification, improving security and financial specialist exchanges. The rising emphasis on information security and protection is leading financial institutions to consider decentralized character arrangements to boost client confidence and administrative compliance.

Leave a Comment