Top Industry Leaders in the Wind Turbine Blade Market

*Disclaimer: List of key companies in no particular order

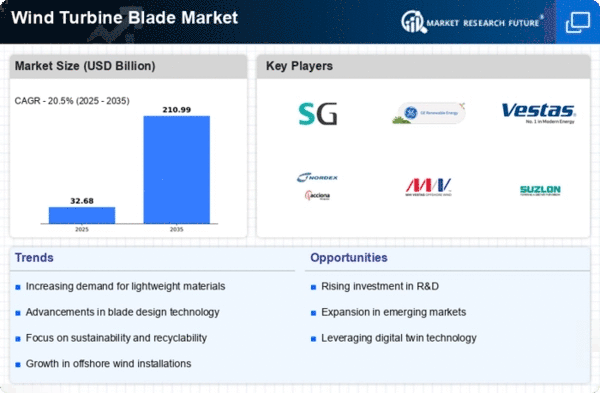

The wind turbine blade market, a vital conduit in the renewable energy revolution, is pulsating with intense competition. Established global players and nimble newcomers are vying for market share, deploying diverse strategies and capitalizing on emerging trends.

Titans of the Trade: Leading the charge are industry giants like LM Wind Power (a GE Renewable Energy company), Vestas Wind Systems, and Siemens Gamesa Renewable Energy. These behemoths leverage economies of scale, boasting vertically integrated manufacturing and longstanding relationships with turbine OEMs. LM Wind Power has carved a niche with advanced fiberglass blades, while Vestas excels in lightweight composite designs. Siemens Gamesa, through a recent merger, combines expertise in both offshore and onshore solutions, offering a broad portfolio to cater to diverse wind regimes.

Emerging Challengers: The arena isn't solely dominated by historical heavyweights. Aspiring players like Shanghai Electric Wind Power and Xinjiang Goldwind Science & Technology Co. are rapidly closing the gap. These Chinese players benefit from government subsidies and a booming domestic market, enabling them to offer competitive pricing and ramp up production. Additionally, nimble companies like Blade Dynamics and Senvion are carving niches with innovative blade designs and materials, such as balsa wood cores and carbon fiber reinforcements, promising enhanced efficiency and weight reduction.

Sharpening the Edge: Key Strategies: To stay ahead, established players are adopting multi-pronged strategies. Research and development remain a key focus, with investments in blade optimization, material science, and digital manufacturing. LM Wind Power's "LM Blades 105" exemplifies this, pushing the boundaries of blade length and efficiency. Partnerships with research institutions and universities further fuel innovation, fostering co-creation and knowledge transfer.

Sharing the Skies: Collaboration, not just Competition: Interestingly, the competitive landscape isn't solely defined by cutthroat rivalry. Collaborations are also blossoming, with players like Vestas and LM Wind Power partnering on research and development projects and even sharing manufacturing facilities. This signals a recognition of the need for collective industry advancement, especially in addressing shared challenges like blade recyclability and end-of-life management.

Reading the Winds: Market Share Analysis: When gauging market share, factors like regional presence, blade size, and technology expertise come into play. LM Wind Power currently holds the lion's share, followed by Vestas and Siemens Gamesa. However, regional variations exist. Chinese players dominate their domestic market, while European players hold sway in mature markets like Europe and North America.

Shifting Sands: New and Emerging Trends: The wind turbine blade market is constantly evolving, fueled by several noteworthy trends. The rise of offshore wind farms, with their harsher wind conditions, is driving demand for longer, sturdier blades. This benefits players like Siemens Gamesa, with their expertise in offshore solutions. Additionally, digitalization is transforming the landscape, with smart blades equipped with sensors and data analytics capabilities becoming increasingly sought-after. Vestas' "Active Blade Control" system exemplifies this trend, optimizing blade performance in real-time.

The Forecast: A Blustery Future: The wind turbine blade market is poised for sustained growth, driven by the global green energy push and continued technological advancements. Established players will retain their dominance, but agile contenders will continue to chip away at market share. Collaborations and strategic partnerships will play a crucial role in accelerating innovation and addressing shared challenges. Ultimately, the competitive landscape promises to be dynamic, with the race for windswept supremacy far from over.

Industry Developments and Latest Updates:

TPI Composites Inc.

• December 12, 2023: Achieves record quarterly revenue of $368.3 million in Q3 2023, driven by high demand for onshore wind blades. (Source: TPI Composites Inc. press release)

• November 16, 2023: Secures a multi-year supply agreement with Vestas for wind blades in the United States. (Source: TPI Composites Inc. press release)

Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

• December 20, 2023: Announces the successful development of a 115-meter wind blade, expected to enter mass production in 2024. (Source: China Wind Power, Chinese)

• October 18, 2023: Signs a strategic partnership agreement with Siemens Gamesa for the joint development of offshore wind solutions. (Source: Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. website, Chinese)

LM Wind Power

• December 15, 2023: Unveils the next-generation offshore wind platform with 14 MW turbines featuring longer blades for increased energy capture. (Source: LM Wind Power press release)

• November 9, 2023: Invests €150 million in blade manufacturing facility expansion in Poland to meet growing demand. (Source: LM Wind Power press release)

Nordex SE

• December 27, 2023: Launches the new Delta4000 wind turbine platform with 145-meter blades, targeting high-wind offshore markets. (Source: Nordex SE press release)

• November 23, 2023: Secures a €1.1 billion order for wind turbines with 163-meter blades for projects in Europe and Asia. (Source: Nordex SE press release)

Siemens Gamesa Renewable Energy, S.A.

• December 22, 2023: Announces plans to invest €2 billion in offshore wind blade production facilities in Spain and France. (Source: Siemens Gamesa Renewable Energy press release)

• November 10, 2023: Unveils the SG 14-222 DD offshore wind turbine with 115-meter blades, offering improved energy output. (Source: Siemens Gamesa Renewable Energy press release)

Top Companies in the Wind Turbine Blade industry include:

TPI Composites Inc. Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd LM Wind Power Nordex SE Siemens Gamesa Renewable Energy, S.A. Vestas Wind Systems A/S MFG Wind Sinoma Wind Power Blade Co. Ltd Aeris Energy Suzlon Energy Limited Enercon GmbH, and others.