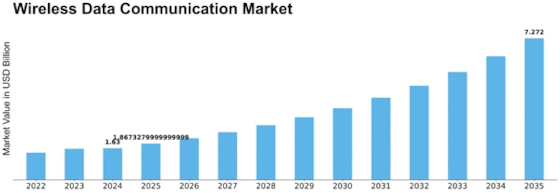

Wireless Data Communication Size

Wireless Data Communication Market Growth Projections and Opportunities

Various powers impact the turn of events and development direction of the wireless data communication market. Critical determinants remember progressions for innovation. As new innovations arise, for example, the sending of 5G organizations, the interest for wireless data communication market altogether. The interest for speedier and more solid associations from the two clients and organizations is driving business sector advancement and improvement. Besides, shopper conduct assumes a significant part in forming the wireless data communication area. The rising dependence on smart gadgets, for example, cell phones, tablets, and comparable gadgets elevates the criticality for productive and consistent information transmission.

Versatile application use, video web based, and different information concentrated exercises add to the heightening interest for trustworthy wireless data communication. Economic situations in the media communications industry are considerably affected by the serious climate. Media communications organizations endeavour to outflank each other through the arrangement of upgraded contributions, extended network inclusion, and quicker information move rates. This opposition serves to boost the two buyers and foundation venture, subsequently adding to the extension of the industry. Government arrangements and guidelines are an extra critical market impact. States overall assume a critical part in forming the remote correspondence scene through the execution of guidelines overseeing range circulation, permitting, and safety efforts.

The guidelines being referred to can possibly either work with or block the extension of business sectors, subsequently impacting the tasks of organizations in a particular area. The remote information correspondence market is prominently affected by financial circumstances; withdrawals influence purchaser buying, while development animates interests in advanced framework, subsequently impacting network extension. Expanding network protection dangers stand up to the market, requiring continuous interests in shields to guarantee reliable and secure information transmission. Disturbances to correspondence framework brought about by ecological factors, for example, environment related occasions and cataclysmic events can have repercussions available, and the strength of remote organizations used by organizations and shoppers. Cultural patterns, segment movements, and social factors all effect the elements of the wireless data communication market; the interest for modern administrations and continuous network is essentially pushed by more youthful segment gatherings.

Leave a Comment