Wireless Pos Terminal Size

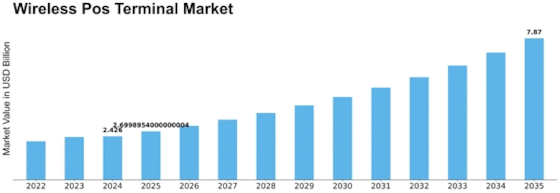

Wireless Pos Terminal Market Growth Projections and Opportunities

The Wireless POS Terminal market is significantly influenced by several market factors that shape its dynamics and growth trajectory. One crucial factor is the increasing adoption of wireless technologies across various industries. As businesses strive for greater flexibility and mobility, wireless POS terminals offer a solution by enabling transactions to occur seamlessly, without the constraints of physical connections. This trend is particularly evident in the retail sector, where businesses seek to enhance customer experience through faster and more convenient payment options.

Additionally, the growing demand for contactless payment methods has become a driving force in the wireless POS terminal market. With the rise of digital wallets, mobile payments, and NFC technology, consumers are increasingly opting for contactless transactions. This shift is pushing businesses to invest in wireless POS terminals that support these advanced payment methods, aligning with the changing preferences of tech-savvy consumers.

Moreover, the need for improved efficiency and reduced transaction time is propelling the market forward. Wireless POS terminals enable quicker transactions, reducing the overall processing time and enhancing the overall operational efficiency of businesses. This efficiency is particularly crucial in industries such as hospitality and food services, where prompt and hassle-free transactions are paramount for customer satisfaction.

Furthermore, the global trend towards digital transformation is playing a pivotal role in shaping the wireless POS terminal market. Businesses are embracing digital solutions to streamline their operations, enhance customer interactions, and stay competitive in the evolving market landscape. Wireless POS terminals fit seamlessly into this digital ecosystem, providing businesses with the tools to modernize their point-of-sale systems and stay ahead in the digital age.

Security concerns also contribute significantly to the market dynamics of wireless POS terminals. With the increasing frequency and sophistication of cyber threats, businesses are prioritizing secure payment processing. Wireless POS terminals come equipped with advanced security features, such as encryption and tokenization, to safeguard sensitive financial information. This heightened focus on security is not only driven by regulatory requirements but also by the need to build trust among consumers who are increasingly cautious about the safety of their financial data.

Furthermore, the market is influenced by the evolving regulatory landscape surrounding payment systems. Compliance with industry standards and regulations is paramount for businesses operating in the wireless POS terminal market. As governments and regulatory bodies enact measures to ensure the security and integrity of payment transactions, businesses need to adapt their POS systems accordingly, contributing to the continuous evolution of the market.

Lastly, the competitive landscape and the presence of key market players significantly impact the wireless POS terminal market. Established companies and new entrants alike are continuously innovating to gain a competitive edge. This innovation often involves the development of advanced features, integration with other business tools, and strategic partnerships to expand market reach. The level of competition in the market influences product pricing, technological advancements, and overall market trends.

Leave a Comment