Top Industry Leaders in the Wireless Sensor Network Market

Competitive Landscape of Wireless Sensor Network Market

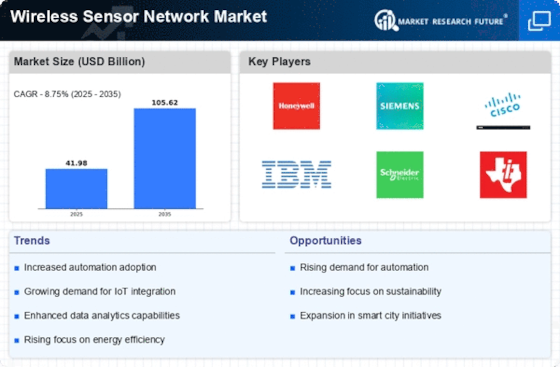

The wireless sensor network (WSN) market, where tiny sentinels gather data like whispers on the wind. From monitoring factory floors to tracking environmental changes, these interconnected sensors weave a tapestry of real-time data, illuminating insights and powering automation. In this dynamic space, established players and agile innovators lock arms, all vying for a stronger signal in the data deluge. Let's dissect the key strategies and players shaping this captivating landscape.

Some of the Wireless Sensor Network companies listed below:

- ABB Ltd.

- Endress+Hauser AG

- Emerson Electric Co.

- General Electric Company

- ST microelectronics

- Honeywell International Inc.

- Siemens AG

- Texas Instruments

- Yokogawa Electric Corporation

- Schneider Electric SA

Strategies Adopted by Players:

- Technological Differentiation: Companies compete fiercely on technological advancements, focusing on factors like lower power consumption for extended sensor life, improved network reliability and security, wider range and accuracy of data sensing, and advanced data analytics capabilities. Developing energy-efficient protocols, robust mesh networking technologies, and AI-powered data processing algorithms are key differentiators.

- Expanding Application Reach: Moving beyond traditional applications in industrial automation and environmental monitoring to address the needs of diverse sectors like agriculture, healthcare, smart cities, and logistics unlocks new market segments and drives wider adoption. Developing tailored sensor modules and data dashboards for specific applications is crucial.

- Addressing Cost and Scalability: Making WSN technology more affordable and easily deployable is vital for widespread adoption. Offering modular and scalable solutions, reducing installation costs, and providing flexible deployment options are key strategies.

- Building Partnerships and Collaborations: Fostering partnerships with technology providers, cloud platforms, and system integrators accelerates innovation, shares expertise, and expands market reach. Collaborating on industry standards, developing reference designs, and promoting the benefits of WSNs contribute to market growth.

Factors for Market Share Analysis:

- Revenue Generated: This straightforward metric reflects a company's market penetration and financial strength.

- Number of Sensor Nodes Deployed: Understanding the volume of deployed sensors provides insight into customer adoption and market reach.

- Technology Advancements: Assessing a company's investment in R&D, patent portfolio, and cutting-edge WSN technologies helps gauge its future competitive edge.

- Customer Satisfaction: Analyzing user feedback and loyalty metrics reveals how effectively a company caters to customer needs and builds brand reputation.

Latest Company Updates:

November 2023- Worldsensing, a major player in the Internet of Things remote monitoring industry, has released its latest wireless sensor, The Vibration Meter. This sensor measures vibrations for long-term, ongoing vibration monitoring projects. The new product utilizes a 3-axis MEMS accelerometer that has a longer battery life, wider communications range, and more competitive pricing compared to other vibration-related technologies currently available. It complies with key regulatory standards. The Vibration Meter has the potential to help mining engineers cost-effectively meet regulatory vibration requirements, as it monitors and evaluates vibrations caused by long-term mining activities above and below ground, as well as the building of tailing dams and waste piles.

November 2023- Prylada has developed a new Energy-Harvesting Wireless Sensor Platform called WASP. This platform is intended to wirelessly transmit data from important industrial assets to a remote-control panel. The data can then be analysed and visualized on the panel. A key benefit of WASP is that it enables almost any sensor to operate completely wirelessly. As a result, wireless data gathering from critical assets can greatly streamline monitoring, reduce cabling, and enable real-time alarm management for emergencies. The wireless transmission uses Sub-1 GHz channels. Overall, WASP simplifies and improves wireless monitoring of industrial assets.

March 2023- Butlr Technologies Inc., a startup that describes itself as an "artificial intelligence of things" company, recently revealed that it has received new funding from Qualcomm Ventures LLC. The company also launched the latest version of its Heatic wireless sensors. Butlr's application programming interface provides real-time and historical data on a building's indoor foot traffic, occupancy levels, and activity. This data can be used for asset management, real estate investment planning, and policymaking.