Top Industry Leaders in the Wireline Logging Services Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of Wireline Logging Services Market: Navigating a Dynamic Terrain

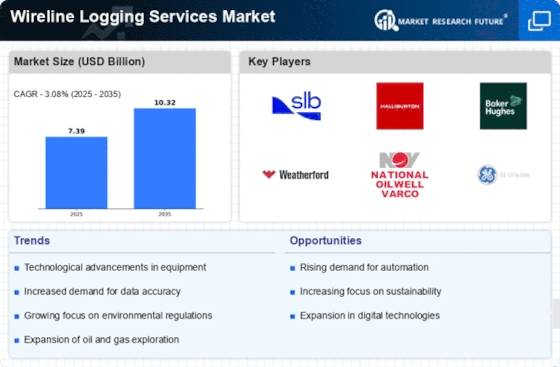

The global Wireline Logging Services market this growth is driven by factors such as increased drilling and completion activities, exploration of unconventional resources, and technological advancements. However, the market landscape is fiercely competitive, with established players battling for market share and new entrants seeking to disrupt the status quo.

Key Players and Strategies:

Industry Titans: Schlumberger, Halliburton, Baker Hughes, Weatherford, and China Oilfield Services dominate the market, accounting for a significant share. These companies leverage their expansive global presence, diverse service portfolios, and robust R&D capabilities to maintain their competitive edge. Schlumberger, for instance, focuses on developing advanced logging tools and data analytics solutions, while Halliburton prioritizes integrated well completion solutions to optimize reservoir performance.

Regional Challengers: National oilfield service companies (NOCs) like Sinopec and CNPC play a crucial role in their respective regions, benefiting from strong government support and local market knowledge. They pose a challenge to established players by offering competitive pricing and tailored solutions catering to specific regional needs.

Emerging Innovators: Smaller, technology-driven companies are emerging with innovative tools and services, challenging the traditional wireline logging approach. They focus on niche applications, real-time data acquisition, and automation solutions, aiming to deliver higher accuracy, efficiency, and cost-effectiveness. For example, Wellbore Integrity Solutions offers advanced fiber-optic logging tools for real-time wellbore stability monitoring.

Market Share Analysis:

Technology & Service Portfolio: The breadth and sophistication of a company's technology and service portfolio play a crucial role in market share. Offering a comprehensive range of logging tools, data analysis capabilities, and integrated solutions caters to diverse client needs and enhances competitiveness.

Geographical Presence: Global reach and established regional presences are critical factors. Companies with strong footholds in key exploration and production regions, such as North America, the Middle East, and Asia Pacific, gain access to wider market opportunities.

Cost Efficiency & Pricing Strategies: Operational efficiency and competitive pricing strategies are essential for attracting and retaining clients. Implementing streamlined workflows, leveraging automation, and offering flexible pricing models can enable companies to stand out in a cost-sensitive market.

Partnerships & Acquisitions: Strategic partnerships and acquisitions can be powerful tools for expanding market reach, acquiring new technologies, and gaining access to new client segments. Schlumberger's partnership with TMK for integrated well completion solutions is a prime example of this strategy.

New & Emerging Trends:

Real-time Data Acquisition & Analytics: Real-time data acquisition through advanced sensors and tools, coupled with powerful data analytics platforms, is transforming the wireline logging landscape. This enables informed decision-making during drilling and completion operations, optimizing reservoir performance and maximizing production.

Focus on Unconventional Resources: The exploration and production of unconventional resources like shale oil and gas are driving demand for specialized logging tools and services. Companies are developing solutions tailored to the unique challenges of unconventional reservoirs.

Automation & AI-powered Interpretation: Automation of logging operations and the integration of AI-powered data interpretation tools are gaining traction. This reduces human error, enhances efficiency, and provides deeper insights into reservoir characteristics.

Overall Competitive Scenario:

The Wireline Logging Services Market is poised for continued growth, fueled by technological advancements, exploration of unconventional resources, and regional variations in demand. The competitive landscape is dynamic, with established players facing pressure from regional competitors and innovative startups. Success will hinge on the ability to adapt to technological trends, cater to diverse client needs, and offer cost-effective solutions. Companies that embrace innovation, forge strategic partnerships, and maintain a strong regional presence are best positioned to capture the potential of this growing market.

Expro International Group Holdings Ltd (September 20, 2023):

• Reported strong financial results for the first half of 2023, with wireline services contributing significantly to revenue growth. (Source: Expro International Group Holdings Ltd press release)

Schlumberger (October 19, 2023):

• Unveiled a new wireline logging tool designed for real-time formation evaluation while drilling, enhancing operational efficiency. (Source: Schlumberger press release)

Nabors Industries Ltd (August 15, 2023):

• Announced investment in new wireline logging technologies and expanded service offerings to cater to growing demand in North America. (Source: Nabors Industries Ltd press release)

Casedhole Solutions (July 6, 2023):

• Launched a new cased-hole logging tool for improved fracture stimulation monitoring and well performance analysis. (Source: Casedhole Solutions press release)

Top listed global companies in the industry are:

Baker Hughes

GE company

Casedhole Solutions

Expro International Group Holdings Ltd

Halliburton

Nabors industries ltd.

Oilserv

Pioneer Energy Services

Superior Energy Services

Schlumberger

Weatherford International Inc.