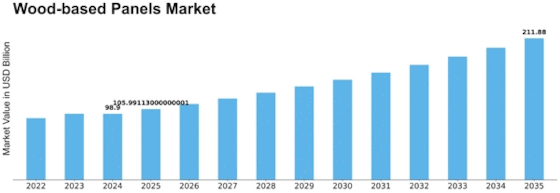

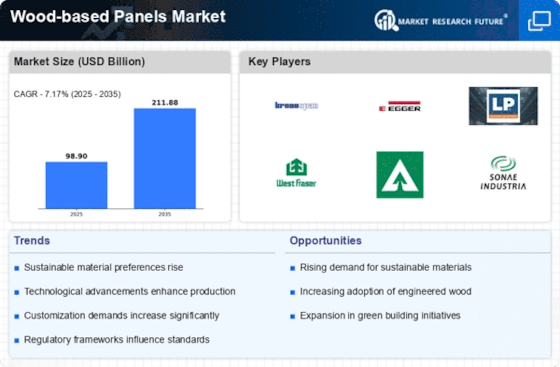

Wood Based Panels Size

Wood Based Panels Market Growth Projections and Opportunities

The wood-based panels market is influenced by various factors that shape its dynamics and growth trajectory. These factors encompass a wide range of market forces, economic conditions, technological advancements, and environmental considerations. One of the primary market factors is the demand for wood-based panels in construction and furniture industries. As urbanization continues to drive construction activities globally, the need for affordable and durable building materials like plywood, particleboard, and medium-density fiberboard (MDF) remains high. Similarly, the furniture industry relies heavily on wood-based panels for manufacturing various products due to their versatility and cost-effectiveness.

The global wood based panels market has witnessed an upward surge on the back drop of increase in growth of construction industry over the past few years. Growing investments in residential and commercial construction in emerging economies such as Brazil, Saudi Arabia, India, and China has further propelled the demand for wood based panels market.

Moreover, the availability and cost of raw materials significantly impact the wood-based panels market. Wood, being the primary raw material, is subject to fluctuations in supply and pricing influenced by factors such as forestry practices, environmental regulations, and trade policies. Sustainable sourcing practices and certification schemes play an increasingly important role in ensuring a stable and ethically sourced supply of wood for panel production, thereby mitigating risks associated with resource depletion and environmental degradation.

Furthermore, technological advancements and innovations in manufacturing processes contribute to the evolution of the wood-based panels market. Improved production techniques, such as advanced gluing technologies, precision cutting methods, and innovative resin formulations, enhance the quality and performance of wood-based panels while also increasing production efficiency and reducing waste. Additionally, developments in surface treatments and finishes expand the aesthetic possibilities of wood-based panels, catering to evolving consumer preferences and design trends in architectural and interior applications.

Market factors also include regulatory frameworks and environmental considerations that shape industry practices and market dynamics. Government regulations related to emissions, waste management, and sustainable forestry practices influence the production processes and product standards in the wood-based panels industry. Compliance with these regulations not only ensures environmental sustainability but also enhances market competitiveness by meeting the growing demand for eco-friendly and socially responsible products.

Moreover, macroeconomic factors such as economic growth, consumer spending patterns, and housing market trends influence the demand for wood-based panels. Strong economic growth and rising disposable incomes drive construction and renovation activities, boosting the demand for wood-based panels in residential, commercial, and infrastructure projects. Conversely, economic downturns and fluctuations in consumer confidence may lead to reduced demand for construction materials, impacting the wood-based panels market.

Global market trends and trade dynamics also play a crucial role in shaping the wood-based panels market. International trade agreements, tariffs, and trade disputes affect the flow of raw materials and finished products, influencing pricing dynamics and market competitiveness. Additionally, shifting consumer preferences, demographic trends, and lifestyle changes drive innovation and product development in the wood-based panels market, leading to the introduction of new products and applications catering to evolving market demands.

Leave a Comment