Market Analysis

In-depth Analysis of Workflow Management System Market Industry Landscape

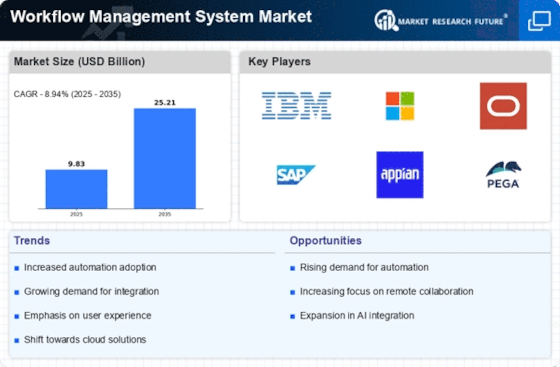

Workflow Management market develop through a number of factors, some of which act as contributors to its expansion and evolution. The primary engine of this market is business automation grounded on the trend of digitalization. Organizational efforts continues to focus on the modification of processes in order to achieve higher efficiency and reduce repetitive manual works. One noticeable outcome of this drive is the demand for Workflow Management solutions that can manage the flow and tasks of work in several departments. Today, the incorporation of technologies like robotics process automation (RPA) and artificial intelligence (AI) play a critical role in the modern work environment by letting companies create smarter and adaptive processing solutions.

In addition, Workflow Management solutions have been spurred on because of the need to improve communication within teams and across the departments It has shifted employee collaboration to a different level. Today, as remote and distributed workplace environment becomes prevalent among organizations, the problem for them is to identify tools that help to easily carry on with collaboration, task assignment and progress tracking. Therefore, due to the increasing popularity of cloud-based Workflow Management systems, their usage is escalating very rapidly and these support users across the globe and provide simultaneous accessibility and real-time updates, regardless of the locations.

There is another element which defines the shape of Workflow Management that is regulatory compliance. In an increasingly dynamic and responsive to the different regulations, industries are obliged to accept business processes that guarantee compliance to the existing legislation. Many times the solutions rendering these services have in-built features that ensure compliance checks and are automatic, thereby reducing the chances of mistakes and process alignments with industry legislation.

The competitive climate and the dynamics of the fragmentation process also have a decisive influence upon the Workflow Management market. The integration plans among the workflow management software products’ suppliers are become a common and swiftly described merger and acquisitions phenomenon. Moreover, Workflow Management platforms might get the leverage they need through an increase in joint ventures between these vendors and other technology providers, with organizations able to use a range of solutions that oversees many workflow requirements.

Commercialization process is one of the driving forces behind this phenomenon which leads to advancement of workflow management. While companies expand their operations beyond borders, they face diversity in culture and environment. Hence, the companies need solutions that can be a part of their workflow management and set an instance for different cultural and regulatory environments. Thus, the implementation of such solutions with features as localization and the ability to cover workflows existing in cross-geographical and time zone separated work processes, is becoming more and more popular.

Leave a Comment