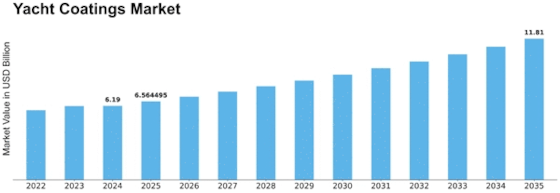

Yacht Coatings Size

Yacht Coatings Market Growth Projections and Opportunities

The yacht coatings market is influenced by several key factors that shape its dynamics and growth trajectory. One of the primary market factors is the demand from the yacht manufacturing industry. As yacht production increases, so does the demand for coatings to protect and enhance the appearance of these vessels. Factors such as consumer preferences for customized coatings, environmental regulations, and advancements in coating technology also play a significant role in driving demand.

Consumer preferences and trends are crucial market factors influencing the yacht coatings industry. Yacht owners often seek coatings that not only provide protection against harsh marine environments but also offer aesthetic appeal. Customized coatings, including metallic finishes, vibrant colors, and special effects, are increasingly popular among yacht owners looking to personalize their vessels. Manufacturers must stay abreast of these trends and adapt their product offerings accordingly to remain competitive in the market.

Environmental regulations also have a significant impact on the yacht coatings market. Stringent regulations governing the use of certain chemicals and volatile organic compounds (VOCs) in coatings drive the demand for eco-friendly and low-VOC coatings. Yacht manufacturers and coatings suppliers must comply with these regulations to ensure the environmental sustainability of their products. Additionally, innovations in environmentally friendly coatings, such as biodegradable and non-toxic formulations, present opportunities for market growth by catering to eco-conscious consumers.

Advancements in coating technology drive innovation and product development in the yacht coatings market. Manufacturers are constantly striving to develop coatings that offer superior protection, durability, and performance. Nanotechnology, for example, has enabled the development of nanocoatings that provide enhanced resistance to scratches, abrasion, and UV radiation. Similarly, self-cleaning coatings that repel dirt and contaminants are gaining popularity among yacht owners seeking low-maintenance solutions. These technological advancements not only improve the performance of coatings but also contribute to the overall growth of the market.

Global economic conditions and geopolitical factors also influence the yacht coatings market. Economic stability and growth drive consumer confidence and purchasing power, impacting the demand for luxury goods such as yachts and associated coatings. Geopolitical tensions, trade policies, and currency fluctuations can affect raw material prices, supply chains, and market dynamics, posing challenges for manufacturers and suppliers operating in the global market. Market players must monitor these external factors and adapt their strategies accordingly to mitigate risks and capitalize on opportunities.

Moreover, the aftermarket segment of the yacht coatings market presents its own set of market factors. As yachts age, their coatings may degrade or become damaged, necessitating recoating or refurbishment. Factors such as maintenance schedules, refurbishment trends, and the availability of aftermarket coatings influence the demand for coatings in this segment. Additionally, technological innovations in coating application methods, such as spray application systems and robotic painting systems, streamline the recoating process and drive efficiency in the aftermarket segment.

Leave a Comment