Summary Overview

Fleet Management Australia Market Overview:

The global fleet management industry is steadily expanding, driven by demand from industries such as logistics, manufacturing, and retail, particularly in Australia. This market contains a wide range of fleet management products, including telematics, GPS tracking, and maintenance management systems. Our paper delves deeply into procurement developments, with particular focus on cost optimization tactics and the use of digital solutions to optimize fleet operations.

The key challenges associated with fleet management procurement are managing fleet maintenance costs, assuring scalability, maintaining vehicle safety and compliance, and integrating emerging technologies with current systems. Digital procurement technologies and strategic sourcing are critical for improving fleet operations and promising long-term sustainability. As demand for efficient fleet solutions continues to climb, organizations in Australia are harnessing market intelligence to improve fleet performance and mitigate risks.

-

Market Size: The global Fleet Management market in Australia is projected to reach AUD 668 million by 2035, growing at a CAGR of approximately 9.70% from 2025 to 2035

-

Manufacturing and Supply Chain Optimization: Australian manufacturers and supply chains rely heavily on real-time data and seamless integration of fleet management procedures to optimize vehicle usage, improve logistics, and assure timely delivery. -

Retail and E-Commerce Expansion: The implementation of advanced fleet management systems to improve delivery scheduling, inventory management, route optimization, and customer happiness is critical for the Australian retail and e-commerce industries.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The growing adoption of cloud-based fleet management solutions in Australia improves scalability, price effectiveness, and real-time data access, making it easier to manage big and complicated fleets.

-

Advanced Features: The integration of AI, IoT, and GPS technology enables Australian firms to enhance decision-making, improve fleet efficiency, and ensure compliance with environmental and operational standards.

-

Focus on Sustainability: Fleet management systems in Australia assist businesses decrease their carbon footprint, improve fuel efficiency, and comply with tight environmental rules, all of which contribute to industry-wide sustainability goals.

-

Customization Trends: In Australia, there is a growing need for fleet management solutions targeted to specific industries such as retail, logistics, and agricultural, all of which require flexible and scalable systems.

-

Data-Driven Insights: Advanced analytics features in fleet management solutions help Australian firms optimize routes, reduce downtime, estimate demand, and maximize vehicle utilization.

Growth Drivers:

-

Digital Transformation: Australian firms are increasingly using digital fleet management systems to boost productivity, cut operating costs, and increase supply chain efficiency.

-

Demand for Process Automation: In Australia, fleet operations are becoming increasingly reliant on automation to cut manual tasks such as vehicle maintenance scheduling, fuel tracking, and compliance reporting.

-

Scalability Requirements: As Australian businesses grow, they seek fleet management solutions that can scale with them, allowing them to manage expanding vehicle fleets and service regions.

-

Regulatory Compliance: Fleet management systems assist Australian firms in complying with increasingly severe safety, environmental, and operational standards by automating important activities such as driver logs and maintenance reporting.

-

Globalization: Australian organizations with international supply chains are looking for fleet management systems that can handle several currencies, regions, and regulatory needs, assuring consistent performance and adherence to global standards.

Overview of Market Intelligence Services for the Fleet Management Australia Market:

Recent evaluations have highlighted important issues in the fleet management sector, such as high implementation costs and the requirement for customized system configurations. Market intelligence reports help businesses traverse these obstacles by providing meaningful insights into procurement prospects, allowing them to uncover cost-cutting methods, optimize supplier management, and increase implementation success. These insights are critical for complying with industry laws, maintaining high operational quality, and successfully controlling costs.

Procurement Intelligence for Fleet Management Australia: Category Management and Strategic Sourcing

To remain competitive in the fleet management market, companies are streamlining procurement procedures through spend analysis and supplier performance monitoring. Effective category management and strategic sourcing are critical for lowering procurement costs and maintaining a consistent supply of dependable fleet management solutions. Using actionable market intelligence, organizations can fine-tune their procurement strategies, negotiate favourable terms with suppliers, and streamline fleet operations for enhanced efficiency and cost-effectiveness.

Pricing Outlook for Fleet Management Australia: Spend Analysis

Pricing for fleet management solutions in Australia is projected to be moderately volatile, impacted by several factors. Advancements in fleet management technology, increased demand for cloud-based solutions, customization requirements, and regional pricing variances are all key drivers. Furthermore, the growing use of AI, IoT connectivity, and a greater emphasis on data security and compliance are pushing up cost in the fleet management sector.

Graph shows general upward trend pricing for Fleet Management Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement procedures, improve vendor management, and implement modular fleet management systems are critical for cost control. The use of digital tools for market monitoring, pricing forecasting via analytics, and effective contract administration can all help to create cost savings.

Strategic alliances with dependable fleet management providers, negotiating multi-year contracts, and considering subscription-based pricing structures are critical tactics for fleet management can fine-tune their procurement strategies, negotiate favourable terms with suppliers, and streamline fleet operations for enhanced efficiency and cost-effectiveness.

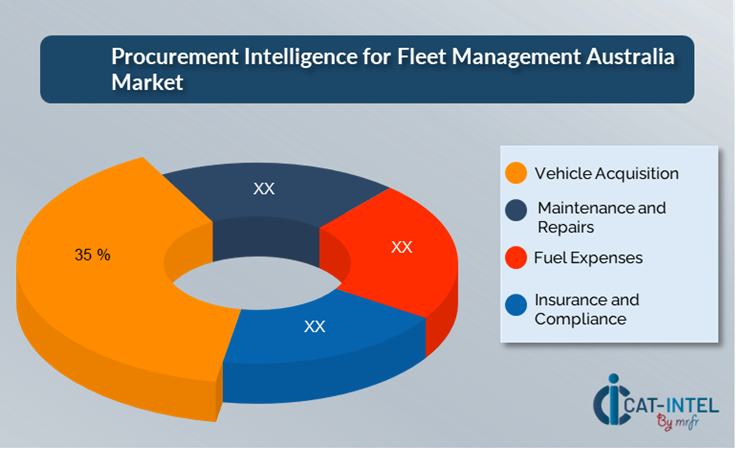

Cost Breakdown for Fleet Management Australia: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Vehicle Acquisition Costs: (35%)

-

Description: Vehicle acquisition costs include the purchase price, taxes, fees, and any other expenses related with acquiring fleet vehicles. This covers financial expenditures such as interest on loans or leases, as well as the vehicle's depreciation rate over time.

-

Trends: Leasing is becoming increasingly popular due to capital restrictions and a desire for flexibility. Furthermore, fleets are increasingly opting for electric and hybrid cars, which may have greater initial expenses but offer long-term savings in fuel and maintenance.

- Maintenance and Repairs cost (XX%)

- Fuel Expenses: (XX%)

- Insurance and Compliance Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fleet management Australian industry, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with fleet management providers, particularly those that offer cloud-based solutions, can result in more attractive pricing structures and terms, such as volume discounts and bundled service packages. Subscription-based approaches and multi-year contracts provide opportunity to lock in reduced rates while mitigating price rises over time.

Collaboration with fleet management providers who value innovation and scalability provides additional benefits, including as access to advanced analytics, AI integration, and modular fleet solutions that streamline operations and lower long-term expenses. Implementing digital procurement technologies like contract management systems and usage analytics increases transparency, reduces over-provisioning, and optimizes fleet utilization. Diversifying vendor options and adopting a multi-vendor strategy can reduce dependency on a single provider, mitigate risks such as service outages, and strengthen negotiating leverage, ultimately ensuring cost-effective fleet operations and greater flexibility.

Supply and Demand Overview for Fleet Management Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The fleet management sector in Australia grows steadily, driven by the growing usage of digital technologies in industries such as logistics, retail, and healthcare. Technological improvements, industry-specific needs, and overall economic conditions all have an impact on fleet management supply and demand dynamics.

Demand Factor:

-

Digital Transformation Initiatives: The growing requirement for centralized fleet data management and process automation is driving demand for fleet management systems in an assortment of industries.

-

Cloud Adoption Trends: The transition to cloud-based fleet management platforms is driving up demand for scalable, subscription-based software that enables real-time fleet tracking and management.

-

Industry-Specific Requirements: Industries such as healthcare, logistics, and retail demand fleet management solutions that are adapted to their specific operational workflows and regulatory standards.

-

Integration Capabilities: There is an increasing demand for fleet management systems that can connect smoothly with other corporate software and IoT devices in order to improve fleet performance and operational efficiency.

Supply Factors:

-

Technological Advancements: Innovations in AI, machine learning, and IoT are strengthening fleet management systems, increasing supplier competitiveness, and improving fleet operations capabilities.

-

Vendor Ecosystem: With an increasing number of fleet management providers, ranging from huge multinationals to niche companies, businesses now have a varied variety of options to choose from according on their individual requirements.

-

Global Economic Factors: Economic conditions like as fuel prices, labour costs, and currency rates have an impact on the cost and availability of fleet management systems in Australia.

-

Scalability and Flexibility: Contemporary fleet management systems are increasingly modular, allowing suppliers to offer solutions that can be tailored to businesses of varying sizes and operational complexities, enhancing flexibility for fleet owners.

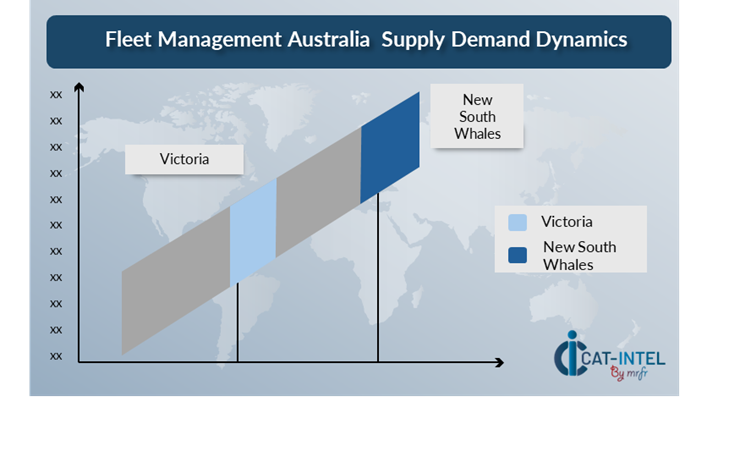

Regional Demand-Supply Outlook: Fleet Management Australia

The Image shows growing demand for Fleet Management Australia in both New South Whales and Victoria with potential price increases and increased Competition.

New South Whales: Dominance in the Fleet Management Market in Australia

New South Australia, particularly Sydney, is a dominant force in the global fleet management market due to several key factors:

-

Economic Hub: NSW, particularly Sydney, is Australia's financial and economic hub. With so many organizations and industries, there is a huge demand for fleet management services to support logistics, transportation, and business operations.

-

Infrastructure and Connectivity: NSW boasts vast road networks, well-developed ports, and an international airport in Sydney. This infrastructure is critical for fleet management, enabling firms to efficiently manage vehicle operations both locally and nationwide.

-

Industry and Commercial Presence: NSW is home to several national and international enterprises, and its sectors include logistics, transportation, construction, and retail. To sustain productivity, these sectors demand sophisticated fleet management solutions.

-

Government Support and Policies: NSW has progressive policies that promote fleet management services, such as incentives for electric vehicles (EVs) and environmental efforts. The state government aggressively encourages innovation in fleet management, particularly in green technology.

-

Large Workforce: Strong demand for employee mobility, vehicle leasing, and fleet management services. Companies want efficient fleet solutions to manage their enormous workforces across multiple regions of the state.

New South Whales Remains a key hub ERP Software Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in Australia's fleet management industry is diversified and competitive, with a mix of global leaders and regional players influencing market dynamics. These providers have a significant impact on price structures, fleet management service customization, and the quality of maintenance and support.

Well-established companies dominate the industry, providing full fleet management solutions such as vehicle tracking and maintenance scheduling, as well as fuel management and driver behaviour monitoring. Meanwhile, smaller, niche suppliers specialize in specific parts of fleet management, such as advanced telemetry, AI-powered analytics, and industry-specific capabilities like transport or logistics compliance management. The fleet management provider ecosystem in major regions of Australia comprise prominent worldwide vendors offering robust, scalable solutions, as well as innovative local players who cater to specific needs within sectors like retail, logistics, and mining.

Key Suppliers of Fleet Management Market in Australia include:

- Toyota Fleet Management

- SG Fleet

- ORIX Australia

- FleetPartners

- Custom Fleet

- Geotab Australia

- Qube Holdings

- Fleetcare

- LeasePlan Australia

- Eclipx Group

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The fleet management market in Australia is expanding rapidly, driven by the growing need for businesses to optimise their fleet operations, increase productivity, and manage resources more efficiently, particularly as logistics and transportation demands rise in both urban and regional locations. |

Cloud Adoption |

In Australia, there is a noticeable shift toward cloud-based fleet management systems, driven by the need for scalability, cost efficiency, and the ability to remotely monitor and manage fleet performance, especially with the rise of hybrid working environments and the need for fleet operators to access data at any time and from any location.

|

Product Innovation |

AI-powered analytics, real-time data processing, and tailored modules for specific industries such as transportation and logistics, , and mining. These innovations are designed to improve decision-making, asset utilization, and driver performance. |

Technological Advancements |

Machine learning, Internet of Things (IoT) integration, and self-driving vehicle tracking are revolutionizing fleet management in Australia. These advancements enable predictive maintenance, route optimization, and real-time vehicle monitoring, thereby increasing operating efficiency and lowering expenses. |

Global Trade Dynamics |

Changes in trade rules, fuel prices, and environmental legislation all influence fleet management adoption. This is especially crucial for Australian businesses that operate across borders or manage large, multi-site fleets that must follow to varied regional and international compliance requirements. |

Customization Trends |

There is an increasing demand for customisable fleet management solutions, with businesses looking for modular systems that can be tailored to specific requirements like as fuel management, vehicle diagnostics, and driver behaviour monitoring. These personalized solutions provide greater flexibility and cost. |

|

Fleet Management Australia Software Attribute/Metric |

Details |

Market Sizing |

The global Fleet Management market in Australia is projected to reach AUD 668 million by 2035, growing at a CAGR of approximately 9.70% from 2025 to 2035. |

Fleet Management Australia Technology Adoption Rate |

Approximately 60% of Australian organizations have implemented fleet management solutions, with a significant preference for cloud-based platforms that offer increased scalability, flexibility, and the ability to manage fleet operations remotely.

|

Top Fleet Management Australia Industry Strategies for 2025 |

Key fleet management strategies in Australia include integrating AI and machine learning for predictive analytics to optimize vehicle performance, streamlining operations with modular fleet management solutions, prioritizing cybersecurity to protect data, and implementing mobile fleet management systems for improved accessibility and real-time monitoring.

|

Fleet Management Australia Process Automation |

Approximately 45% of fleet management deployments in Australia focus on automating regular operations like vehicle tracking, fuel management, and compliance reporting to improve operational efficiency and eliminate manual involvement. |

Fleet Management Australia Process Challenges |

Major obstacles in Australian fleet management include high installation costs, personnel reluctance to change, data migration issues during system transitions, and the requirement for continual updates to ensure system efficacy and security. |

Key Suppliers |

Leading |

Key Regions Covered |

Regions such as New South Whales, Sydney, Melbourne, and Brisbane, as well as regional and distant areas where fleet operations are critical for the mining, agriculture, and logistics industries. |

Market Drivers and Trends |

Fleet management is expanding in Australia due to the growing need for centralized vehicle data management, the increasing adoption of cloud-based systems for scalability and cost efficiency, the demand for real-time operational insights, and the integration of advanced technologies such as IoT and AI for predictive maintenance and route optimization. |