Summary Overview

Base Oil - Group II Market Overview

The global Base Oil - Group II market is witnessing substantial growth, driven by the increasing demand across automotive, industrial, and marine sectors. With enhanced lubricating properties and lower volatility, Group II base oils are becoming the preferred choice for applications requiring improved performance and environmental compliance. Our report provides a comprehensive analysis of emerging procurement trends, emphasizing cost-saving strategies, the shift toward sustainable production processes, and innovations within the lubricants industry. Future procurement challenges, such as supply chain volatility and stringent regulations, are addressed, underscoring the significance of digital tools for efficient forecasting and resource management to help clients adapt in this evolving market landscape. Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for Base Oil- group II development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems.

The outlook for the Base Oil - Group II market is positive, with several growth trends and projections shaping the market through 2032

-

Market Size: The global Base Oil - Group II market is expected to reach approximately USD 45 billion by 2032, growing at a compound annual growth rate (CAGR) of around 4.7% from 2024 to 2032.

- Sector Contributions:

-

Automotive Industry: Growth in vehicle production and increased adoption of fuel-efficient vehicles are boosting demand for high-quality lubricants. -

Industrial Applications: Expanding industrial activities across various sectors are leading to a rising demand for Group II base oils for machinery lubrication.

-

Technological Transformation and Innovations: Advances in refining technologies, including hydrocracking and catalytic dewaxing processes, are enhancing the quality and performance of Base Oil - Group II products. In addition, supplier performance management and vendor performance assessment are becoming critical for companies in this competitive landscape. These advancements ensure improved oxidation stability, viscosity control, and broader application suitability, helping organizations meet evolving industry standards and customer demands. -

Environmental Regulations: Stricter emission standards and environmental policies are driving the adoption of cleaner, high-performance base oils, positioning Group II oils as a sustainable choice. -

Regional Insights: North America and Europe currently dominate the market, but rapid industrialization and automotive growth in Asia-Pacific, particularly in China and India, are projected to lead to significant market expansion.

Key Trends and Sustainability Outlook

-

Shift to Higher Performance Lubricants: Increasing awareness about equipment longevity and fuel economy is driving demand for high-quality lubricants based on Group II oils. -

Environmental Compliance: The push for eco-friendly and energy-efficient lubricants is promoting the use of Group II base oils in various sectors. -

Blending Innovation: Companies are investing in advanced blending technologies to improve the efficiency and performance of lubricants derived from Group II oils.

Growth Drivers:

-

Regulatory Influence: Stringent environmental regulations worldwide are motivating companies to shift toward lower-sulfur, high-performance base oils. -

Technological Advancements: Improvements in hydrocracking processes and advanced refining techniques are facilitating the production of Group II base oils with enhanced properties. -

Increasing Demand for Industrial Lubricants: Expanding industrial applications and infrastructure projects are fueling the demand for high-performance base oils. -

OEM Recommendations: Original Equipment Manufacturers (OEMs) are increasingly recommending Group II oils, further boosting market adoption

Overview of Market Intelligence Services for the Base Oil- group IIs Market

Recent reports indicate that the Base Oil - Group II market is facing rising costs, largely driven by fluctuations in raw material prices and refining costs. Market analyses offer cost forecasts and insights on procurement savings, helping organizations manage price volatility while maintaining product quality. Leveraging insights from these reports allows stakeholders to adopt cost-saving strategies, optimize procurement processes, and ensure steady access to quality base oils amid fluctuating market conditions.

Procurement Intelligence for Base Oil - Group II market: Category Management and Strategic Sourcing

To stay ahead in the Base Oil - Group II market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring timely availability of essential raw materials for base oil production. By utilizing detailed supplier performance data and market insights, companies can improve supplier relationships, manage cost volatility, and ensure a reliable supply of high-quality base oils.

Pricing Outlook for Base Oil - Group II Market: Spend Analysis

The Base Oil - Group II market is seeing steady price growth in 2024, driven by increased demand in sectors such as automotive lubricants and manufacturing. Regional supply challenges, including factory closures and shipping delays, have exacerbated price fluctuations, particularly in the Asia-Pacific and Middle Eastern markets. The market is also affected by geopolitical tensions and rising crude oil costs, which influence logistics and pricing across major ports.

With demand expected to rise due to industrial growth and ongoing geopolitical risks, the pricing outlook remains upward, though regional variations may occur. Companies are advised to adjust procurement strategies to secure long-term contracts and mitigate cost volatility.

Cost Breakdown for the Base Oil- group II market: Total cost of ownership TCO and Cost saving opportunity

- Raw Material Costs (50%)

-

Description: This category covers crude oil and refining materials that are key to the production of base oils. Crude oil prices directly impact the cost of producing Group II base oils. -

Trends: Crude oil price fluctuations significantly influence production costs. While crude oil prices have been volatile in recent years, increasing demand for high-quality lubricants and technological advancements in refining are helping stabilize the market

- Labor Costs (XX%)

-

Description: XX -

Trends: XX

- Refining & Production Services (XX%)

-

Description: XX -

Trends: XX

- Distribution & Logistics (XX%)

-

Description: XX -

Trends: XX

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

Optimizing procurement in the base oil market can lead to substantial cost savings while improving operational efficiency. Strategic partnerships and bulk purchasing can reduce raw material costs, while advancing refining technologies can increase yield and decrease waste. Collaboration with logistics providers can streamline distribution, reducing transportation and inventory costs. Additionally, energy-efficient refining processes help lower operational costs, while embracing automation and digitization can reduce labor expenses. Consolidating suppliers and using predictive maintenance technology for production equipment can minimize downtime and prevent costly repairs. Overall, these procurement strategies not only enhance profitability but also contribute to sustainability goals in the base oil market.

Supply and Demand Overview of the Base Oil- group IIs Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

The Base Oil - Group II market is expanding, driven by demand across sectors like automotive, industrial, and marine industries. Technological advancements in refining processes are also shaping supply trends, while environmental regulations and market competition are influencing both cost structures and availability.

Demand Factors:

-

Automotive Growth: Rising global vehicle production and the increasing adoption of high-performance lubricants are driving the demand for Group II base oils. -

Industrial Expansion: Increased industrial activities in sectors like manufacturing, construction, and mining are fueling the need for lubricants and oils. -

Regulatory Requirements: Stricter emission regulations for vehicles and equipment are pushing the demand for high-quality base oils, which are crucial in producing advanced lubricants. -

Marine Industry Growth: The rising demand for eco-friendly lubricants in marine applications is adding pressure to supply systems.

Supply Factors:

-

Refining Advancements: Continuous improvements in hydro processing and other refining technologies are increasing the availability of high-quality Group II base oils. -

Technological Innovations: The emergence of cutting-edge refining technologies improves efficiency, allowing for better quality oils and lower production costs. -

Global Sourcing Networks: Strategic collaborations and global supply chain optimization are enhancing the reach and availability of Group II base oils, ensuring more stable supply channels. -

Market Competition: The competition among major players in the market is driving both quality improvements and more favorable pricing structures.

Regional Demand-Supply Outlook: Base Oil - Group II Market

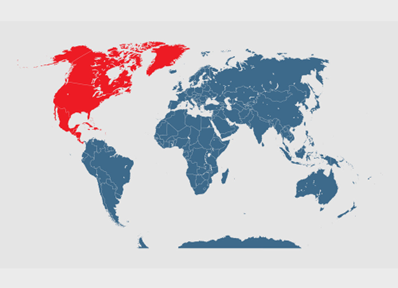

The image shows growing demand for Base oil group ll in both North America and Asia, with potential price increases and increased competition.

North America: Leading the Base Oil - Group II Market

North America, especially the U.S., plays a central role in the Base Oil - Group II market, with the following key drivers:

-

Strong Demand from Automotive Sector: The automotive industry's robust growth, especially in vehicle production and aftermarkets, ensures a steady demand for high-quality base oils. -

Technological Leadership in Refining: The U.S. leads in technological advancements in refining processes, significantly enhancing the supply of Group II base oils. -

Environmental Regulations: With strict regulations surrounding lubricant quality and emissions, North America remains a dominant region, influencing the demand for Group II base oils. -

Strategic Partnerships: Collaborations with international players and local refiners allow for a diverse and competitive market that ensures availability and competitive pricing. -

Sustainability Efforts: Growing focus on sustainability in automotive and industrial sectors increases the demand for high-performance, eco-friendly lubricants made from Group II base oils.

North America remains a key hub base oil-group II innovation and growth

Supplier Landscape: Supplier Negotiations and Strategies

The supplier penetration in the Base Oil - Group II market is substantial, with a growing number of global and regional players contributing to the production and distribution of high-quality base oils. These suppliers play a crucial role in the overall market dynamics, impacting pricing, innovation, and availability. The market is highly competitive, with suppliers ranging from major multinational oil companies to specialized refiners focusing on advanced processing technologies for Group II base oils.

Currently, the supplier landscape is characterized by significant consolidation among top-tier multinational oil companies, which dominate the market share. However, emerging refiners and regional players are also expanding their footprint by focusing on sustainable and high-performance base oils to meet evolving demand.

Some of the key suppliers in the Base Oil - Group II market include:

- ExxonMobil

- Chevron

- Shell

- Saudi Aramco

- BP

- SK Lubricants

- Hyundai Oil bank

- Lukoil

- Reliance Industries

- PetroChina

Key Development: procurement category significant development

Development |

Description |

Impact on Market |

Rising Demand for High-Performance Oils |

Increased adoption of Group II oils in automotive and industrial lubricants due to their superior viscosity and stability. |

Drives growth in the base oil market as manufacturers prioritize higher-quality oils. |

Advancements in Refining Technologies |

New refining processes (e.g., hydrocracking) are improving the production of high-quality Group II oils with lower sulfur content and enhanced oxidative stability. |

Helps meet stringent environmental regulations and enhances the competitive edge for suppliers. |

Environmental Regulations and Sustainability Focus |

Growing emphasis on reducing emissions and improving fuel economy has accelerated the demand for low-sulfur, high-performance oils. |

Drives innovation in Group II oil formulations to meet tighter environmental standards and improve sustainability. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The Base Oil - Group II market is projected to grow from USD 20.75 billion in 2024 to USD 45 billion by 2032, with a CAGR of 4.7% (2024-2032). |

Procurement Technology Adoption Rate |

40% of organizations are adopting advanced filtration and refining technologies to improve the quality and efficiency of Group II base oils. |

Top Procurement Strategies for 2024 |

Focus on increasing operational efficiency, sustainability in production, optimizing raw material sourcing, and expanding supply chain resilience. |

Procurement Process Automation |

30% of manufacturers have automated aspects of their production processes, especially in refining and packaging Group II base oils. |

Procurement Challenges |

Major challenges include fluctuating crude oil prices, ensuring consistent quality standards, and maintaining supply chain stability amidst geopolitical tensions. |

Key Suppliers |

Key suppliers include ExxonMobil, Chevron, Royal Dutch Shell, Phillips 66, and Sinopec. These companies dominate the market with large-scale refineries and robust distribution networks. |

Key Regions Covered |

North America, Europe, Asia-Pacific, and the Middle East, with a specific focus on the U.S., China, India, and the UAE due to high consumption and manufacturing activities in the automotive and industrial sectors. |

Market Drivers and Trends |

Growth driven by increased demand from the automotive sector, stringent emissions standards, and rising demand for high-performance lubricants. Notable trends include the shift towards sustainable and eco-friendly base oil production methods. |