Summary Overview

Batteries Market Overview

The global batteries market is poised for significant growth, driven by the increasing demand for energy storage solutions, advancements in battery technologies, and the transition to electric vehicles (EVs). This market encompasses various battery types, including lithium-ion, zinc-air, and emerging technologies like solid-state batteries. With heightened demand from sectors such as automotive, consumer electronics, and renewable energy storage, the market is expected to see robust growth through 2032. Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for battery development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems.

The batteries market is forecasted to expand rapidly, with key drivers fueling this growth:

-

Market Size: The global market for batteries is expected to reach USD 195 billion by 2032, growing at a compound annual growth rate (CAGR) of approximately 7.2% from 2024 to 2032.

- Key Sectors Driving Growth:

-

Electric Vehicles: Increasing demand for EVs, driven by government regulations, environmental concerns, and growing consumer interest in sustainable mobility, is expected to be a major growth catalyst. -

Consumer Electronics: As the demand for portable devices like smartphones, laptops, and wearables continues to rise, the battery market is set to see continued expansion. -

Renewable Energy: The shift toward renewable energy sources and energy storage solutions is propelling the adoption of advanced battery technologies, especially in grid-scale storage systems. -

Transformation and Innovations in the Batteries Market Advances in battery technology, including the development of solid-state batteries, lithium-ion innovations, and energy storage systems, are significantly improving battery efficiency, lifespan, and energy density. Furthermore, innovations in fast-charging technologies and eco-friendly materials are enhancing the sustainability of batteries. In addition, supplier performance management and vendor performance assessment are becoming increasingly crucial for companies in this highly competitive market. Effective supplier relationship management and monitoring are essential to ensuring high-quality components, timely delivery, and maintaining cost-effective production in the rapidly evolving battery industry.

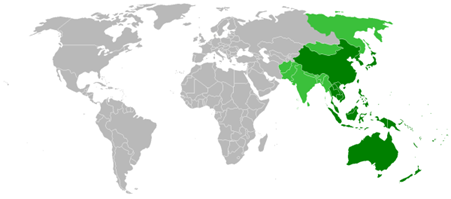

Regional Insights:

-

Asia-Pacific remains the dominant market, driven by major manufacturers in China, Japan, and South Korea, alongside the increasing adoption of electric vehicles. -

North America and Europe are expected to see strong growth, fuelled by the push toward clean energy initiatives and the rapid expansion of EV infrastructure.

Key Trends and Sustainability Outlook

-

Battery Recycling: With the increase in battery production, recycling technologies are advancing to reduce environmental impact and recover valuable materials. -

Solid-State Batteries: These offer higher energy densities and greater safety than conventional lithium-ion batteries, attracting significant investment and research.

Growth Drivers

-

Government Policies: Incentives for EVs, renewable energy adoption, and green technology innovations are accelerating battery demand. -

Technological Advancements: Breakthroughs in battery efficiency, charging times, and sustainability are key to fuelling market expansion.

The batteries market faces challenges such as raw material price fluctuations and supply chain constraints, particularly for lithium and cobalt. However, increasing investment in alternative battery technologies and enhanced manufacturing capabilities is expected to address these challenges. As technological advancements continue, market participants are leveraging these insights to optimize procurement strategies and reduce operational costs.

For more information, the battery market is growing dynamically with key developments expected through 2032, driven by the surge in demand from electric vehicles, energy storage systems, and consumer electronics

Procurement Intelligence for the Batteries Market: Category Management and Strategic SourcingTo stay ahead in the batteries market, companies are optimizing procurement strategies by leveraging spend analysis solutions for vendor spend analysis and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring the timely availability of essential raw materials, such as lithium, cobalt, and nickel, for battery production. With growing demand for electric vehicles (EVs) and renewable energy storage, effective procurement practices are crucial in securing reliable suppliers, reducing costs, and supporting the shift towards more sustainable energy storage solutions.

Batteries Market Pricing Outlook: spend analysis

line chart illustrating the projected outlook for the battery market pricing from 2021 to 2025. The chart shows trends for material prices, demand growth, and the impact of technological advancements over time, highlighting the factors influencing pricing in the market.

The battery market is experiencing a mixed pricing environment, with rising raw material costs offset by excess inventories. Prices of key materials like cobalt are low, but production remains strong, particularly in Indonesia and the DRC. Meanwhile, midstream production is shifting away from China, with investments increasing in regions like South Korea, Canada, and Morocco. This could lead to regional price variations. Technological advancements, such as sodium-ion and LMFP batteries, are expected to impact the market by late 2024, potentially altering price dynamics. The reduction of EV subsidies in some markets may further affect demand and pricing

Cost Breakdown for the Batteries Market : cost of ownership TCO and cost saving opportunities- Raw Materials (40%)

-

Description: This category includes critical materials such as lithium, cobalt, nickel, and graphite, which are essential for battery production, especially for lithium-ion (Li-ion) batteries. -

Trends: The cost of raw materials has seen fluctuations due to geopolitical instability and supply chain constraints, especially for lithium and cobalt. Additionally, the demand for these materials has surged as the electric vehicle (EV) and energy storage markets grow rapidly

- Labor (XX%)

-

Description: XX -

Trends: XX

- Energy & Manufacturing Infrastructure (XX%)

-

Description: XX -

Trends: XX

- Logistics & Distribution (XX%)

-

Description: XX -

Trends: XX

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

In the batteries market, there are several procurement strategies that can lead to significant cost savings while improving operational efficiency.

-

Collaborative Sourcing of Raw Materials: Manufacturers can engage in joint sourcing of critical raw materials like lithium, cobalt, and nickel to secure bulk pricing and reduce individual procurement costs. Collaborative partnerships in the supply chain help mitigate the impact of price volatility. -

Recycling and Reuse of Materials: Recycling battery materials such as lithium and cobalt can significantly reduce material costs, reduce waste, and provide an eco-friendly option for production. Investment in sustainable recycling processes helps lower procurement costs in the long term. -

Optimization of Manufacturing Processes: Adopting advanced manufacturing technologies, such as automation and AI-driven production, helps reduce labor costs and enhance production efficiency. This, in turn, leads to lower unit production costs and higher throughput. -

Energy Efficiency: Incorporating renewable energy sources into the manufacturing process, such as solar or wind power, can reduce the dependency on traditional power grids and lower energy expenses for battery production plants. -

Strategic Supplier Relationships: By developing long-term relationships with key suppliers, manufacturers can negotiate better contract terms, reduce the cost of materials, and stabilize the supply of critical components. This is particularly beneficial considering the fluctuating raw material prices. -

Transportation and Logistics Optimization: Utilizing more efficient transportation options and improving logistics management can reduce shipping costs, especially as the market for electric vehicles and batteries grows globally.

Supply and Demand Overview of the Batteries Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

The batteries market, driven by electric vehicle (EV) adoption and renewable energy storage, is experiencing significant growth. The demand for batteries is high, especially in sectors such as electric vehicles, energy storage systems (ESS), and consumer electronics.

Demand Factors:

-

Surge in EV Adoption: The increasing demand for electric vehicles (EVs) globally is the primary driver of battery demand. As governments push for cleaner transportation, battery requirements are soaring. -

Growth in Renewable Energy Storage: Batteries, particularly lithium-ion batteries, are essential for storing energy generated from renewable sources like solar and wind, fueling their demand in energy storage systems (ESS). -

Technological Advancements: Continued improvements in battery performance, energy density, and cycle life are driving adoption across various industries, enhancing the demand for advanced battery types. -

Electronics Expansion: Consumer electronics, such as smartphones, laptops, and wearables, continue to require high-performance batteries, contributing to demand.

Supply Factors:

-

Global Raw Material Supply: The availability and pricing of critical raw materials like lithium, cobalt, and nickel are key to battery production. Limited access to these materials or price hikes can constrain supply. -

Manufacturing Innovations: Advances in battery technology, such as solid-state batteries and more energy-efficient manufacturing processes, are expanding supply capabilities. -

Strategic Partnerships: Collaboration between battery manufacturers, automakers, and renewable energy companies strengthens the supply chain, ensuring steady production and availability of batteries. -

Recycling and Second-Life Batteries: Battery recycling and repurposing used batteries for secondary applications help meet demand while reducing reliance on newly sourced raw materials.

Regional Demand-Supply Outlook: Batteries Market

The image shows growing demand for Batteries in both North America and Asia, with potential price increases and increased competition

Asia-Pacific: The Global Hub for Battery Production

The Asia-Pacific region, particularly China, Japan, and South Korea, plays a pivotal role in the battery market, driven by several factors:

-

Dominant Battery Manufacturers: Leading companies like CATL (China), LG Energy Solution (South Korea), and Panasonic (Japan) dominate the battery production landscape, contributing to their regional dominance. -

Government Support for EVs and Renewable Energy: Governments in these regions have implemented favourable policies to support the growth of the electric vehicle market and renewable energy storage, driving up the demand for batteries. -

Extensive Raw Material Reserves: Asia is home to significant reserves of key raw materials like lithium and nickel, providing a competitive advantage in meeting battery production needs. -

Technology and Innovation: Continuous advancements in battery technology, such as faster-charging batteries and solid-state innovations, are being pioneered in the Asia-Pacific region, further boosting the global supply chain. -

Global Supply Chain Leadership: Asian manufacturers are leading the way in scaling production capacities for electric vehicle batteries, enabling them to set global pricing trends and supply standards.

ASIA remains a key hub Batteries market innovation and growth

Supplier Landscape: Supplier Negotiations and Strategies in the Batteries Market

The supplier penetration in the batteries market is substantial, with a growing number of global and regional players contributing to the development and manufacturing of battery technologies. These suppliers play a crucial role in the overall market dynamics, impacting pricing, innovation, and accessibility. The market is highly competitive, with suppliers ranging from large multinational energy companies to specialized firms focused on advanced battery technologies such as lithium-ion, solid-state, and sodium-ion batteries.

Currently, the supplier landscape is characterized by significant consolidation among top-tier battery manufacturers, which dominate the market share. However, emerging players and startups are also expanding their footprint by focusing on innovative battery chemistries and solutions for energy storage systems, electric vehicles (EVs), and renewable energy applications. Key suppliers are strategically investing in securing critical raw materials, such as lithium, cobalt, and nickel, while developing sustainable practices to meet growing demand.

Some of the key suppliers in the Batteries Market include:

- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

- Panasonic Corporation

- Samsung SDI

- BYD Co. Ltd.

- Tesla, Inc.

- SK Innovation

- Northolt AB

- Hitachi Chemical Co. Ltd.

- Guo Xuan High-Tech Co. Ltd.

Key Development: procurement category significant development

Development |

Description |

Emerging Capability |

|

Expansion of Solid-State Batteries |

Advancements in solid-state battery technology for improved safety, energy density, and longevity. |

Higher energy density, safer batteries, reduced risk of overheating. |

|

Growth in EV Battery Market |

Rapid increase in electric vehicle (EV) production driving demand for advanced battery solutions. |

Enhanced battery performance to support longer driving ranges. |

|

Development of Lithium Iron Phosphate (LFP) Batteries |

LFP batteries are gaining popularity due to their safety, affordability, and longer life cycles. |

Cost-effective, longer-lasting batteries for mass-market EVs. |

|

Integration with Renewable Energy Storage |

Increasing use of batteries to store energy from renewable sources (solar, wind) for grid integration. |

More efficient grid storage solutions, enabling renewable energy consistency. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The global batteries market is projected to grow from USD 121.22 billion in 2024 to USD 195 billion by 2032, with a CAGR of 7.2% (2024-2032). |

Batteries Technology Adoption Rate |

50% of industries are adopting advanced battery technologies such as lithium-ion, solid-state, and flow batteries for various applications. |

Top Procurement Strategies for 2024 |

Focus on securing long-term supply contracts, enhancing battery recycling processes, and integrating sustainable sourcing practices. |

Batteries Process Automation |

40% of battery manufacturers are leveraging automation to improve production efficiency and quality control in battery assembly. |

Batteries Challenges |

Key challenges include raw material scarcity (especially lithium and cobalt), regulatory compliance, and the high cost of advanced battery technologies. |

Key Suppliers |

Prominent suppliers include CATL, LG Chem, Panasonic, BYD, and Samsung SDI, focusing on lithium-ion and solid-state battery solutions. |

Key Regions Covered |

North America, Europe, Asia-Pacific, and Rest of the World, with specific focus on China, South Korea, and Japan due to major battery production hubs. |

Market Drivers and Trends |

Growth driven by increasing demand for electric vehicles (EVs), renewable energy storage solutions, and the need for longer battery life. Trends include solid-state battery development and sustainability efforts in battery recycling. |