Summary Overview

Bulk Freight Services Market Overview

The bulk freight services market in Australia is integral to the logistics and transportation sector, with key drivers including demand from industries such as agriculture, manufacturing, and retail. The market is influenced by factors like fuel price volatility, rising operational costs, and growing infrastructure needs. Key players like Toll Holdings and Linfox lead the sector, which remains competitive due to the necessity for cost-effective and timely transportation solutions. The market’s future is shaped by technological advancements, including the adoption of digital tools for procurement, supply chain management, and cost optimization.

The bulk freight services sector is expected to grow, driven by investments in road networks and a rise in demand for bulk goods, while sustainability and innovation will play central roles in the industry's evolution.

Key Trends and Sustainability Outlook

-

Technological Innovations: The integration of digital procurement tools and data analytics is increasing efficiency in managing the supply chain, optimizing costs, and improving decision-making. -

Sustainability Initiatives: There is a strong push toward environmentally friendly practices, such as reducing fuel consumption and utilizing more efficient transportation technologies. -

Regional Demand: The eastern seaboard continues to dominate freight activity, although growing industrial demand in other regions is influencing market trends.

Growth Drivers:

-

Rising Demand for Bulk Transport: The need for moving large quantities of goods quickly and efficiently is fuelling demand, particularly in sectors like agriculture and manufacturing. -

Infrastructure Developments: Improvements to Australia's transportation networks support growing freight volumes, ensuring cost-efficient services. -

Fuel Cost Fluctuations: While fuel price volatility poses a challenge, freight carriers are leveraging strategic pricing adjustments to maintain profitability. -

Digital Transformation: Increased adoption of digital procurement tools is streamlining operations and improving the management of supply chains.

Overview of Market Intelligence Services for Bulk Freight Services

Market intelligence services are essential in helping companies navigate price fluctuations, manage operational risks, and improve procurement practices. Through detailed reports and forecasts, businesses can manage the volatility in freight costs and optimize purchasing decisions. Strategic sourcing solutions provide companies with the tools necessary to ensure supply chain resilience and mitigate external risks.

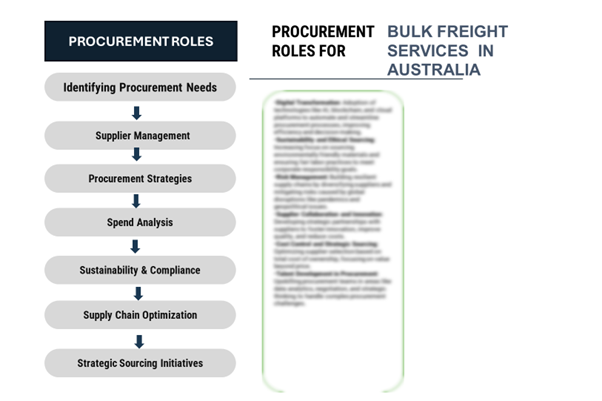

Procurement Intelligence for Bulk Freight Services in Australia: Category Management and Strategic Sourcing

To stay ahead in the bulk freight services market in Australia, companies are increasingly optimizing procurement strategies by utilizing spend analysis tools for vendor spend analysis, enhancing supply chain efficiency through supply market intelligence, and adopting digital procurement tools to improve decision-making. Procurement category management and strategic sourcing are becoming integral to ensuring cost-effective and timely freight solutions, which are vital for the efficient movement of bulk goods across the country.

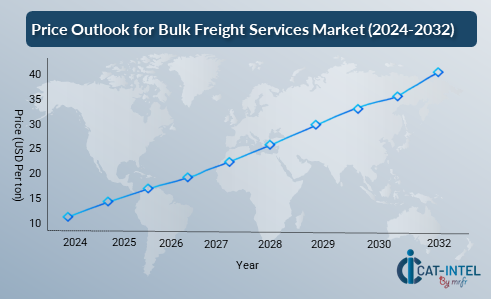

Pricing Outlook for Bulk Freight Services in Australia: Spend Analysis

The bulk freight services market in Australia is experiencing a dynamic pricing environment influenced by factors such as fluctuating fuel costs, labour expenses, and infrastructure investments. As demand for bulk transportation grows, driven by sectors like agriculture, manufacturing, and retail, the pricing landscape is evolving with both opportunities and challenges.

line chart illustrating the projected pricing outlook for bulk freight services in Australia from 2024 to 2032.

Our advanced analysis suggests a steady increase in freight rates, influenced by several key factors:

-

Rising Fuel Costs: Fluctuations in global oil prices directly impact fuel expenses, a major cost driver in bulk freight transportation. Fuel price volatility remains a significant challenge for freight companies, influencing overall pricing trends. -

Labor and Operational Costs: Increasing labour costs, along with enhanced regulatory requirements and operational complexities, are contributing to rising prices in the bulk freight sector. The shortage of skilled drivers is further intensifying labour-related cost pressures. -

Demand Surge: Strong demand for bulk freight services, especially in industries like agriculture and construction, is putting upward pressure on rates. Seasonal variations in demand also influence pricing, particularly in peak periods. -

Infrastructure Developments: Government investments in infrastructure, including road and rail networks, are expected to improve efficiency but may also result in temporary disruptions that can affect pricing. -

Environmental Factors: Weather events and natural disasters, such as floods or droughts, can disrupt supply chains, leading to temporary pricing fluctuations.

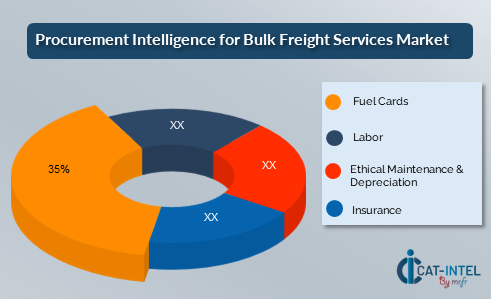

Cost Breakdown for Bulk Freight Services in Australia: Cost-Saving Opportunities

- Fuel Costs (35%)

-

Description: Fuel is one of the primary cost drivers in the bulk freight services sector in Australia. Fuel prices fluctuate based on global oil markets and domestic supply chain dynamics, significantly affecting transportation costs. -

Trends: Fuel prices have seen volatility due to geopolitical factors, supply disruptions, and changes in global oil prices. Companies are increasingly looking for fuel-efficient vehicles and optimizing routes to manage these costs. As of 2024, the trend indicates that fuel costs are expected to remain volatile, with some relief expected from advances in alternative energy solutions for freight transport, like electric trucks.

- Labor Costs (XX%)

- Vehicle Maintenance & Depreciation (XX%)

- Insurance (XX%)

- Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the bulk freight services market in Australia, significant cost savings can be achieved through strategic procurement practices. Collaborative purchasing allows companies to negotiate bulk discounts, while fuel management and the adoption of alternative energy solutions help manage rising fuel costs. Implementing technology for route optimization and fleet management improves efficiency, reducing operational expenses. Long-term contracts with service providers can lock in favourable rates, and automating labour-intensive processes cuts down on labour costs. Additionally, shared services, such as joint marketing campaigns, further reduce overheads, enabling businesses to enhance profitability while managing expenses effectively.

Supply and Demand Overview of Bulk Freight Services in Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The bulk freight services market in Australia is witnessing significant growth due to expanding trade, rising demand for logistics efficiency, and increasing globalization of supply chains. The demand for bulk freight services is being driven by key industries such as mining, agriculture, manufacturing, and retail, while supply challenges related to infrastructure, workforce availability, and fuel costs impact service delivery.

Demand Factors:

-

Economic Growth and Trade Expansion: Increased trade activities, especially with Asia-Pacific and international markets, fuel demand for bulk freight services to move goods efficiently. -

E-commerce Growth: The surge in online shopping and the need for fast, reliable delivery systems are pushing the demand for freight services, particularly for bulk shipments of retail and consumer goods. -

Mining and Agriculture: Australia's mining and agriculture sectors, key drivers of bulk freight needs, contribute significantly to the demand for transporting raw materials, agricultural products, and resources. -

Supply Chain Efficiency: Businesses seek optimized freight solutions to lower costs and improve lead times, leading to higher demand for integrated logistics and bulk freight services.

Supply Factors:

-

Infrastructure Availability: Australia's vast network of ports, railways, and highways supports the supply of bulk freight services. However, limited capacity in some regions may restrict supply. -

Labor Force Challenges: The shortage of skilled truck drivers and port workers is a growing concern, potentially leading to supply bottlenecks and impacting service reliability. -

Fuel Costs and Environmental Concerns: Rising fuel prices and environmental regulations, such as carbon emissions targets, influence supply dynamics, pushing freight companies to adopt fuel-efficient or alternative energy solutions. -

Competitive Market Landscape: Intense competition among freight service providers encourages quality improvements, price adjustments, and innovations to meet growing demand while maintaining profitability.

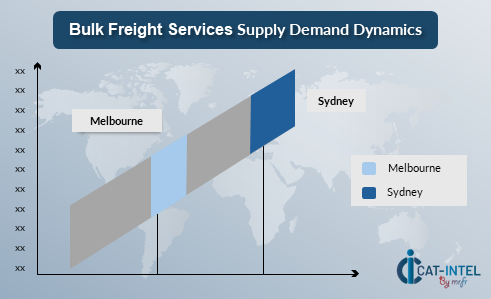

Regional Demand-Supply Outlook: Bulk Freight Services in Australia

The demand for bulk freight services in Australia is influenced by key regional factors, with significant demand driven by mining, agriculture, and retail sectors. The image below highlights growing demand for bulk freight services in both domestic and international markets, reflecting the evolving supply chain needs and competitive pressures.

The image shows growing demand for Bulk Freight services in both Sydney and Melbourne, with potential price increases and increased competition

Australia: A Key Player in Bulk Freight Services

-

Strong Export Market: Australia is a major exporter of raw materials, agricultural products, and manufactured goods, driving the demand for bulk freight services. Key exports include coal, iron ore, grains, and agricultural commodities, which require efficient bulk freight logistics. -

Key Infrastructure Hubs: Australia's major ports, such as in Sydney, Melbourne, and Fremantle, play a critical role in supporting the bulk freight supply chain, while road and rail networks facilitate the inland movement of goods. These hubs are crucial for ensuring that Australia remains competitive in international trade. -

Mining and Agriculture Dominance: Australia's mining and agricultural sectors are vital drivers of bulk freight demand. The increasing global demand for raw materials, such as coal, iron ore, and agricultural exports, strengthens the need for bulk transport solutions. -

Focus on Efficiency and Sustainability: Freight companies are increasingly adopting innovative technologies and sustainable practices, such as fuel-efficient vehicles and eco-friendly shipping solutions, to meet environmental targets and improve cost efficiency in the supply chain. -

Growing Domestic Consumption: While export demand is high, the increasing consumption of goods within Australia, particularly in the e-commerce and retail sectors, also drives the need for bulk freight services to transport a variety of products across the country.

Bulk Freight Services in Australia Market innovation and growth

Supplier Landscape: Supplier Negotiations and Strategies in the Bulk Freight Services Market in Australia

The supplier landscape in Australia’s bulk freight services market is diverse and competitive, with various regional and global players offering transport solutions across land, sea, and air freight. The market is essential for moving raw materials, agricultural products, and manufactured goods, with a broad network of companies driving market dynamics through competitive pricing, innovative logistics solutions, and strategic partnerships.

Key players in the market range from large multinational logistics companies offering end-to-end freight services to specialized regional players focused on specific freight solutions such as bulk liquids, agricultural products, or heavy cargo. Supplier negotiations focus on achieving cost savings, improving transit times, and managing fuel costs, all while enhancing sustainability in transportation operations.

Some of the key suppliers in the Bulk Freight Services Market in Australia include:

- Toll Group

- Linfox

- Asciano (now part of Qube Holdings)

- Civmec Logistics

- K&S Corporation

- DB Schenker

- Qube Holdings

- Aurizon

- Patrick Terminals

- Vopak Australia

Key Development : procurement category significant development

Development |

Description |

Impact on Market |

Technology Integration |

Adoption of digital platforms, IoT, and automation for real-time tracking and optimized route planning. |

Improves efficiency, reduces lead times, and enhances visibility in the supply chain. |

Sustainability Initiatives |

Increased focus on green logistics and carbon reduction strategies, such as electrification of fleets. |

Drives cost savings through fuel efficiency and appeals to eco-conscious consumers. |

Consolidation of Freight Networks |

Mergers and acquisitions leading to integrated freight solutions across rail, road, and maritime transport. |

Creates economies of scale and reduces operational redundancies, lowering costs. |

Outsourcing of Non-Core Functions |

Companies focusing on core business activities, outsourcing freight management to third-party providers. |

Enhances flexibility and allows businesses to focus on value-added services. |

Regional Expansion |

Expansion of freight services to cater to remote and emerging markets within Australia and Asia-Pacific. |

Boosts competition and provides access to new markets, improving service availability. |

Improved Supplier Relationships |

Strengthening partnerships with key logistics providers to negotiate better pricing and terms. |

Enables better contract terms and ensures reliability in service delivery. |

Fuel Price Volatility Management |

Adoption of fuel hedging strategies and use of alternative energy sources (e.g., LNG, electric vehicles). |

Reduces dependency on fluctuating fuel prices, leading to more stable operating costs. |

Regulatory Compliance |

Adjusting operations to comply with evolving environmental regulations and safety standards. |

Ensures legal compliance and mitigates risks associated with non-compliance. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The bulk freight services market in Australia is projected to grow from AUD 7.5 billion in 2023 to AUD 11.8 billion by 2032, with a CAGR of 5.5% during the forecast period. |

Adoption of Bulk Freight Solutions |

Growing demand for integrated supply chain solutions and optimization in freight management, with increased adoption of digital platforms for route and fleet management. |

Top Strategies for 2024 |

Focus on sustainability, fuel-efficient fleets, integration of digital technologies (IoT, AI), and expanded services in regional and international markets. |

Automation in Bulk Freight |

Increasing use of automation in freight handling, vehicle tracking, and real-time route optimization. Over 30% of bulk freight services are adopting these technologies. |

Procurement Challenges |

Key challenges include fluctuating fuel prices, regulatory compliance, environmental impact concerns, and increasing competition in the logistics industry. |

Key Suppliers |

Major players include Toll Group, Linfox, Qube Holdings, and DB Schenker, focusing on regional and international freight services. |

Key Regions Covered |

Major markets include Australia, with significant demand from sectors such as mining, agriculture, and manufacturing, particularly in New South Wales, Queensland, and Victoria. |

Market Drivers and Trends |

Growth driven by demand for efficient and cost-effective freight solutions, rising exports, the push for sustainability, and technological innovations in logistics. |