Summary Overview

Business Jets Market Overview

The global business jets market is undergoing substantial evolution driven by corporate travel demand, increasing wealth of high-net-worth individuals, and innovations in aircraft design. This dynamic market is bolstered by investments in sustainable aviation technologies and advanced manufacturing processes. The report provides an in-depth analysis of procurement trends, highlighting opportunities for cost optimization through strategic sourcing and collaborative supplier practices. Furthermore, it addresses supply chain challenges and emphasizes the importance of digital procurement tools to navigate market complexities effectively.

Strategic sourcing and procurement management are pivotal in streamlining operations for development. Amid increasing competition, stakeholders leverage market intelligence solutions and procurement analytics to enhance supply chain efficiencies.

Market Size and Growth

The global business jets market is forecasted to reach USD 68.5 billion by 2034, growing at a CAGR of 7.8% from 2024 to 2034.

Growth Rate: 7.8%

Sector Contributions

Growth is primarily driven by:

-

Corporate Travel: Increasing demand for efficient, time-saving travel solutions by businesses. -

Luxury Segment: Rising interest among ultra-high-net-worth individuals in premium and customizable jets. -

Technology Innovations: Adoption of fuel-efficient engines, advanced avionics, and sustainable materials.

Key Trends and Sustainability Outlook

-

Sustainability Initiatives: Increasing adoption of Sustainable Aviation Fuels (SAF) and hybrid propulsion technologies. -

Fractional Ownership Models: Gaining traction among cost-conscious clients seeking shared access to business jets. -

E-commerce Integration: Streamlining charter services through digital platforms for better accessibility.

Growth Drivers

-

Executive Travel Demand: Growing corporate globalization boosts private aviation needs. -

Economic Growth: Expanding wealth in Asia-Pacific and the Middle East fuels demand for luxury jets. -

Export Opportunities: The North American market leads exports due to manufacturing dominance and technological advancements. -

Digital Procurement: Enhanced supply chain forecasting and cost control through advanced digital tools.

Overview of Market Intelligence Services for the Business Jets Market

Recent analysis indicate volatility in jet pricing due to fluctuating raw material costs and regulatory factors. Market reports offer detailed cost forecasts and procurement strategies, enabling stakeholders to optimize purchasing decisions. Strategic sourcing practices mitigate risks, providing a competitive advantage and ensuring the procurement of high-quality aircraft.

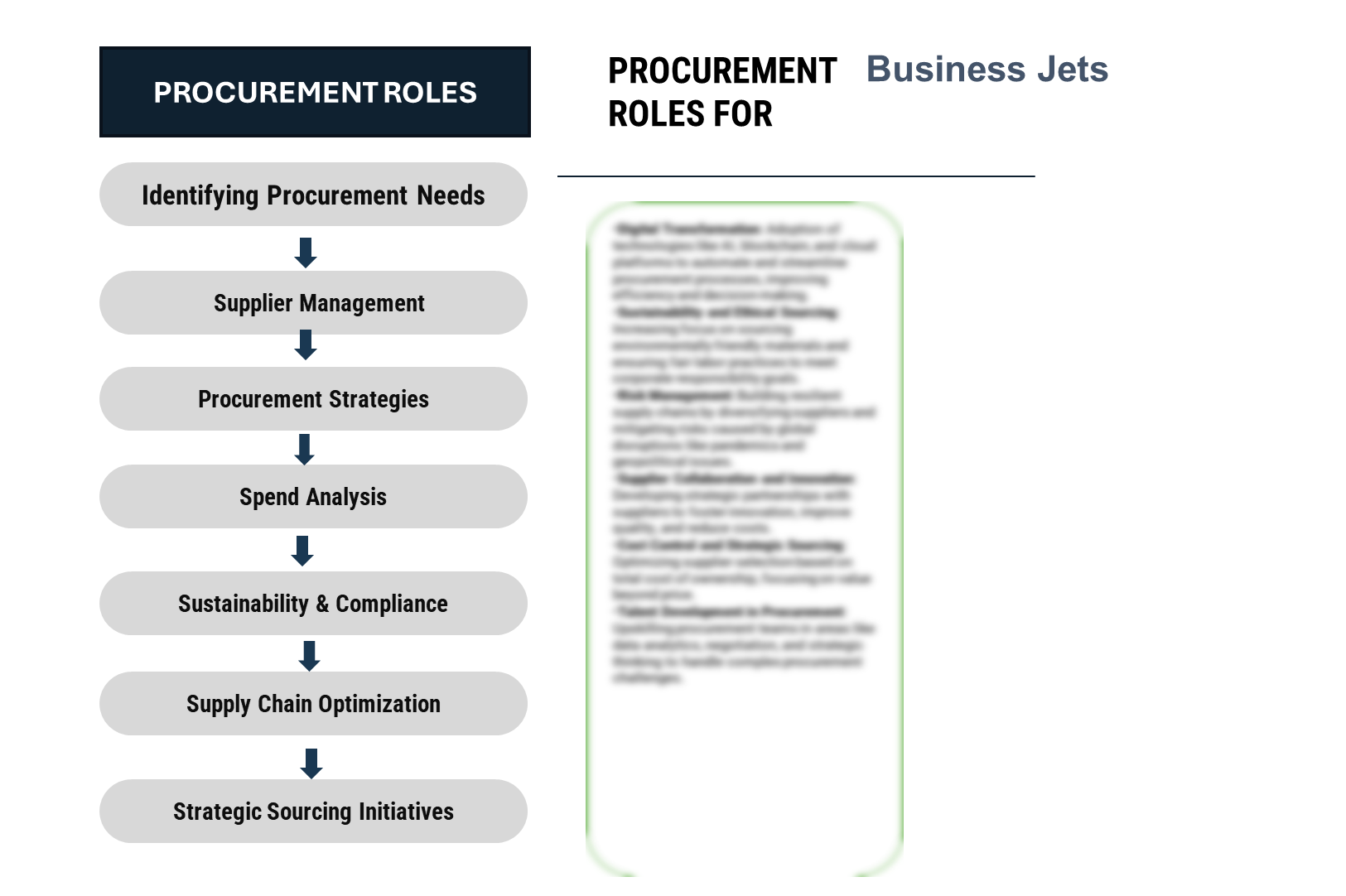

Procurement Intelligence for Business Jets Market: Category Management and Strategic Sourcing

The business jets market leverages procurement strategies like spend analysis, strategic sourcing, and supply market intelligence to optimize costs and ensure component availability. Companies focus on long-term supplier partnerships, risk mitigation in complex supply chains, and sustainability initiatives, prioritizing eco-friendly materials and efficient supplier networks. These approaches streamline sourcing, reduce risks, and enhance supply chain resilience while ensuring high-quality components for production

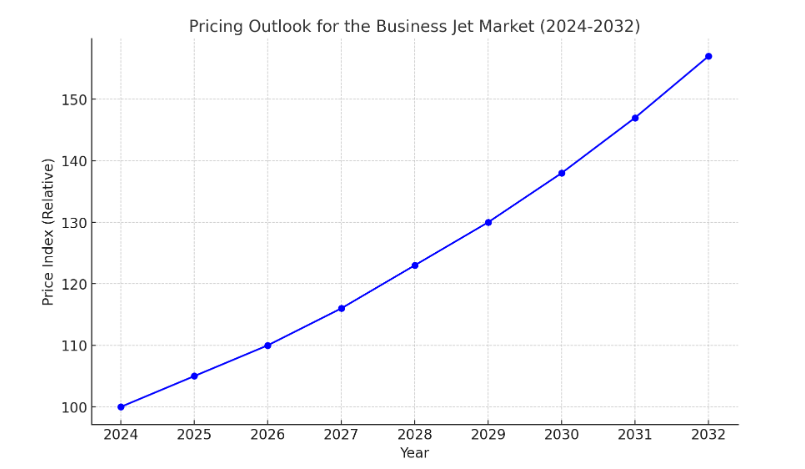

Pricing Outlook for the Business Jet Market: Spend Analysis

The business jet market is undergoing significant transformations, driven by fluctuating demand and advances in aviation technology. Key trends shaping the pricing dynamics include economic growth, regional demand variations, and evolving preferences among high-net-worth individuals and corporations.

line chart depicting the pricing outlook for the Business Jet Market from 2024 to 2032.

Our analysis highlights the following factors influencing pricing in the business jet market:

-

Increasing Demand for Advanced Jets: Rising global business travel and a preference for ultra-long-range and technologically advanced jets are expected to drive prices upward through 2032. The market's growth in regions like North America, Europe, and the Asia Pacific is fueled by infrastructure development and an increase in corporate aviation demand. -

Production and Operational Costs: Higher production costs associated with sustainable aviation fuels (SAFs) and hybrid engines are contributing to increased jet prices. Manufacturers are focusing on innovative, environmentally friendly designs, adding to the costs. -

Impact of Regional Demand: North America remains the largest market, with significant growth driven by infrastructure and fleet expansions. Meanwhile, Asia Pacific and the Middle East are emerging as growth hubs, supported by rising investments and preference for private aviation. -

Supply Chain Challenges: Ongoing supply chain disruptions and the limited availability of parts for advanced jet manufacturing are likely to influence pricing. Companies are adapting through acquisitions and partnerships to enhance their capabilities.

Cost Breakdown for the Business Jet Market: Cost-Saving Opportunities

- Aircraft Manufacturing (50%)

-

Description: This represents the cost of manufacturing jets, including materials like carbon fiber and the labor involved in assembling aircraft. Technological innovations and the complexity of manufacturing influence pricing. -

Trends: Prices in this category are impacted by factors such as fuel prices, labor rates, and advancements in manufacturing technology. There is potential for cost savings through automation and materials optimization.

- Labor (XX%)

- Maintenance & Operations (XX%)

- R&D and Technological Innovation (XX%)

- Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the business jet market, cost-saving opportunities include bulk purchasing agreements for key components, supplier performance management for better terms, and the adoption of technologies like 3D printing and predictive maintenance to reduce manufacturing and operational costs. Additionally, fuel efficiency initiatives, outsourcing maintenance services, and exploring leasing or fractional ownership models help mitigate high upfront costs and improve cash flow. These strategies collectively drive procurement efficiency, ensuring long-term profitability and reduced operational expenses.

Supply and Demand Overview of the Business Jets Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The business jet market is experiencing growth driven by increasing demand for private travel, improved air travel efficiency, and expanding international markets. With rising global affluence, corporations, and high-net-worth individuals seeking to streamline their travel operations, demand for business jets continues to surge. Technological innovations and sustainability considerations also play a significant role in shaping the demand-supply dynamics.

Demand Factors:

-

Private and Efficient Travel: Increasing preference for private jet travel due to timesaving, convenience, and luxury is driving demand, particularly in the corporate and high-net-worth individual segments. -

Global Economic Growth: Economic prosperity, especially in emerging markets, fuels demand for business jets as more companies and individuals seek private transportation options for business and leisure. -

Technological Advancements: The demand for more fuel-efficient, technologically advanced jets with better connectivity and comfort is driving innovation in the market. -

Sustainability Trends: As businesses and individuals look to reduce their carbon footprint, demand for sustainable, fuel-efficient jets and hybrid/electric aircraft is increasing, with an emphasis on lower emissions.

Supply Factors:

-

Production Constraints: While demand is increasing, the business jet supply remains constrained due to the complex and high-cost nature of aircraft manufacturing, which involves significant lead times and investment. -

Key Manufacturers: Major manufacturers like Gulfstream, Bombardier, and Dassault dominate the supply landscape. Their ability to meet increasing demand relies heavily on supply chain efficiency and production capacity. -

Technological Innovations in Manufacturing: Advances in materials, automation, and manufacturing processes help boost supply by lowering production costs and shortening lead times. -

Global Competition and Pricing Pressure: As more players enter the market, particularly in emerging economies, competition increases, affecting pricing strategies and availability, especially for entry-level jets and mid-sized aircraft.

Regional Demand-Supply Outlook: Business Jets Market

The business jets market is experiencing strong regional growth, particularly in North America, Europe, and emerging markets in Asia. The demand for private jets is driven by rising wealth, increasing corporate travel, and the growing desire for efficient, private, and comfortable air travel.

The image shows growing demand for Business Jets Market in both North America and Asia, with potential price increases and increased competition

North America: A Key Player in the Business Jets Market

North America, especially the United States, continues to be a dominant force in the global business jets market, characterized by:

-

Leading Manufacturers: North America is home to major business jet manufacturers, including Gulfstream, Bombardier, and Textron Aviation, ensuring the region's strong production capabilities and global influence in aircraft production. -

Strong Domestic Demand: High-net-worth individuals (HNWIs) and corporations in the U.S. maintain a strong demand for business jets for both business and personal use, driving the market's resilience. -

Export Opportunities: North American business jet manufacturers are key exporters to regions like Europe, the Middle East, and Asia, where growing affluence and corporate demand boost market activity. -

Technological Advancements: U.S. manufacturers lead in developing innovative business jets, focusing on fuel efficiency, luxury, and state-of-the-art technology for enhanced passenger experience. -

Sustainability and Regulatory Focus: There is a growing focus on sustainable aviation and compliance with environmental regulations, pushing manufacturers to innovate with fuel-efficient technologies and explore hybrid/electric aircraft options. -

Consumer Preferences: The increasing preference for private travel and luxury, particularly in business sectors and among HNWIs, sustains strong demand for both light and large business jets, ensuring the U.S. remains a global leader in the market.

North America remains a key hub Business jets market and its growth

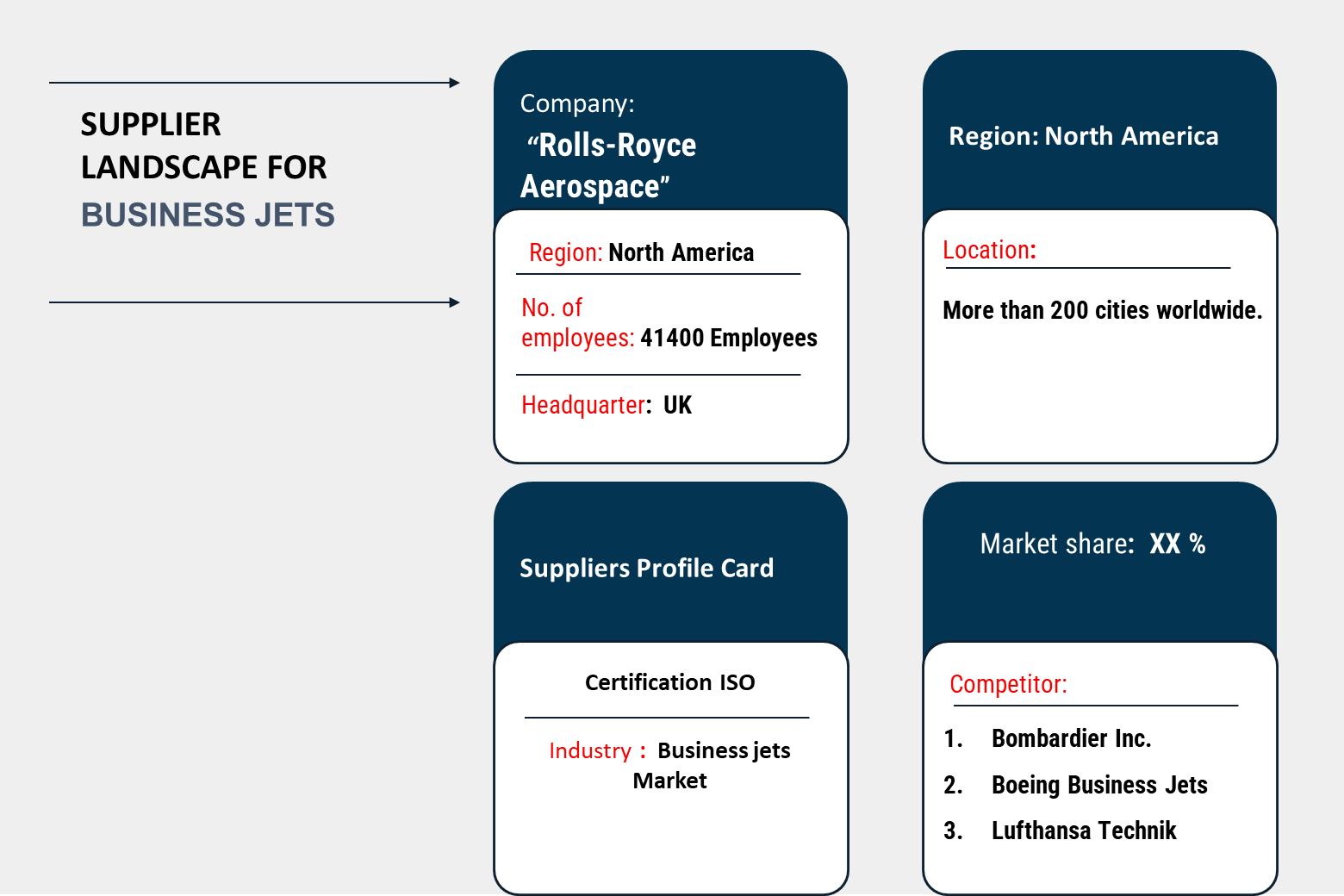

Supplier Landscape: Supplier Negotiations and Strategies – Business Jets Market

The business jets market has a complex supplier landscape that includes global manufacturers, component suppliers, and service providers. These suppliers provide critical raw materials, aircraft components, and services that contribute to the production, maintenance, and operation of business jets. Key suppliers provide avionics, engines, aircraft materials (such as composites and metals), and maintenance services, which are essential for the design, manufacturing, and operational efficiency of business jets.

Currently, the supplier landscape is characterized by long-term relationships between business jet manufacturers and their suppliers of aircraft components and materials. These partnerships are crucial for ensuring the quality, performance, and safety of the aircraft while driving innovation in the business aviation sector.

Some of the key suppliers in the business jet market include:

- General Electric Aviation

- Rolls-Royce Aerospace

- Honeywell Aerospace

- Pratt & Whitney

- Dassault Aviation

- Gulfstream Aerospace

- Textron Aviation

- Bombardier Inc.

- Boeing Business Jets

- Lufthansa Technik

Key Development: Procurement Category significant development

Procurement Category |

Key Developments |

Aircraft Components |

Advancements in lightweight materials (e.g., composites) reduce fuel consumption and improve performance. |

Engines & Power Systems |

Growing focus on fuel-efficient engines and hybrid-electric technologies to reduce carbon emissions and costs. |

Avionics & Technology |

Integration of advanced avionics, such as AI-driven systems and enhanced cockpit displays, for improved safety. |

Maintenance, Repair & Overhaul (MRO) |

Expansion of MRO services and facilities to support growing fleet sizes and reduce downtime. |

Fuel & Energy |

Increased use of sustainable aviation fuels (SAF) to lower the environmental impact and improve fuel efficiency. |

Aircraft Interiors & Design |

Customization of cabin interiors to meet luxury demands while focusing on ergonomic and space-saving designs. |

Logistics & Supply Chain |

Digitalization and real-time tracking improve supply chain transparency and reduce delays in aircraft deliveries. |

Sustainability Initiatives |

Adoption of sustainable production methods, waste reduction, and recycling programs in aircraft manufacturing. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The business jet market is projected to grow from USD 26.2 billion in 2023 to USD 68.5 billion by 2032, with a CAGR of 7.8% during the forecast period. |

Adoption of Business Jet Services |

Rising demand for private and chartered jet services, driven by growing corporate travel needs and wealthy individuals seeking personalized travel options. |

Top Strategies for 2024 |

Emphasis on enhancing fuel efficiency with hybrid-electric aircraft, expanding service offerings in emerging markets, and increasing investments in digital cabin technology. |

Automation in Jet Manufacturing |

Over 30% of major business jet manufacturers are investing in automation, with robotic arms and 3D printing improving precision and reducing production time. |

Procurement Challenges |

Key challenges include managing supply chain disruptions, maintaining high safety standards, dealing with rising raw material costs, and addressing sustainability concerns. |

Key Suppliers |

Major suppliers include Gulfstream Aerospace, Bombardier, Dassault Aviation, Embraer, and Textron Aviation, with a focus on luxury features, innovative avionics, and lightweight materials. |

Key Regions Covered |

Major markets include North America, Europe, and the Middle East, with notable demand from the U.S., UAE, and China. |

Market Drivers and Trends |

Growth is driven by increasing demand for private jet services, advancements in sustainable aviation technologies, and rising wealth among high-net-worth individuals globally. |